Hi! I am single, 27, Italy.

Unfortunately, I learned about financial independence late.

I work part time, 25h a week as an accountant, office worker, earning net €10k/year. I am living with my parents, in a double villa, divided, a part for me and a part for my parents; my hometown is all you could ask for, but it’s really too hot, and here, everyone waste 2 months of life, to stay indoors, with air conditioning (August/September). Salary/COL ratio is bad, even for specialists, if compared to other European countries.

Current expenses - Current COL: Living with parents.

| ITEM | MONTH | YEAR |

|---|---|---|

| Housing | €0 | €0 |

| Bills | €0 | €0 |

| Food Home | €20 | €240 |

| Food Eating Out | €20 | €240 |

| Taxes: Income Tax (deducted from salary) | €0 | €0 |

| Trasportation: Car | €80 | €960 |

| Leisure (Books, Gifts, Devices, Subcriptions) | €15 | €180 |

| Travel | €150 | €1800 |

| Personal/Healthcare | €20 | €240 |

| TOTAL (Cost of living) | €305 | €3660 |

Future expenses - Basic COL: Living by myself, same town, own house.

| ITEM | MONTH | YEAR |

|---|---|---|

| Housing | €0 | €0 |

| House Maintenance | €31 | €365 |

| Bills | €100 | €1200 |

| Food Home | €200 | €2400 |

| Food Eating Out | €20 | €240 |

| Taxes: Income Tax (deducted from salary) | €0 | €0 |

| Trasportation: Car | €80 | €960 |

| Leisure (Books, Gifts, Devices, Subcriptions) | €15 | €180 |

| Travel | €150 | €1800 |

| Personal/Healthcare | €20 | €240 |

| TOTAL (Cost of living) | €626 | €7512 |

|---|---|---|

Future expenses - Travel COL: Living by myself, same town, own house. Focus on travelling.

| ITEM | MONTH | YEAR |

|---|---|---|

| Housing | €0 | €0 |

| House Maintenance | €31 | €365 |

| Bills | €90 | €1080 |

| Food Home | €200 | €2400 |

| Food Eating Out (extra is incl. in Travel exp.) | €20 | €240 |

| Taxes: Income Tax (deducted from salary) | €0 | €0 |

| Trasportation: Car (extra is incl. in Travel exp.) | €80 | €960 |

| Leisure (Books, Gifts, Devices, Subcriptions) | €15 | €180 |

| Travel | €400 | €4800 |

| Personal/Healthcare | €20 | €240 |

| TOTAL (Cost of living) | €856 | €10272 |

Assets:

Savings: €20.000

ParentsHouse1 (Where I live): current value €150.000

ParentsHouse2 (Future Inheritanche): current value €150.000

Car old Fiat: €2500

E-bike: €400

Friends: ∞

Personality test:: INFJ-T

Comment:

Unfortunately, I learned about financial independence late.

I work part time, 25h a week as an accountant, office worker, and I am living with my parents, in a double villa, divided, a part for me and a part for my parents; my hometown is all you could ask for, but it’s really too hot, and I waste 2 months of my life, to stay indoors with air conditioning (August/September). Salary/COL ratio is bad, even for specialists, if compared to other European countries.

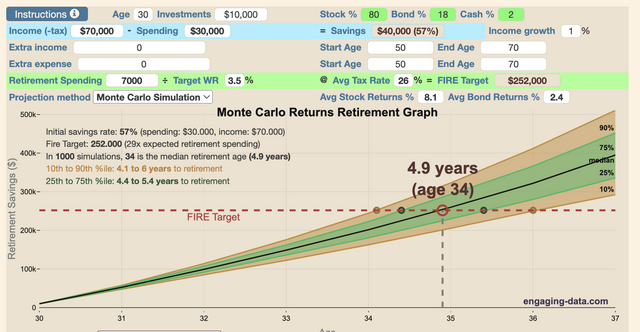

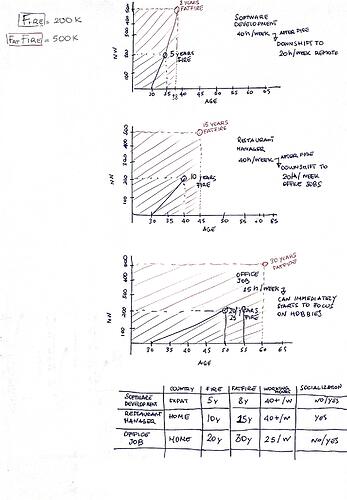

#1Strategy

Given this… I was thinking about getting a degree/specialization, or just do anything that would allow me to take a specific, “high paying” job, work fulltime, 40+/h a week, till I reach the FIRE goal asap (based on “Future expenses - Basic COL”, which is €8k/year), then downshift working hours to 20/h a week, and work remote at that same job, or just find something else, locally.

