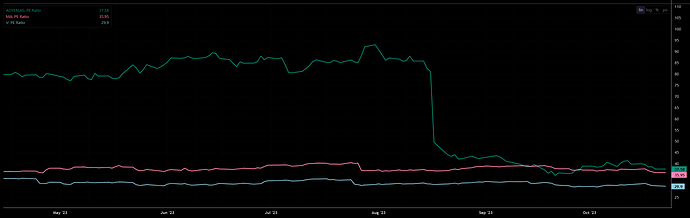

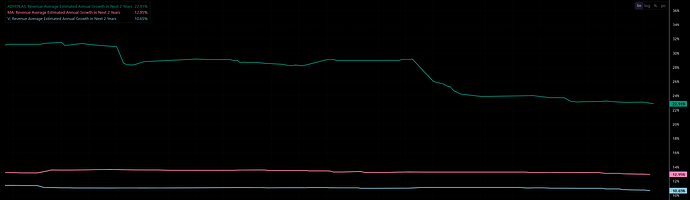

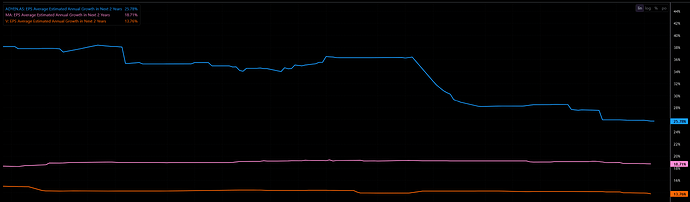

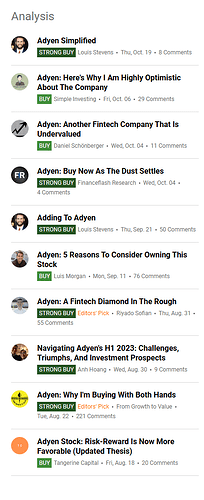

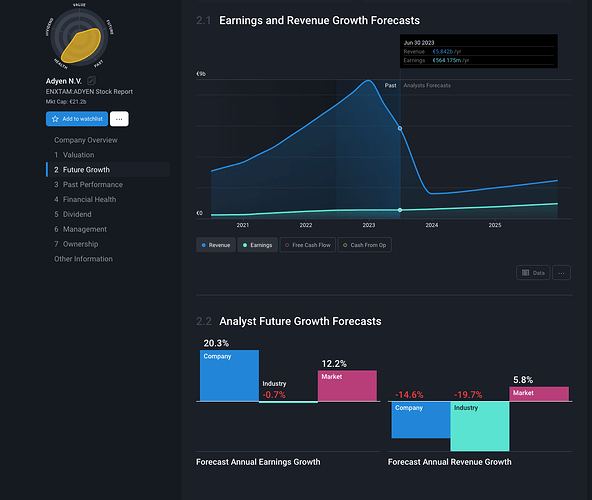

Has anybody reviewed recently Adyen (ADYEY; ADYEN.AS)? After ~40% price drop mid-August as consequence of H1 financial results, they are now trading on similar P/E to Mastercard, with much higher expected revenue and EPS growth. What is your take on Adyen?

I looked at it previously. Was ridiculously overpriced and IMO remains so even after the drop.

Care to share your own’s stock analysis for discussion ?

See also FT: Payment company Worldline’s shares drop 50% after revenue forecast cut. Shares in Worldline were suspended on Wednesday after plunging around 50 per cent to all-time lows, as the payment group cut its revenue forecast for the year.

Adyen fell another 10% today.

P/E at 38, I would put a small amount of money and consider it a gambling stock atm.

It didn’t implode, but they changed re

H1 2023 Shareholder letter (getbynder.com)

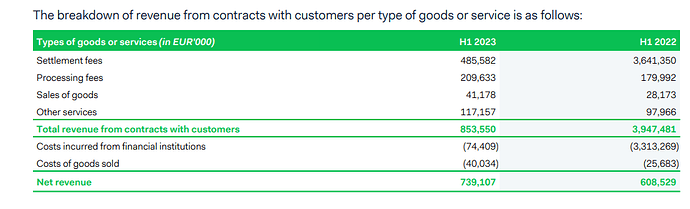

In the current period, Adyen amended its terms and conditions applicable to merchant agreements in

order to specify the responsibilities of the services provided by financial institutions and network scheme

providers involved in the payment processing and acquiring services. The change in terms and

conditions specifies the distinct services provided in the payment flow, clarifying that Adyen does not

provide a significant service of integrating the services from third parties into one combined output for

the merchant, nor does it control the inputs from third parties before services are provided to the

merchant. As such, Adyen acts as agent for the pass-through settlement fees prospectively from

January 1, 2023.

Net revenue actually grew:

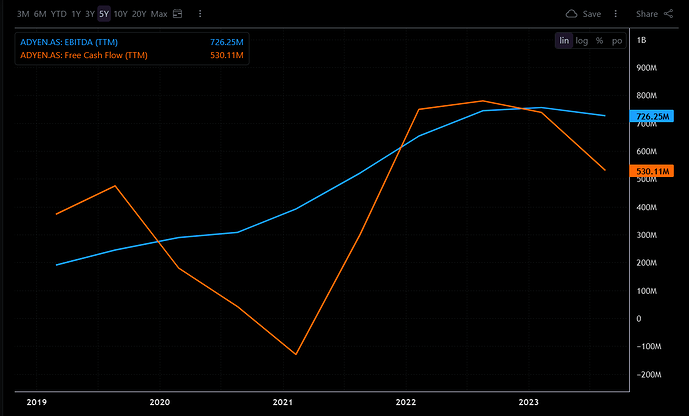

But EBITDA and Free Cash Flow declined:

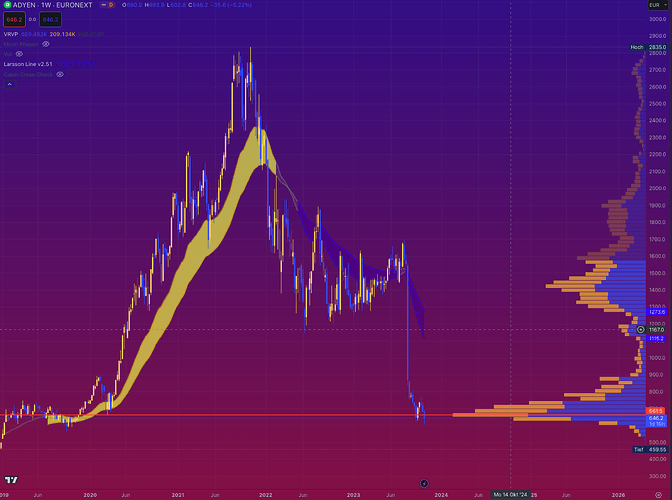

Price sits currently at year long resistance but the charts looks extremely weak and might even break further down here. I wouldn’t expect a quick recovery at this point. Risk/reward seems unfavorable to me at this point even if even if fundamentals are strong and long term outlook might be good.