Talk your book 2.0:

So, I have some cash on the sidelines that I want to deploy soon’ish. I just went through my current holdings and updated my potential shopping list for the next month or so.

First pass - undervalued, but no visible headaches looming (like BMY* or MMM**), growth intact - gives me about 28 potential buys*** and 7 potential sells.****

Second pass - taking into account personal preferences like acceptable dividend for my needs, existing open cash secured puts, etc - boils it down to these shortlists:

- Buys: BK, CVS, ES, OZK, STT

- Buys, but excluded for personal risk management (my positions are full): BTI, CMCSA, GWO, IMB, LNC, MAIN*****, MTB, NFG, O, UNM, VICI

This is just screening through current and (for the sells including) past holdings.

I might update the shopping list after screening through my full watchlist if I get to it during this Easter break.

Anyway, point is that the the market is reaching new highs, but I feel I can still deploy cash in some corners of the market that seem undervalued.******

FastGraphs for my shortlist if you are interested:

-

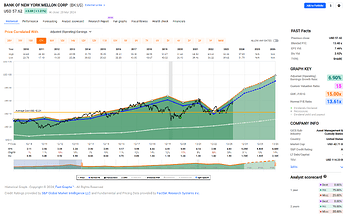

Bank of New York Mellon (BK)

+: Nice growth expectations, acceptable dividend yield, nice credit rating, no debt (?!?).

-: Only just fairly valued, average growth since the GFC. -

CVS Health (CVS)

+: Clearly undervalued, ok dividend yield (but good dividend growth again), good credit rating.

Also, look at that steadily growing earnings chart - what a beauty!

-: Didn’t they just do another acquisition? I’ll need to look into that. -

Eversource Energy (ES)

Mentioned before, see above. -

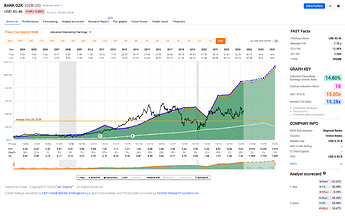

Bank OZK (OZK)

+: Dividend growth, severly undervalued, acceptable dividend.

-: Regional bank. Seems solid to me, but dragged down from debt duration fiasko which might or might not be justified. -

State Street (STT)

+: Nice expected growth, undervalued, nice dividend, nice dividend growth.

-: Flat stock price for about a decade (or longer, if you include the GFC).

Good luck and good night!

* BMY: Negative growth over the next couple of years, otherwise fine.

** MMM: Unresolved lawsuits, otherwise fine.

*** Buy longlist: ADM, BK, BTI, CVS, ES, GPK, GPN, GWO, IMB, JNJ, LNC, MAIN, MET, MTB, NFG, O, OC, OZK, SJM, STT, SWKS, T, TD, UGI, UNM, VICI, VZ, WAL.

(includes full positions of mine that I won’t add to or only hesitantly add to)

**** Sell longlist: GD, IBM, IRM, LOW, PG, SO, WSM.

***** I keep DRIPping into MAIN despite having a full position, but I don’t won’t to increase my position outside DRIP.

****** Famous last words, I know.