I won’t consider “the be my own boss” path, because of the “thinking at your business for 24/7”, would make me mentally-ill.

So, for this scenario, I was thinking about expat to Switzerland to reach the FIRE goal in 5y or less, and then come back to Italy to just work on a remote job for Switzerland, if possibile, or just search jobs in Italy that would allow me to work remotely! (or just a job which would pay for COL). So in this case I am not pretending to be FIREd, because I don’t want to put all my focus into just the “FIRE project”, instead, I would like to differentiate with a low energy demand job, which would still pay for my COL, allowing the invested money to grow. I would allow any job that would have a working schedule, less than 4h in 5 days, or 6h in 3 days.

#1Strategy; Fired 35y.o.:

FIRE: will bring 8k a year, but I won’t withdraw them.

COL: covered by the 20h job; savings reduced to 10/20%, will be invested.

PASSIVE INCOME: we are not considering inheritance.

JOB: 18/20h a week.

LIFE: I could dedicate 24-8(sleep)-4(job)= 12 hours of real life.

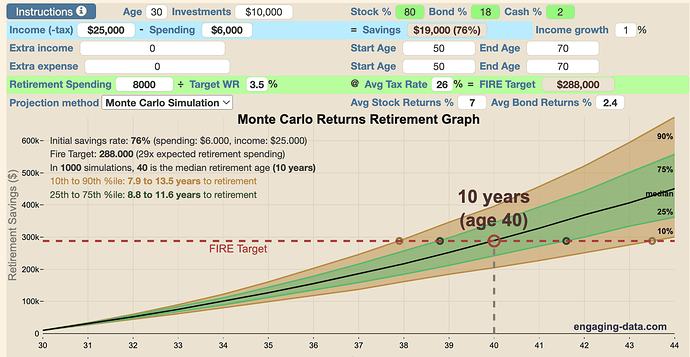

#2Strategy

As alternative to the #1Strategy, I could have a “standard” job in Italy, until I reach the FIRE goal, in this case, in 10 years. Such as:

- Restaurant Manager: 36+ hours a week, €23k net /year, 18h avaiability.

- Condo Admininistrator: 40+ hours a week, €27k net /year, 24h avaiability.

#2Strategy; Fired 40y.o.:

FIRE: will bring 8k a year, but I won’t withdraw them.

COL: covered by the 20h job; savings reduced to 10/20%, will be invested.

PASSIVE INCOME: we are not considering inheritance.

JOB: 18/20h a week.

LIFE: I could dedicate 24-8(sleep)-4(job)= 12 hours of real life.

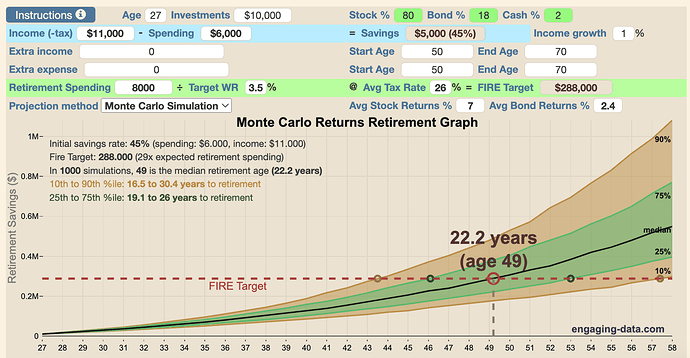

#3Strategy

But I can’t understand if this is really necessary…Am I am already retired, even with the current p.time, 25h a week job? I will inherit a house in the future, which would bring at least 5k year of passive income, and also, may be I really like Switzerland that it would be hard to come back to Italy. We also know there is the hot summer problem, so I could live 10 months in Italy, and the hotter 2, I will stay in Switzerland, but in such a case, I think the cost of living will increase drastically. I do also like the USA, Japan, UK and Portugal but it’s far away from home.

#3Strategy; Fired yet or at 50y.o.?:

FIRE: will bring 8k a year at 50 y.o., but I won’t withdraw them.

COL: covered by the 25h job; savings reduced to 20/30%, will be invested.

PASSIVE INCOME: we are not considering inheritance.

JOB: 25h a week.

LIFE: I am dedicating 24-8(sleep)-5(job)= 11 hours of real life. (I can do what I love, starting now)

What would I do in a life without the need of money? What I love to do?

Mostly: Writing, Drawing, Music.

(Someone suggested me to write/draw/play music freelance, and do it as a “WFH job”. This makes sense, but I don’t know if is there any good to think about making money with your passion. That would be ruined)

Also:

Reading, Travelling, Socialization, Food, Photography, Learning, etc.

END

…updated…