It’s still the case. The expected returns are indeed terrible in CHF but we also have low inflation, and if you add bonds to a portfolio to reduce overall portfolio volatility, the purpose of the bonds is not to generate significant real returns. I’d also recommend limiting the bond duration, especially with the already very low interest rates.

Yeah but for instance IBKR doesn’t like the liquidity sometimes. E.g. WEGB on SIX has 100% margin requirement vs 30% on XETRA.

Yes, I also noticed that at least some SIX ETF listings have a 100% margin requirement at IBKR. I’m not sure what their exact reasoning for this is. Even if sometimes the spread is a bit wider than at other exchanges, it should always be possible to immediately liquidate a position for a more or less fair price. I don’t see why IBKR considers this more risky.

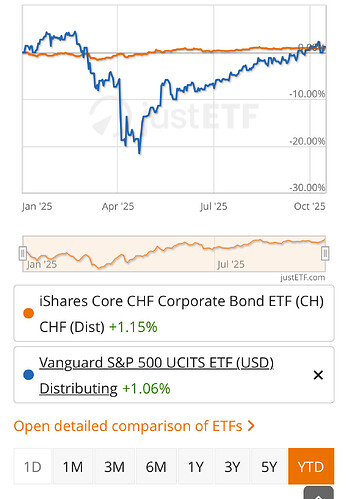

Thanks, we can cherry pick almost any asset over another asset to show how they outperform it over some set period. But do you genuinely belive that swiss bonds are a necessary asset in a portfolio with 20+ year timeline focused on growth?

I think Swiss bonds might not be tax efficient but Swiss CHF is also fine for low risk portion of portfolio.

The point is that 100% equity portfolio will definitely crash the spirits of many investors in the time of a serious crash like GFC.

Everyone I know pretends to have 20+ investment horizon and rock solid risk tolerance. Reality is most cannot stomach a 50% crash if it lasts for 5-10 year period.

in summary -: investing is a balance of risk and return. Often people completely forget about risk part of equation.

Do I expect Swiss bonds to outperform stocks? NO

Do I think people should have 100% equity portfolios? NO

—

P.S -: probability of experiencing a 50% crash in investing horizon of 30 years is 100%