Came across an interesting article today in the WSJ: Wall Street’s Trash Contains Buried Treasure

The basic idea is to buy the stocks of companies after they’ve been kicked out of the index and then outperform the index with thosed kicked out companies. ![]()

It’s an idea I have heard of before, and I believe studies have been done on this to support the claim, but this week an index – cleverly named NIXT – will be launched that does this for you.

The key points from the fund managers themselves:

- "Historically, index deletions have beaten the Russell 2000 Value Index in spectacular fashion and could add an abnormal upside to a portfolio when the current growth-dominated bubble starts to deflate.

- Deletions lag the market by more than half in the year leading up to their removal from an index, but they historically outperform the market for at least five years after the breakup.

- A deletions strategy relies on two growth drivers to fuel performance: long horizon mean reversion and a liquidity effect."

Oh, if you’re interested when the S&P 500 rebalances, I’ve already googled that for you:

03.15.2024

06.21.2024

09.20.2024

12.20.2024

(source)

I’ll stick to my fundamentals approach, but will maybe occasionally check whether newly kicked out companies match my fundamental criteria or are perhaps already on my eternal watchlist.

In June 2024, Robert Half (RHI), Illumina (ILMN) and Comerica (CMA) got booted from the S&P 500.

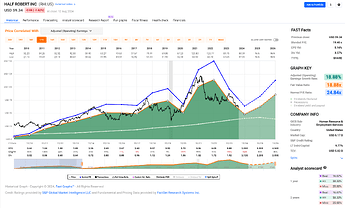

RHI actually looks interesting. It’s a little cyclical but is overall growing earnings at a nice cliff.

Still a little too pricey for me, though. I like to buy with a margin of safety and this one doesn’t have one (yet).