2022 is coming to an end and I thought I’d provide an update here for those interested.

Stockpicking portfolio now contains over 100 securities. I added about 20 companies since my initial post and sadly had to sell a few in December (because they’re publicly traded U.S. limited partnerships, e.g. EPD, which starting next year you basically can’t reasonably own anymore as a non US citizen).

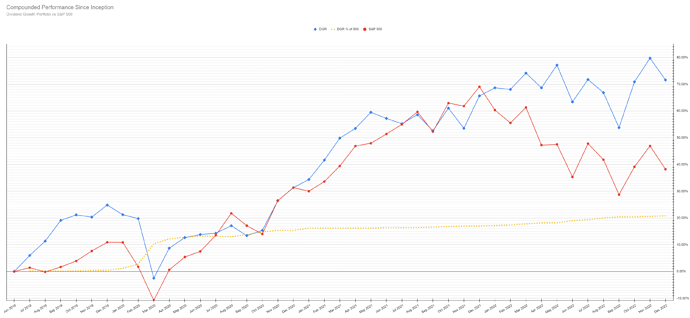

Yield on cost is 5% and the TWR for this year so far is about 3.5% (CAGR since inception in June 2019 is about 24%).

Since inception the stockpicking portfolio has mostly tracked the S&P 500 on a compounded return basis, but this year – funnily enough right around since the market peaked – it has left the S&P 500 somewhat in the dust.

My picks mentioned in the March 2022 post all went lower. ![]()

I still believe in the businesses though, so I stuck to the plan and kept averaging down and added to the positions until they became full (full position = dividend return reaches 2k USD per year).

The 5 March picks are part of about 25 positions which are in the red since I started buying them. The rest are green. I don’t believe I’ll be able to maintain this ratio and will over time maybe consider selling insanely overrated positions instead of holding them forever as initially planned. One current deterrant from selling are Swissquote’s insane transaction fees.*

For giggles … well, actually, more as proof that diversification works:

- my best position (OLN) is up over 400%

- my worst position (LNC) is down over 40%

Feel free to comment, but if you’re a fundamental index only person, thanks for clicking into this, please enjoy your time elsewhere.

* Maybe this will solve itself if Swissquote wants to charge me on my portfolio on a percentage basis instead of the flat cap – I’ll then surely transfer to IB.