Hello fellow mustachians,

I only discovered Mustachian Post recently, but read a lot of the blog posts already. It’s great to have someone blogging about his personal experiences while trying to reach FI in Switzerland.

I’m 36 years old, originally from the “Big Kanton” (for those of you who don’t know: that’s Germany), living in Basel since nearly two years now. Since I was a child, I had the frugal mentality. If I got some pocket money from my grandmother, I made sure to at least save 50% of the cash (even if it wasn’t that much).

I’ve been working in the IT area since more than 10 years (if you count job years), but have been doing IT since mid of the 90s (coax cables, administrating WIN NT machines, fixing problems for relatives). The good old days. Ok, maybe not…

Anyway, I’ve been living a frugal lifestyle for most of my life. When still in Germany, I had a decent salary for the region where I was living, but nothing special in fact.

When I received the job offer from Switzerland in 2017, I was shocked (positively) at first. You could make so much money, just for doing the same things I’ve been doing for years??

I think I’ve been telling people that I’m going to retire way before the official retirement age all my life. Read a lot of books about financial topics, and theoretically I already knew back in 2013 that investing in large passive index ETFs is the best option to invest. BUT, I’m a perfectionist, hence I always wanted to read more and more, waiting for the perfect time before investing my hard earned money. Stock markets had recovered quite well from 2008, so I was hesitant. Btw, I also knew back then that market timing doesn’t work, but still it’s hard to believe if you think you can influence all other things in your life…

Additionally, I also read a lot of blogs. MMM, german blogs from the FIRE movement. Again, all nice to read, but still didn’t invest. Instead, I saw the cash grow on my bank account (slowly, but steadily).

Long story short, here I am now. Still reading a lot of stuff, but finally managed to open an account at DEGIRO, transferred 10k there and bough three ETFs:

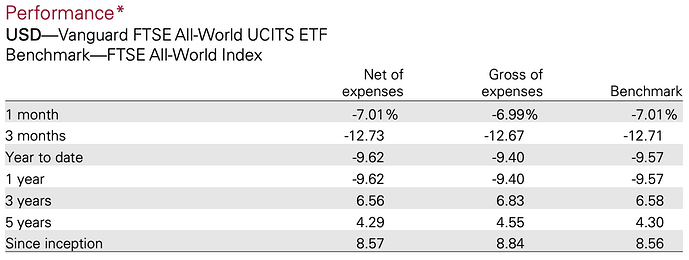

75% Vanguard FTSE All-World (IE00B3RBWM25) in CHF

15% iShares Core MSCI Emerging Markets IMI UCITS ETF (IE00BKM4GZ66) in EUR

10% SPDR® MSCI World Small Cap UCITS ETF (IE00BCBJG560) in EUR

I decided to add more EM to the portfolio due to All-Wold only having 10%. The SmallCap can be debated. For me it’s a bet to gain more Alpha.

I still have a lot of cash lying on the bank account, which will be invested within the next weeks and months.

First question I have: does it make sense to spread the ETFs in CHF and EUR? In my case it was the spread, which was better at EAM than at SIX. I don’t plan to retire in Switzerland. Still, the bet is on which currency is more stable in the coming years. I know that the underlying currency is USD.

Second question: would it make more sense to switch to IB directly? The fees at DEGIRO were pretty good, but from what I’ve read IB is the better place to hold your portfolio

Third question: would it be better to buy funds like VT directly in USD? VT has more stocks, including small caps, afaik

Fourth question: I read the nugget thread about taxation, but I don’t get it. Is it better to hold funds in USD to save taxes in Switzerland? Or can I also hold Irish domiciled ETFs?

Fifth, and final question: regarding the 60k threshold for US funds. MP writes that the situation is unclear, and if you die (as a non-US citizen) everything above 60k is taxed fully. I read several threads in this forum, and there I’ve read that the threshold is 5 million if your country has a tax agreement with the US. Which one is true? I’d like to invest in VT, but I have mixed feelings about the 60k threshold.

For the sake of completeness: I don’t have any 3rd pillar so far, because this money is blocked until your retirement. I don’t like my money being blocked, so I did not invest any cash there yet.

I guess that’s it for (thanks for reading until here). Don’t hesitate to ask if anything is unclear. Of course you can also point me to other threads, if my questions have all been answered before. I read a lot of threads already, but sometimes you don’t see the forest for the threes…

BR FIREstarter