I thought so too, but I asked them and they confirmed that this value will be frozen. I guess they want to make it as unattractive to quit as they possibly can. Very unfavorable conditions for the customer.

Because it’s dogshit! They’ll 1000% invest and profit from the money themselves until the owner can get it out, more free float for them, and this is really free if the policy is frozen.

Ok. One last thing

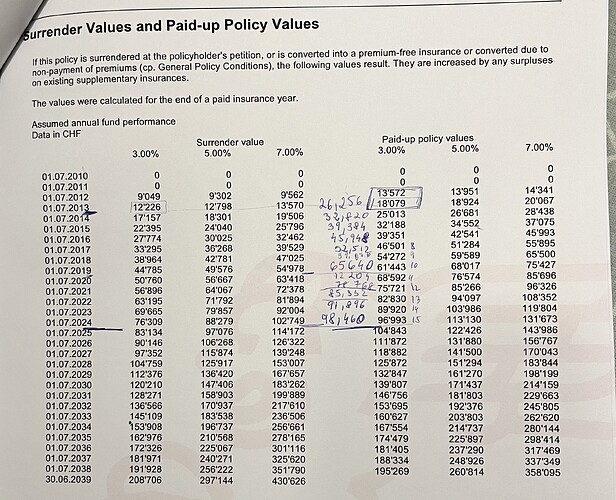

In beginning you said they were showing calculations with 3/5/6 percent annual increase in fund value and showed some simulations

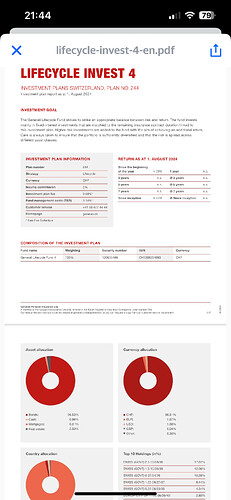

How was that possible if 100% of investment fund is in Swiss bonds? Bonds don’t have such returns.

I feel either you selected a low risk strategy which has also reduced the returns so far OR the salesperson just showed some standard charts without even knowing how things work.

This is the paper they gave me when I signed the policy. In handwriting, is how much I have paid in.

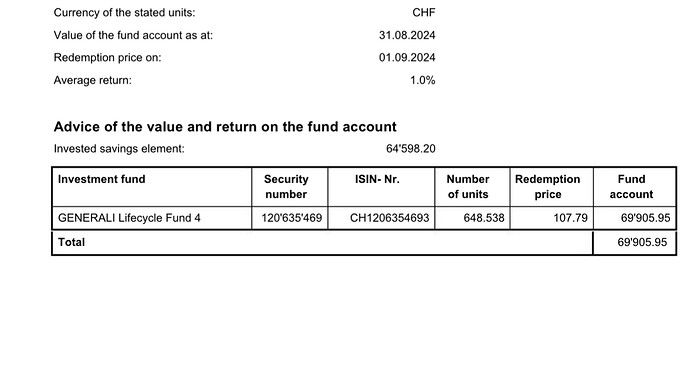

In June I got a letter that they will change the investment fond. This is where it is in now. Just got this today, no idea why it is only 69k. I need to call them tomorrow. I wish I would be a bit more knowledgeable in this matter… I wish I would have looked into it a bit earlier…

Interesting

They mentioned assumed fund performance and then invested all money in bond funds. Makes no sense

I am sorry to see you got involved into this.

But hey , at least now you know and can act.

The business model of cash-value life insurance, at least up until now, has been to charge you inflated insurance premiums and extremely high “adminstrative fees,” and then hope that the returns on your investment make up for these over the full insurance term. Basically the insurance company takes your returns in the form of its “administrative fees.”

The guaranteed cash value (for offers that have guranteed cash value) typically only matches the sum total of premiums paid in the year in which the policy matures.