If it is about this CSIF (ISIN CH0336206674) you posted. Seems that the announcement is usually early May and the actual distribution mid May.

https://imgur.com/NG2RFhy

Thanks guys.

The CSIF funds I was talking about are all here:

https://viac.ch/en/strategies/

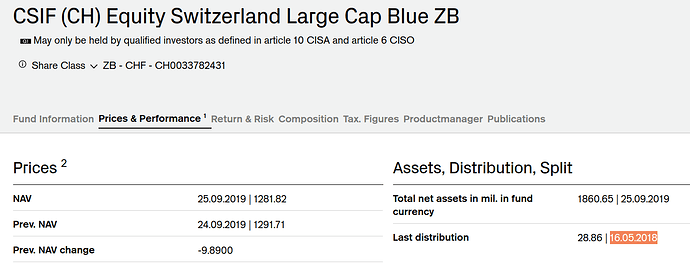

The last distribution was on 16.05.2018 for most of them. This year very few got a distribution on 16.05.2019/ 17.05.2019.

The VIAC page contains links to all factsheets where you can see the latest distribution. I can put as example the fund for SMI (but it’s the same for most of other CSIF funds):

I was just wondering when the next distribution would happen but it’s ok.

Thanks.

Thanks for a detailed reply. One clarification: even if I’m not adjusting the strategy, VIAC still does the rebalancing every month, which results in fees. Is there a way to make it less frequent, e.g., [half-]yearly unless the strategy is adjusted manually?

Probably most are using the Global 100 strategy with total costs of 0,55 (0,52 Verwaltungsgebühr, 0,03 Produktionskosten) or something else?

Many people here have their own custom strategy with 97% stocks.

I’m not sure if I should use the Global 100 (don’t like the fact that 28% is SMI) or just do something on my own:

3% cash

12% SMI

25% SPI Extra

20% World ex CH

20% SP500

10% World ex CH Small Cap

10% EM

or

3% cash

12% SMI

25% SPI Extra

5% Pacific ex Japan

7% Japan

10% Europe ex CH

25% SP500

3% Canada

10% EM

My ideal scenario would be something that comes close to VT, but due to swiss regulations 40% needs to be in CHF and I don’t want the CHF hedged index funds.

Hi there,

I am considering something similar but I am wondering what you would not want to used hedged funds.

CHF/USD hedge has a huge impact on performance, especially these days (-2.5%/year). I don’t know many CHF hedged funds, but just one example:

107% compared to 65%. USD/CHF 10 years ago: 1.01, today: 0.99. So the hedge was completely useless and made you lose a lot of money.

Thanks for the answer. I guess I don’t understand enough how hedging works to properly get why their performances was that much smaller.

FED interest rate: 1.75%

SNB interest rate: -0.75%

Hedging USD/CHF costs: 2.50%

It was even higher in the past as FED cut their rates in the past months. Even 2.5% compounded over 10 years will cost you almost 30% in performance.

Was looking through the VIAC threads, but did not find any good answer to my question.

Would it not make sense to keep the yearly max CHF 6’826.- and invest it as usual, instead of investing it into the 3a pillar (even VIAC) and losing the potential tax deduction?

Dividends get taxed at your marginal tax rate. That is an additional cost of around 40 basis points. Then there is also the wealth tax that costs between 15 and 80 basis points.

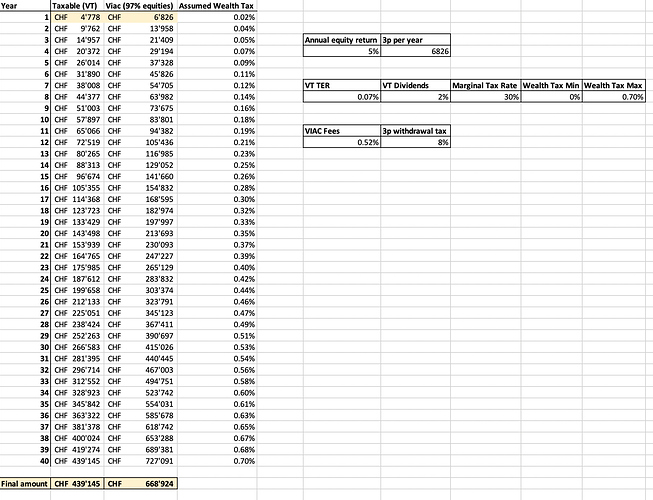

Easy to calculate. Let’s assume a 30 year horizon and 7% average annual returns:

Value after 30y in VT (0.07% TER)

687,877.92 CHF

pre-dividend tax

assuming 30% marginal tax on 2% dividend

623,280.81 CHF

Value after 30y in VIAC (0.52% TER + opportunity cost of having 3% in cash)

630,241.55 CHF

tax-free

Worth it ![]()

You forgot tax rebate of ~CHF2k for putting in 3p.

So investing 6.8k in VIAC is the same as paying 2k more tax and then investing 4.8k in VT.

You also forgot wealth tax which would be an extra drag of 0.1%-0.7% per annum.

My conclusion has been that VIAC 97% equities is the best passive investment you can get in Switzerland and pretty much every single taxpayer in the country should really be abusing it yearly.

Totally. Assuming the extra 2k in saved taxes gets reinvested in VT, the return after 30y grows from ~630k to 800k CHF.

With some quick Excel modelling I came to the below conclusion. Can debate the parameters but I think these ones are fairly reasonable and show how strong VIAC 97% equities can be over a career.

You assumed a very high withdrawal tax.

This shows that it’s worth to split 3A over multiple accounts.

Mr. Rip wrote a nice blog post about this topic:

I think the most important things are:

- You save 2k in taxes, that you can invest in VT.

- Taxes: Dividends in 3rd pillar are not taxed and hopefully soon also without the US tax withdrawal. Plus no wealth tax.

This alone will overcompensate any loss from the higher TER and the 3rd pillar withdrawal tax in the future. It’s a no-brainer!

a few years back, i came to the conclusion of VIAC being very similar to non-viac up to a small margin:

using my back-then sophisticated 3a modeller

for being locked away and subject to uncertainty of future legislation, I personally decided that I’d rather stick to my IB-portfolio.

If I had marginal tax of 30% instead of like 15%, i should reconsider.

Dont’t forget Kapitalbezugsteuer, applying once on recieving your 3a stash.

bottom line: to me there is no clear “VIAC 3a is best!”

Here is a simulation with very low marginal tax rates. Kapitalbezugssteuer is calculated for each year.