[Initially wanted to tack this onto an existing SWR topic, but the system asked me somewhat accusatory “do you really want to (paraphrasing) wake up about 200 people who commented on this topic before?”

Now that I’m opening a new topic the system tells me “Your topic is similar to … plenty of threads mentioning SWR …”

![]() ]

]

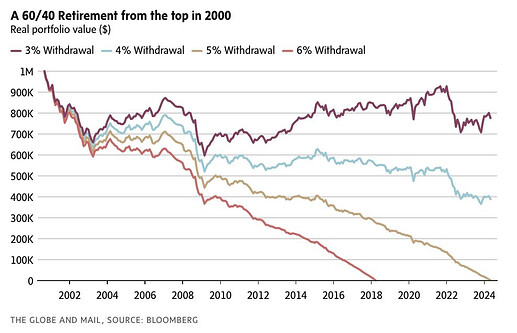

Came across this on Twitter:

(Source: x.com, further details see below*)

Details aside (currencies, markets, 60/40 implementation, what not) I found this interesting.

To be clear: Not meant as FUD. I personally don’t think we’re anywhere close to what the top in 2000 looked like.

I just find it interesting on its own.

* The original article is behind a paywall but with some poking the original text reveals:

- the author applies the original Bengen paper for a Canadian investor

- his 60/40 portfolio is

- 40%: “the Canadian bond index”

- 20%: “the Canadian stock index”

- 20%: S&P 500

- 20%: MSCI EAFE Index