Hi, would like to know if anyone have looked at JEPI and JEPQ for dividends. Any advice would be appreciated

I would not use covered call etfs, especially in Switzerland and when you don‘t need the income.

What they essentially do is turn tax-free capital gains into taxable income distributions, due to the options structure they use.

They are very inefficient as a swiss investor.

I’ve looked at them a lot, dreaming of the day they will make 100% of my portfolio (JEPI and JEPG, the UCITS versions), but wouldn’t have them in Switzerland for the reasons Tony says. The US ETF versions probably make it possible to retain/reclaim at least half of the US dividend tax via the W8-BEN form, and maybe all of it through the DA-1 form.

I think 15% of the dividends would be lost in the Irish (UCITS) versions, and the dividends would be taxed as income here, but if the country doesn’t tax UCITS ETF capital gains or dividends (e.g., like Greece, at the moment) then they’re good for income.

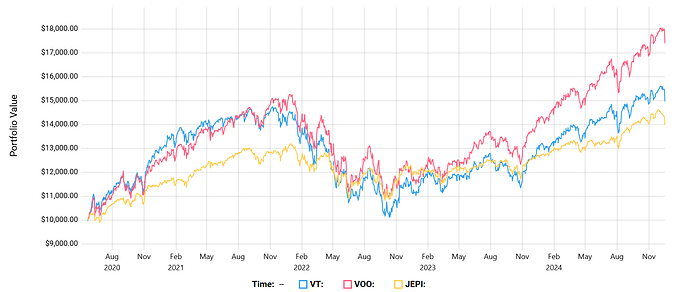

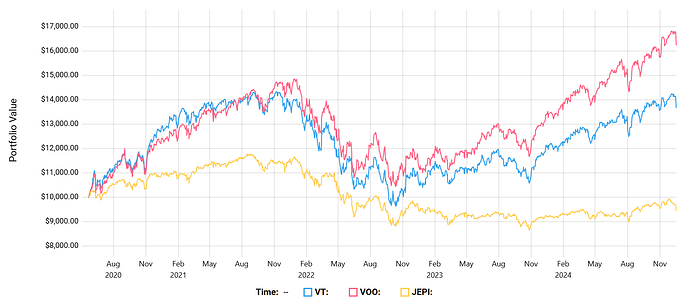

I’d also like to see them through a good drop and prolonged sideways market (or maybe not), too. In 2022 JEPI did a lot better than VOO or VT, but lost the upside of the market in a big way in 2023-today, which is encouraging because it shows that it is working as intended.

All in all, even with reinvested dividends one would lose a ton of upside due to how they work, but in my view this is ok if the owner understands what they are and why they hold them, they are not designed to capture the upside.

If you don’t reinvest dividends (i.e., consume them) the picture changes quite a lot, but still works as intended, and that’s still good in my opinion because it’s nearly 3 years since the 2022 drop and 2023-2024 bull and they didn’t canibalize the NAV.

So all in all, they are not good for Switzerland, and they are not good for growth, and also not good for dividend growth investing, but could be very good for income in some markets.

Edit: staggering amount of crap and misinformation around these and other ETFs around the web, peddled as free money/money glitch. For me they do have a place, at some point in an investor’s “career”.

Thanks for the reply…

Kinda deflating innit?

But if the dividends gets re-invested in the ETF is that not the same as VT or VOO or the other ETFs that pays dividends.

The first chart by @Mirager is already a total return chart assuming dividends being reinvested, and actually reinvested tax-free. So a real world case, would be even worse, as more is lost to taxes for JEPI.

Thanks, understood.

I have some. I compare them to a cushion part of my portfolio rather than the main ETF.

Tax-wise? Unimportant. Is it suboptimal compared to funds that reinvest? Yes, but again that’s not the reason you should hold them. Regarding being taxed, I don’t have a precise answer (no one has it?) Usually accumulating funds get taxed as well, so that part is unimportant.

Not asking how big of a cushion, but my own estimates say that the distributions from up to 150k in JEPI are basically pocket money, even in Greece, 250k begin to be meaningful, and you need at least 500k in it to be somewhat decently (but frugally) liveable, and still not in CH ![]()

JEPI dividend yield was >7%. I don’t understand your comment.

Anyway I’m talking about how it loses less than say VT.

Ok, I think I see what you mean now. A cushion in terms of volatility, is this correct?

Did I use a new term? I think I’ve seen used here as well.

Yes, similar to the bond part of a portfolio.

I’m experimenting. Right now i just have a tiny amount to see how it works (I am myself victim of a “Cortana effect”, when I buy, they go down.

Actually ictax reports most of the income as tax free capital gain for JEPG.

As I don’t get it (yet), and still am dreaming about it, I had to calculate the 2024 numbers for JEPG (price on 31/12/2024: CHF 23.59):

- untaxed capital gains: CHF 1.03 (77%)

- taxable income: CHF 0.31 (23%)

Cash flow according to ICTax was CHF 1.34 p.a. (5.6% of share price)

Swiss Income tax could have been ~20% of 0.31 = CHF 0.06

Earnings after tax = CHF 1.28 p.a. (5.4% of share price)

Can someone help me with US-WHT: which amount would have been unclaimable with JEPG?

Only the income (assuming underlying is 100% US company dividends)

Just tested your question with GPT-5 with an example of invested USD 100k:

| JEPG (Irish) | JEPI (US) | |

|---|---|---|

| Gross dividends | USD 8,000 | USD 8,000 |

| US WHT | -USD 720 (15 %) inside fund | -USD 1,200 (15 %) direct to you |

| Swiss reclaim | ||

| Net after WHT | USD 7,280 | USD 8,000 |

EDIT: There is a rough drag of ca. 0.2% p.a. just because of WHT.

Isn’t it ~0.2%?

0.31/23.59*15%

Hmm, yes, I think as well.

Seems the number from GPT-5 is somehow incorrect…

What a surprise ![]() (to be fair my recent experience – with claude – is that if you prompt properly it works, but you need to explain all the details)

(to be fair my recent experience – with claude – is that if you prompt properly it works, but you need to explain all the details)