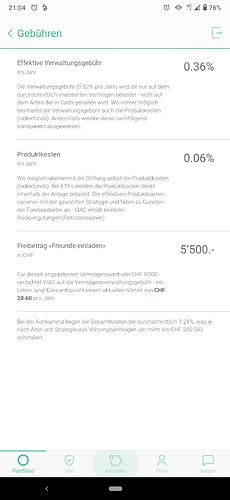

Global 100, but I have sent lump sump for 2021(6883 CHF) on the 5th of January so that still sits uninvested as a cash.

Then the fees will raise when it is invested.

I would also spread out the money over the different portfolios.

Also, if you used a referral code or somebody used some of yours, a certain amount is deducted from the invested sum, thus lowering your effective fee. AFAIK this shows up there too.

There is no fee for the cash part, so you see the total fee. Will be at 0.51% in 2 weeks.

I guess you have 22-23k in total?

Yes, exactly currently I have 22,4k. Thank you all. I did not realise that I have missed the rebalancing day at the beginning of the year because of the bank transfers etc.

The fee should be 0.52% for a 100% stock portfolio - it says so in the text in your screenshot. They don’t charge for cash positions, so either if you have <100% stocks, or if you pay-in and hold cash before the re-balancing at month end.

What is odd, however, one of my portfolios with them is 100% stocks and I don’t pay in, there should be no cash positions. Yet my fee is given as 0.44%…

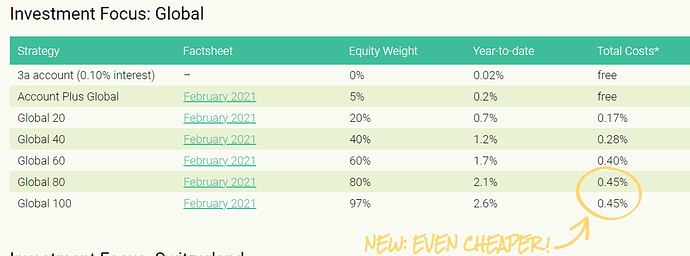

Fees have decrease: 3e pilier: Stratégies – VIAC

This one is a bit clearer I think Wie funktioniert der Gebührencap bei VIAC? – VIAC

Does that make VIAC the most affordable choice again?

Good news!

I wonder what the price would be without the “free” insurance.

It is very competitive ! Really the best move to migrate them from my classic cantonal bank to Viac !

On one of my custom strategy invested 97% in ETF, it cost 0.42%. Cheaper thna the Global100

Oh wow my custom strategy went down to 0.43%. Very nice!

Who knows where they will be in 5-10 years after growing further? Maybe down to 0.2-0.3%?

They’ve annonced that they will proceed to an update of their app and website for today and they’ve annonced a few weeks ago that something new was upcoming. When I logged in the evening I was a bit surprised to see my first account (Global 100) at 0.39% (0.38 + 0.01) and my second account (Global 100) at 0.45% (0.44 + 0.01). I don’t know why I have less fees on the first one

But congratulation to VIAC for having decrease their fees!

Bonus for promoting it to others.

The cheapest choice depends on which allocation you choose. If you choose the maximum of equity (97%), VIAC’s fees will be capped at 0.44%, very close to Finpension’s at 0.42%.

Here’s the details of the fee cap: How does the fee cap work at VIAC? – VIAC

In short: anyone with Equities above 85% of their allocation has gained from the fee cap.

Assuming stocks return 6%/year on average, ValuePensions 99% (instead of 97%) stock allocation has an additonal performance advantage of 0.12%/year.

True, but compared to the previous cost structure I’d say that now the difference is almost negligible. I was considering switching to finpension this year but at this point I won’t bother.

Overall it’ very refreshing to see competition at work, lowering the fees for the end users.

If you had to open 10 accounts right now (5 for you and 5 for your wife) and contribute evenly into them for 20-25 years before moving out of Switzerland at retirement age, would you:

Open all 10 of them at Viac?

Open all 10 of them at Finpension?

Or split 5 and 5 between Viac and Finpension?

Let’s say you are very risk-friendly (3rd pillar will also be a minority of your investment portfolio) so your strategy would be to hit as close to 100 % stock as possible (no real estate, gold, etc.). You want to follow a global index like FTSE All World or MSCI ACWI. No additional exposure to CH stocks or other regions. You just want to follow one simple world index and don’t want to rebalance ever; set and forget auto-pilot type of thing for years to come.

What would you do? Of course I realize that things will change a lot until the day of my retirement, there will be new competitors etc but I need to open a 3a pillar finally…