They introduce this ETF a week ago ![]() So you can invest in it now.

So you can invest in it now.

I have an issue with my first transfer which has left my bank account 10 days ago but as it seems did not land on the IB account yet… I hope this will be solved next week and that it will not always take so long for transfers (I have another account with IB directly and it takes 1 day)

I still fail to comprehend how can anything be free in Switzerland (or anywhere else)?

Some fees somewhere must be due.

How do they make money? ![]()

Perhaps taking the Revolut approach, and some management fees will come up in time?

What I meant was if anybody can check the fully automatic part…

I don’t know but maybe they make enough money with other services and want to lure new customers in with a free ETF Sparplan.

I don’t trust companies, where I don’t understand their business model.

They explain they get money with personalized services. TBF it probably costs them a few minutes per month to click the “rebalance” button on IB TWS so it’s not like they’re throwing away money or something.

Yes they do claim that. But why would anybody use these services that are not really advertised?

Their team consists of 5 people. I don’t see how they can be profitable with less than 500k-1’000k income per year.

A few of them are obviously part time (two of them mention Neologic AG). And given that they make money with financial advice, I assume that’s just one person’s job (the CEO/founder is the only with such a background).

So maybe it’s just a one person company with some IT consultants ![]()

https://thepoorswiss.com/interview-ceo-investart/ mentions premium features too.

I agree with @xorfish.

Their premium service is not advertised and limited to this paragraph in the pricing section:

However, none of the 5 employees have experience in pension or wealth planning. Their CEO used to be a trader. His Linkedin profile doesn’t show any specific education, neither experience in pension and wealth planning

Do they use a 3rd party provider for the premium services and then recharge the costs ?

When it’s free, you are the product. Do they receive any incentive from IB ? generating money with a spread on each buy/sell ?

How they make money remains a mystery.

I agree with you @Guillaume_GVA . Their product is everything I dreamed of in term of functionalities, but there is something I don’t understand.

I exchanged multiple emails with their support team, and you don’t have a human being signing the messages, it’s all impersonal. You don’t have transparent social media profiles, a roadmap. I believe Yova, Selma and others are way behind what Investart is offering, but at least you can trust them somehow.

I would love to get more return of experience, or I will be happy to give them advice on how to improve their positioning by being more transparent.

Actually, you do the automation by setting an automatic transfer from your bank account to your Investart account. And they invest is according to your allocation (if you only want VT in your portfolio, you only have VT). So yes, you can do it.

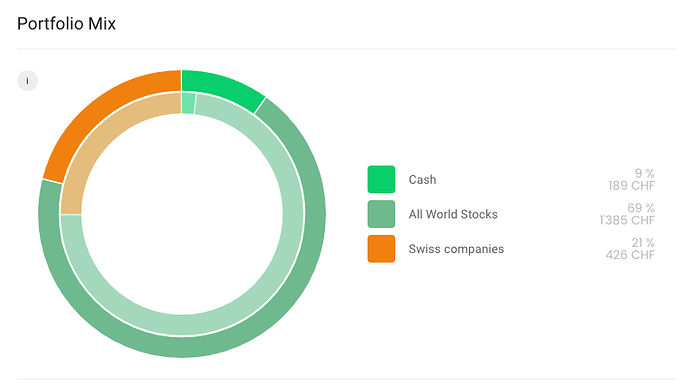

I tried it out, and here is the result:

Inner ring is the target allocation, outer ring is the current allocation (they buy only entire shares, that is the reason of the discrepancy between the two)

Maybe they receive money when they bring in new customers? With the affiliate program or something.

