Anyone with first or second hand practical experience of being technically classified as Nichterwerbstätiger but still working and expected to pay or paying more AHV/IV/EO than the minimal amount of currently CHF 530 per year?

Asking for a friend …

Forum colleagues eager to point out what the rules are should be entitled to those views … but I am not really interested in them: I think I know what the rules are. If you find flaws in my description of the rules, feel free to point these out.

Background:

Said friend has reduced his working pensum to now 10% (but still pays AHV/IV/EO on this income). Technically, they’re now classified as Nichterwerbstätiger.* According to Merkblatt 2.03 they’re encouraged** to pay AHV/IV/EO according to their taxable wealth minus the AHV/IV/EO they still pay on their income.

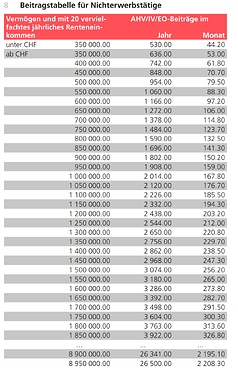

If said friend had less than CHF 350’000 in taxable wealth*** they would have to pay the minimum of CHF 530 per year into AHV/IV/EO. If the person has more wealth, they’re encouraged** to pay additionally according to a formula, basically this table:

As mentioned, the person can substract from the amount due to wealth the amount of AHV/IV/EO still paid via their job.

Said friend has accounted for this additional “tax” many years before falling into the category of Nichterwerbstätige and has pre-calculated the amounts due and was about to contact the AHV Ausgleichskasse for arranging the details when their best friend, an HR and accounting expert fluent in calculating mandatory wage deductions like AHV/IV/EO, told them that the friend’s remaining 10% job resulted in a multiple of the minmal CHF 530 per annum of AHV/IV/EO contributions, that the AHV Ausgleichskasse is not informed by the employer about the working status of the employee – it could be that said friend works 10% in a high paying job or 80% in a shitty paying job or paid “volunteer like” work – and that therefore the AHV Ausgleichskasse will not notice that perhaps said friend is encouraged to be paying higher contributions.

My friend first thought that this was odd advice, especially coming from an HR and accountant expert, but then they warmed up to it: the AHV/IV/EO is mostly processed automatically and it seems unlikely that there’s tight monitoring to catch corner cases as there’s probably very few of them.

Anyhow, curious about any first or second hand stories forum members have, either from themselves or their … ahem, “friends”.

* Works less than 50% or fewer than 9 months per year.

** They don’t have to pay, but if the AHV Ausgleichskasse notices that they miss a Beitragsjahr, the AHV will be reduced accordingly to the number of missed Beitragsjahre.

** Arriving at the limit of CHF 350’000 is a little more complicated to calculate, but for the purpose of this discussion, it would really only be the taxable wealth.