Sorry what do you call your VT ?

VT = Vanguard Total Market ETFs. You can pledge your stocks for a rather low interest rate either directly with IB or the bank that gives you a mortgage.

@Balaclava Comparis offers free advice for mortgages. They negotiate on your behalf not only with banks but also with insurance companies which often provide better rates.

Remember that if you use your 2ème pillar, you have to reimburse whatever you take out before you can make voluntary contributions to the 2ème pillar for tax purposes.

At Comparis I dealt with a former bank employee who was highly experienced in mortgages and tax matters. I can highly recommend him if he is still there. See contact details below:

Frédéric Romanens

Senior Spécialiste Hypothécaire

frederic.romanens@hypoplus.ch

043 311 77 41

Bretter than comparis ? check valuu.ch

As always on that topic some people post without knowing the actual rules valid in CH for financing, some corrections were fortunately made especially on the 2nd pillar topic. Given what you posted it’s not possible to give you an advice on a financing structure, we would need more information on the bonus since banks will average it over the last 3 years and take an haircut on this value (usually 60%).

Once this is known you need to calculate the affordability based on a 5% interest rate, 0.7% maintenance (if it’s a new building), repayment of the 2nd mortgage within 15 years and you can then only see how much you are able to borrow.

OP and his wife are in their early thirties.

You are paying 13’800 CHF/m2, that is still pretty normal

The average price for new buildings was 13’600 CHF/m2 in canton Zurich last year, so you can still consider it an investment and not craziness

We were in a similair situation a few years ago.

we paid 10% cash (that’s a must), 15% 2nd pillar. We didn’t empty the 3rd pillar because it is much better invested compared to the shitty 2nd pillar that is becoming more and more a political tool in the recent years that is used to take money from young people and gives it to old people (voters) and therefore has has a return of around 1,25% (!). There are also ideas being discussed in Bern of no longer allowing using your BVG to buy real estate. That’s why we didn’t hesitate for one second to slaughter our BVG for the apartment. The 3rd pillar was given the bank purely as additional security to increase our rating.

Don’t only ask banks for mortgage, your pension fund and other insurances are also very keen of handing them out at much better (fixed) rates usually. You might not get a nice coffee from a pretty bank assistant though.

Yep, I was very pround when we signed our 1,65% mortgagefor 10 years 6 years back

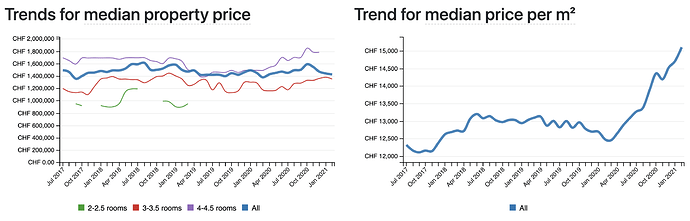

Hey guys I just had a look at immomapper stats. What the hell is going on with these prices in Zurich?

Since April 2020 the median price per sqm really exploded. The total price didn’t move, though.

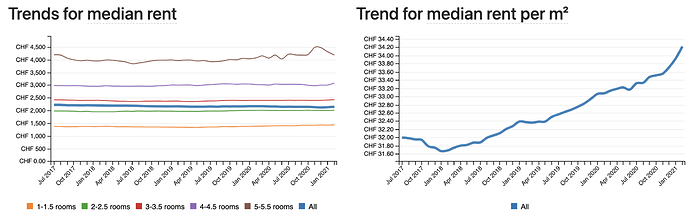

The same can be observed for rent, although the time period is longer. What should this mean? Is the data corrupt or are people putting more smaller flats on the market?

Hi Bojack, I saw this webinar and found it quite insightful (the part of the guest): https://www.youtube.com/watch?v=P32vb4OE5vI

In short: the supply is going down while the demand is going up…

Yes, but thankfully many knowledgeable guys are around to course-correct ![]()

Considering your second point, I am just about to clearify this with a bank and will update you here, once the numbers are defined by a bank (income, bonus etc.) and will be the basis for the further structure / calculations.Its not very straight forward in our case, but I will follow up, once i have the numbers.

Yes I will try that and update you here, once I have the first draft of a structure.

This would be reflected in total prices, but they seem to be pretty stable, only the price per m2 goes up. Also important to keep in mind: the prices on these charts are ASK prices from the offers. We don’t know if they actually get sold or what is the final price.

Maybe people are not able to afford to pay more in total, so they decide to buy smaller properties, pumping just the price per m2?

I wouldn’t say they can’t afford it, but rather that there is more movement on the market of properties with a higher price per sqm. Are smaller flats generally more expensive per m2? I guess so.

Remember that these charts show the ask price of published offers, not actual transactions. So these charts would suggest that the last months have seen more and more flats put for sale that are smaller, so less expensive in total, but with a high price per m2. I don’t know, it seems pretty weird to me. Why did the average total price not go up? I sense a bug in the charts…

Yes and what I recently read somewhere (unfortunately I don’t remember where it was), that on average the transaction price was a few % higher than the asking price (again, don’t remember exact numbers). That’s crazy, I know :).

Could also be a mix change, there’s been a lot of new built coming on the market this year, they tend to be smaller and more high end. E.g. grunhof is like a few hundred apartment right in the middle of Zurich? (http://www.gruenhof.ch/)

Got it (sorry, in French, but translator will do the job if needed):

Yep, could be. Which only shows how the “median price” doesn’t tell you much without proper context.

By the way, these flats like “Grünhof” are exactly something I would never like to live in. The price is high, but the flats are squeezed between existing buildings. You don’t have much view out of the window, or green areas, more like a concrete jungle.

I hope at least the courtyard is green though at Grünhof Siedlung.