They also announced they added these new ETFs :

- US utility companies (VPU)

- All USD bonds (BNDW)

- All US stocks (VTI)

- US small-cap companies (VB)

- S&P 500 (VOO)

- US real estate companies (VNQ)

- US mid-cap companies (VO)

- US high dividend stocks (VYM)

- Low-volatility stocks US (USMV)

- Japanese companies (EWJ)

- Nasdaq 100 (QQQM)

- 3D printing (PRNT)

- Global real estate companies (REET)

- ARK Innovation (ARKK)

- ARK Robotics (ARKQ)

- ARK Internet (ARKW)

- ARK Genomics (ARKG)

- ARK Fintech (ARKF)

- ARK Space (ARKX)

Some serious stuff, what Investart is doing…

Also wondering, how this can even work

So, I update on my situation. Finally the amount has been found by IB and has landed to the proper account and has been invested.

The issue now is that , as I already have an IB account, it seems that IB asked to merge the two. It seems they have told Investart that - I quote - “this account needs to consolidate with other accounts belonging to the same customer. Please have the client log in to Account Management to consolidate his/her accounts.”

Fact is, I don’t want to mix the two things (one managed by me - with our life savings - and one by IS with kids ‘pocket money’) in any way…in case I would have opened a friends & family account with IB directly and both of them would have been under my control.

I think I’ll contact IB support and try to understand what they want to do, if they continue to ask for this I think my adventure with Investart is going to finish… @anon95353169, I think you also have a personal IB account, did sou experience a similar issue ?

@weirded If that’s really the case and not a mistake on investart side or IB side, this really sucks.

I did not have this issue. The two accounts are perfectly separated and I have not been asked to consolidate them so far. If I have to consolidate them, I will simply close my Investart account as well.

Did you get clarity from IS on whether this is truly necessary?

@thepoorswiss not yet, I’ve opened a ticket with IB yesterday evening, I will report back as soon as they respond

So it must be free and at the same time employ dozens of people to answer emails?

It might be stupid and personal. But in 2021 I appreciate to know the name of the person managing my money.

Yova is for example very personal on that matter.

Ah, ARK’s beloved Space Exploration ETF that includes gems like…

- 2 THE 3D PRINTING ETF (if you 3D print parts, surely some of them can be used in space, can’t they?)

- 3 JD.COM (an online retailer with drone delivery. Is this about drone delivery from space?)

- 8 KOMATSU (a company whose machines move about everything …on the ground of the earth. In space? Not really. But hey, at least they have a trademarket “Space Cab” on some of their excavators. No, really!)

- 14 ALPHABET (at least you can google for and get informed about “space”)

- 19 DEERE (somebody’s got to build our tractors for the moon)

- 25 NETFLIX (boy do I enjoy exploring space on Netflix! …in my own living room)

- 34 MEITUAN (a “Chinese shopping platform for locally found consumer products and retail services”, what they’re saying on Wikipedia. With their sale of travel vouchers, I’m confident the Chinese will be among the first nations to travel vouchers to space)

(yes, admittedly I’m jumping on a bandwagon here)

Well, with their customers’ apparent clamouring for the latest and most newfangled bullshit fresh out of ARK Investment’s woods, maybe they may not be so discerning?

@weirded @anon95353169 I had the same issue and IB told me they have decided recently that all accounts of the same user must be combined under 1 login.

This does not pose any problem for my Investart account though, because IB does NOT require merging the accounts, just bringing them all under the same login name. So when you log into your IB Portal you see not only the standalone account, but also the trading account that is linked to Investart (the two stay separated though).

@David thank you for the info. In the meanwhile I’m still waiting from an official feedback from IB.

How do they ensure that the external administrator is not able to see/touch your other account if the two accounts are accessible under the same login credentials ?

Side note: I’ve just noticed that I have a negative balance of approx. -2’000 CHF own my main IB account - which should not be the case. After playing a little bit with the reports I’ve seen that IB had initially credited by mistake my transfer to Investart to my IB account (despite having specified in the bank payment the correct account number). Later I’ve sold all my CHF for USD to buy some stuff and - after that - IB has “probably spotted the mistake and deducted” the 2’000 CHF (moved to my IS account) leaving me with a negative balance (until the end of the month, when my recurring transfer to IB will cover…). Not really happy with this…  (especially the lack of communication from IB’s side)

(especially the lack of communication from IB’s side)