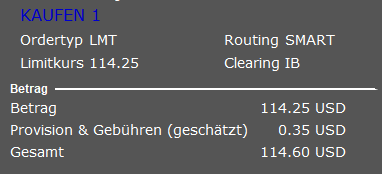

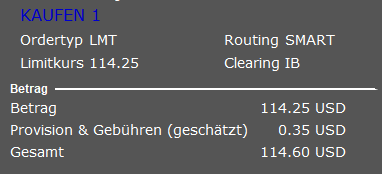

35 Cents.

Basically the same as for 10 or 100 shares for me.

To circument these prohibitive costs, you could buy the same for all accounts and split the cost ![]() .

.

35 Cents.

Basically the same as for 10 or 100 shares for me.

To circument these prohibitive costs, you could buy the same for all accounts and split the cost ![]() .

.

I hear Theranos is a secret hot tip out there … are they public yet?

I think ARKK has them?

Speaking of enigmatic CEOs like Miss Woods … I just read up the WIkipedia article on Elizabeth Holmes, the fraudster CEO of Theranos. Quote that stood out (highlighting mine):

Her father, Christian Rasmus Holmes IV, was a vice president at Enron, an energy company that later went bankrupt after an accounting fraud scandal.

You can’t make these things up …

She was done by toxic masculinity and patriarchy. Clearly.

I found this website somewhere on this forum, subscribed to free newsletter and now got this: Radium – the rare metal worth 120,000x the price of gold - Undervalued Shares. Interesting knowledge for sure, but I wonder which company it is (and I’m not yet ready to pay ;). IBAB.BR?

I was looking for exposure to xAI, OpenAI and SpaceX and found the ARK Venture Fund (ARKVX), which is not available on SQ.

Edit: I’m not touching any ARK etfs

Typical structure of pump & dump shemes.

Dont buy penny stocks which are recommended in newsletters…

Slightly off-topic, but his just came to my mind this week when I was 300 EUR short on my debit card for an online purchase. 2 bucks exchange FX fees, no way I’m paying that when it’s 0.7% cost. Almost as bad as the fees if using my free CHF credit card.

So I came up with this life hack: bought 300k instead (at 0.9350), withdraw 1000 EUR and sold the rest back a day later (at 0.9387). This way, it not only lowers the transaction fee in %, but also gets you a little extra for the next purchase.

I guess you could also use the same trick to buy stocks and don’t have to worry about transaction fees for small trades anymore?

Do I understand this correctly?

Your basic fees would have been 2 CHF for a 300 EUR purchase @0.9350: total CHF required: 282.50 CHF, of which 2 CHF are fees (0.72%).

Instead, you traded for 300k EUR @0.9350 (CHF required: 280.5k), kept 1000 EUR and sold back 299k EUR @0.9387 (CHF recovered: 280’671.30 CHF).

Total cost: -171.30 CHF (you made a gain on the trade)

Opportunity cost: 1 day of 280k CHF sitting around.

But the rate for the buy back could very well have gone in the opposite direction, being 0.9313 instead, in which case, you would have gotten back 278’458.70 CHF for a total cost of 280.5 CHF.

So one option is to pay 2CHF and not need to have 280k sitting around.

The other option means you may gain 171.30 CHF, you may loose 280.50 CHF and you have 280k sitting around.

I wouldn’t do that for stocks: if I have 280k in cash that can get short term exposure to the stock market (a day at -2% means a 6k loss), wouldn’t that rather be invested?

Unless my net worth exceeds 10M, in which case, 300k may be a small enough chunck of it to not move the allocation too much.

That was the idea… In total some 1k (1k EUR + 171 CHF - some 11 commissions).

I don’t have any CHF sitting around in my account, I borrowed them ![]() So, plus some 7 or 8 CHF in interest accruals, I guess

So, plus some 7 or 8 CHF in interest accruals, I guess

In that case, you could buy more to, let’s call it ECA (Euro cost average), until you don’t?

I don’t recommend it, either and should know better ![]()

While I did that trade for my amusement (just once in a while), the post was meant as a joke for my personal rehabilitation

Hmm, seem a little inefficient. Instead, if you put 300k into MSTR yesterday, it would have gone to around $348k. You can then convert 300k back and the remaining 48k into EUR and have extra for next time!

I think you are on to something big here ![]()

Me, I also want to still be able to justify myself if someone else in the family would bother to go through the account statements, for once and asks questions about those little side bets

Just don’t go as far with the numbers that you need to print the account statements in landscape mode … they might start asking questions then … ![]()

Investing / borrowing 300,000 Euros to save 2 Euro doesn’t seem to be an interesting value proposition.

However -: the actual mechanism used to do this is interesting. I this is what a FX trader would do on daily basis. Isn’t it? And if someone does it multiple times, the chance of winning goes down. Otherwise it looks like a free money printer which obviously it isn’t ![]()

And the MSTR equivalents in currency trading do this in currency pairs like Turkish Lire versus CHF while the conservative @Brndete ones pick currency pairs like Euro versus CHF?

Unfortunately, there seems to be no other currency appreciating more reliably than CHF.

Or is there?

I understand the humor and appreciate it but just for the record:

That could take some time if the date of the purchase was the the 29th of October 2007 ^^:

And now up another 20% to $72 now.

I’m having flashbacks to when I wanted to buy LSCC but it just went up from $8 to $10 the day I wanted to buy it and it never went back. Peaking at just under $100 and now down to $50.

You know what happens if you buy it now, don’t you.

The @MarketGods* are having fun with you. They’re astute readers of this forum. ![]()

* Why didn’t I choose that handle? It’s still available … maybe I should reserve it and spray punishing comments under that alter ego on giddy and FOMO posts? ![]()

Exactly. I know exactly what happens if I buy it. And I know exactly what happens if I don’t buy it. ![]() And the latter is preferable!

And the latter is preferable!

Maybe I need to delete it from my portfolio/watchlist. It’s at the top because it was one of the more recent ones I added to watch/buy so now it taunts me every time I check my portfolio!

Luckily, my other uranium stocks are taking up the slack.

EDIT: Just noticed that 3 of my top 10 are now uranium plays (7,8,10):