Wait, for the “traditional” finpension accounts that invests index funds, does the 0.39% fee apply to the invested assets only or to everything, including the 1% cash?

Everything

Has it always been this way or only since they now also offer cash accounts?

I believe it was always like that

Lol. What management fee, this is just cash laying around with no effort.

Cannot understand this move.

“administration fee” is better wording in my opinion. someone needs to build and maintain all user interfaces on for both web and mobile, take care of all legal matters etc. A lot of things need to happen for cash to be able to just lie around.

Even with the management-fee included, its still better interest than if you would put your money into a Neon account, not to speak of the big banks.

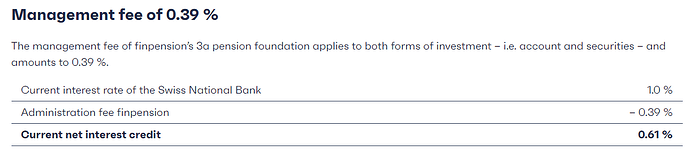

But of course, if you search for cash only depositing, you’ll find better deals which give interest that is more than SNBrate minus 0.4% (i.e. >0.6% currently).

I wouldn’t call it cash sitting there. Cash sitting there would be 0 interest like in private accounts in major banks.

I think to generate some interest on cash, something needs to be done. Right?

That’s VIAC. 0.8% no fees.

It’s also 0.8% at UBS for now

But not on Finpension’s side, that’s the whole point.

But honestly, with these interest rates it’s literally not worth it, just if you intend to park your cash for a certain duration.

So you mean FP can simply loan that money to SNB and get 1% ? Is it how it works?

I was always curious what exactly they need to do to get interest

FWIW I don’t think that’s generally the case. SNB rate at 1% is only for limited amount of deposits, above the threshold there’s a 50 basis point discount (because obviously the SNB would prefer that this money goes into more productive ventures than sitting on its balance sheet).

See Current interest rates and exchange rates (there’s an up to threshold and above threshold rate)

Only a limited number of regulated financial institutions can open an account at SNB.

"3. Criteria for SIC participation with a sight deposit account Subject to the specific criteria in each case, the following domestic financial market participants are eligible to participate in the SIC system with a sight deposit account:

-

banks and branches of foreign banks;

-

securities firms, provided they participate in the securities settlement system SECOM, and correspondingly use the SIC system for processing payments in Swiss francs arising from securities transactions;

-

central mortgage bond institutions; - compenswiss (compensation funds for OASI/DI/IC);

-

cash processing operators, which process cash for third parties on a commercial basis and/or supply them with cash and regularly pay in and withdraw cash at the SNB in their own name, and which also perform an appropriate clearing function. Furthermore, they must be regulated directly or indirectly in respect of compliance with the duty of due diligence with regard to combating money laundering;

-

fintech companies pursuant to art. 1b of the Banking Act whose business model focuses on services in the area of payment transactions in Swiss francs;

-

insurance companies, branch offices of foreign insurance companies, fund management companies, investment companies with variable capital (SICAVs), investment companies with fixed capital (SICAFs) and limited partnerships for collective investment (LPs), provided they contribute to liquidity on the secured Swiss franc money market;

-

financial market infrastructures, specifically central counterparties; central security depositories and DLT trading facilities that operate a securities settlement system; and payment systems authorised in accordance with the Financial Market Infrastructure Act; provided these financial market infrastructures process payments in Swiss francs via the SIC system.

The SNB may permit foreign financial market participants to participate in the SIC system with a sight deposit account."

This is taken from SNBs instruction sheet on the matter: https://www.snb.ch/sicgiro_access_en

Finpension with its licence as securities firm may be eligible for such account, but I dont know whether they have applied.

Yes. My understanding is that they must manage the funds, on your behalf. Meaning that they must establish and maintain (aka re-balance) an asset allocation on your behalf. If they allowed you to trade, they would no longer manage your funds and they would be in a danger zone.

This is also the reason why I am very sceptical about finpension (and I exited all their services accordingly)… With their option to disable re-balancing, they technically violate that principle. I don’t want to do business with companies that ignore and violate laws and regulations…

Can you please expand on what is your concern?

Maybe that’s for a different discussion, I am skeptical of them allowing rebalancing however many times one likes with no cost, there has to be a cost somewhere…

I know we use the term “index funds” to refer to mutual funds here, but my understanding is that mutual funds do their trading daily, after market closure (among the reasons Bogle preferred them to ETFs). My point is tangential, as we’re talking about when VIAC/Finpension are doing THEIR trading, which is once weekly. I still wonder if they could lock in the price for any sell/buy order for the day it was submitted, as buying 1 week later could work out badly too (though by a smaller % than selling as stocks ride the elevator down and take the stairs up!).

3rd Pillar Pension Provider must manage the funds, on behalf of the Customer. The question is what this means in a passive world. The bare minimum how a provider can proof that they manage the funds is that they perform periodic re-balancing. Meaning that they watch the different passive funds and their allocations, and trigger a re-balancing as required (based on a reasonable method).

Finpension allows investors to de-activate the automatic re-balancing. This in my views means that Finpension no longer performs any management at all. Conclusion - I am not sure if they still fully do what they were supposed to be doing.

Clearly, you could argue that they, for the average investor here, did the right thing (by allowing to de-activate re-balancing). Still - laws and regulations were made to protect laymen and not the average user in this community. So even though there was probably no harm done for you and me; I do not support their attitude of over-stretching the rules wherever they can.

When you see what FP does - they just dis-regarded asset allocation / diversification limits (no minimum FX, no need to diversify and allowing you to go 100% Quality, switching off diversification, their wanna be stunt with causing a major WHT chaos in their robo advisor solution, …) - that company simply stands for values I personally don’t support and I don’t think that FP was a good member of our society. Therefore - they won’t get any Tea business with me…

Interesting point of view.

Do you have any information on what is the requirements by law for

- asset allocation

- Diversification

- FX

I see almost all providers offering close to 100% equity solutions - UBS, Finpension, Frankly, Viac, Truewealth

Is FX the key requirement that FP is disregarding?

Thank you for a great explanation.

I am wondering if the answer to the question “if they are doing what they are supposed to” can be “they provide access to funds, are the custodian and execute trades” - maybe it’s stretching it.

I also reserve skepticism around the FX issue, I remember that the answer given re avoiding allocating >=40% in CHF assets being a bit light and IIRC hinging on maintaining a much larger, CHF 2nd pillar/VB account…? I could be wrong, it’s been ages since I read up on that.

Part of me which is still a dumb foreigner thinking all CH stuff is squeaky kosher clean puts these concerns under the rug and thinks “It’s probably fine, they are Swiss and Swiss-regulated, after all” ![]()