By the way, how often can you transfer money to VIAC? Is it possible every month?

I think you can transfer as often as you’d like, but they only buy shares once a month. On the 1st or next working day, I think.

This is indeed how it works.

And if I want to do it with a single transfer of 6768 CHF, do I need to make the transfer until last working day of the year?

That’s not an issue. On the tax side, it will be counted in the 3a even if the money is not invested yet.

Hi there - sorry that I didn’t contribute myself directly in the last weeks. Always great to read through your posts, gives us feedback and inputs!

To clarify some things:

What will be the major features for the Update by the end of May?

- Multiportfolio: It takes you 10 seconds to add a 2nd portfolio. You can have no more than 5 portfolios. each portfolio can have a different strategy.

- Individual Strategy: You can create your own asset allocation. Out of our preselected index funds and ETFs you can create you own strategy in 1% allcation steps.

- Reward Programm: I don’t want to state all the details, but it’s defenitly worth more that the 10.- from ZAK  - stay tuned!

- stay tuned!

And some minors improvments as better notification settings, better performance drilldown - but still TWR  and more. Can’t wait to get your feedback

and more. Can’t wait to get your feedback

Future: We are working on the Webversion and the 2nd pillar (Freizügigkeit) - but not yet sure when it will be available - probably fall 2018.

Regards Daniel

We didn’t make it public so far, but we hit 3’000 customers last friday…

This is great news. Are there any limits for the individual asset allocation or can I put all my money in SPI Extra?

@VIAC

yes, sounds great!

I would be highly interested here. In case you are planning something similar as with pillar 3 (low-cost, high stocks-exposure) i will be eager to know about!

Unfortunately only 35% (to cap the exposure to the underlying single stocks of the index). But if you like small mid caps, you will be able to add “CSIF (CH) World ex CH Small Cap” for example. Stay tuned!

It will be great, sooo great

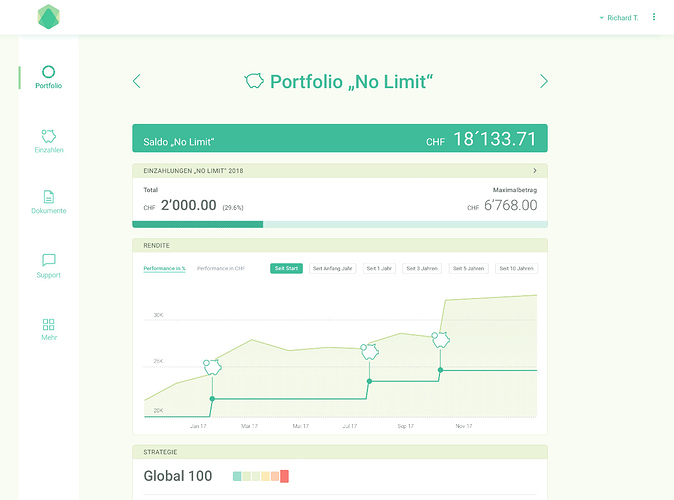

(btw this is the first time ever, that we made a screen of the web-version public…)

What does Freizügigkeit mean? It would be cool if you introduced a mustachian-friendly 2. pillar. Then I would definitely show it to my boss.

That will probably be for self-employed people without 2nd Pillar. They are allowed to pay up to CHF 30k-something to their 3a.

It’s not the same:

Freizügigkeitskonto in 2nd pillar is used when you are not currently connected to a Pensionskasse, either because you are unemployed or you are self employed. This is where your 2nd pillar money will be stored until you connect to a new Pensionskasse.

The big 3a for self-employed people that don’t have a 2nd pillar allows you to pay up to 20% of your income or max. CHF 33’840 into your 3a.

Some people are able to hide their Freizügigkeitskonto from the new Pensionskasse and keep it there. The law is clear on this: Your money has to go to the Pensionskasse, but might be worth a try. Not sure what the risk is.

@VIAC Will there be a minimum swiss allocation we need to have when creating own strategies? If yes around where will it be?

Potential funds out there are CHF 150 billion (https://www.nzz.ch/finanzen/wenig-wertschriftenkonten-in-der-saeule-3a-ld.1293667) from 3a + Freizügigkeit , and the example AUM 100 million wud be only 0.07% of these funds. Even if most people are & remain chicken & prefer cash accounts to ETF’s, big institutions over small start-ups, I’d think it makes a potentially very interesting business case financially with those numbers.

In addition to the 3a money, for my early retirement (still a few years away) I’ve looked at some options for the Pensionkasse money (Säule 2), and if not leaving CH the options are very very limited (mostly accounts paying very low interest). Viac solution will be very interesting for me for that too, and glad to hear this being offered soon.

There is only a currency minimum of 40% for the CHF. So if you choose the MSCI World ex CH hedged or the MSCI World Small Mid Caps ex CH hedged in addition to other foreign investments you can go without a swiss equity allication.

Privately I hold VUSA and VEUR, which are listed in CHF on SIX. Would this also be allowed, or only ETFs, where the base currency is CHF?

The above mentioned funds are both indexfunds with a zero TER. Credit Suisse (who manges these funds) charges us directly for asssets held within these structures and not the customers within the fund. I think we have comparable and most of the time even better products to choose from. You will see all available products directly in the app once our release 2 is public.

Are you refering to the ETFs I mentioned? VUSA and VUR are Vanguard index funds. They don’t have anything to do with Credit Suisse, and don’t have a zero TER.

http://www.six-swiss-exchange.com/funds/security_info_en.html?id=IE00B3XXRP09CHF4

SIX website lists these market makers for the ETF:

- Commerzbank AG

- Flow Traders B.V.

- Goldenberg Hehmeyer LLP

- IMC Trading B.V.

- Optiver V.O.F

- Susquehanna

- Virtu Financial Ireland Ltd.