Dear All,

I searched the forum and didn’t find relevant discussion/answers. Please merge this topic if this is a duplicate.

This is my attempt to file taxes first time and hence would like to make sure I am not making any mistakes. Here are few questions:

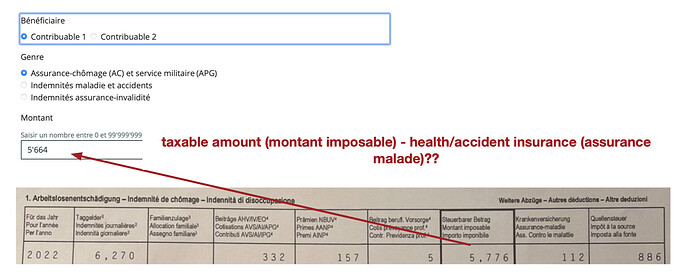

- As an example, see the certificate from unemployment insurance. Last year my CA reported the amount as: taxable amount (montant imposable) - health/accident insurance (assurance malade). In this example, it would be 5776 – 112 = 5664. I am not questing my CA but just want to confirm if this is how you typically do it and wondering why assurance maladie is deducted (by CA).

-

The l’impôt à la source from the unemployment certificate (e.g. 886) needs to be added to Total des acomptes payés/ Total advance payments, right? From my understanding no other information from this unemployment certificate is used anywhere else.

-

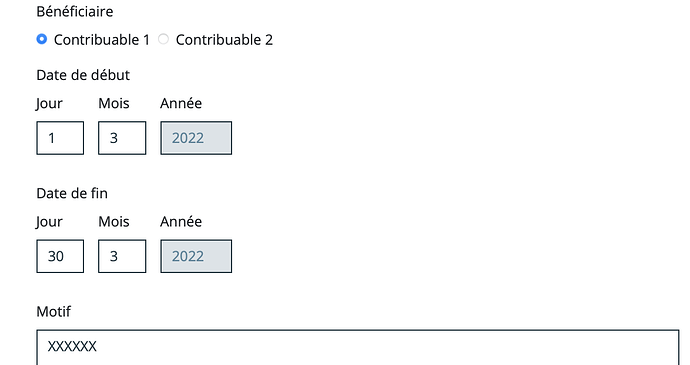

There is a category Periods of work interruption/ Périodes d’interruption de travail (like below, at least in Vaud):

Before starting new employment, I took few weeks of break and unemployment/chomage insurance says as you are taking break for personal reasons/vacation, they won’t pay anything. So I am just mentioning that one month as work interruption with short explanation. Is this correct or work interruption is supposed to be something else like due to accident?

Thank you very much in advance! The existing discussions has helped and clarified so many things!