Hey,

I am looking at the taxation of 3. pillar at withdrawal and I was wondering if it’s really worth it? Are there calculators for this where I could compare?

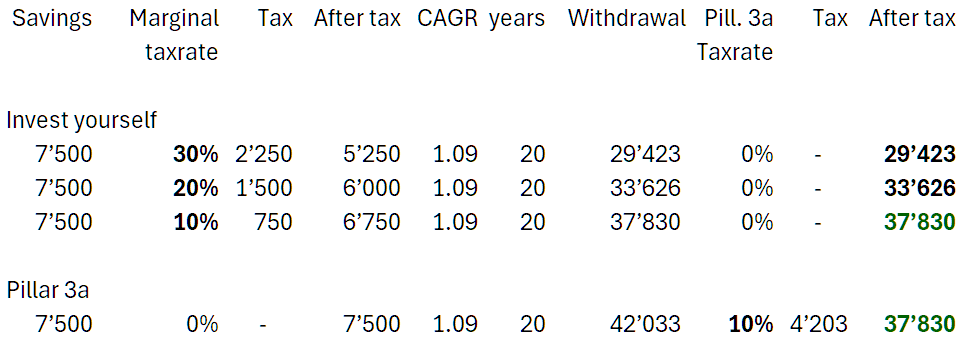

1, Sure, I save about 1.6-2k a year (depending on canton) by reducing my taxable income, and the withdrawal tax is much lower than the marginal tax rate, BUT the money invested also compounds quite significantly during the time, which is also taxed, so I think it comes out quite close in the end? Given the large selection of index funds inside the 3. pillar, I will not mention the potential loss on returns, since I could basically have the same selection of funds, both Swiss, US etc. as with IBKR, so the returns should not be effected by using finpension.

On top of the money being ‘locked’ and who knows what changes will be legally in the future that could potentially increase the withdrawal taxes. So I am a bit skeptical about this, if it really is worth to do?

2, Most of my normal investments are in US stocks, tech ETFs, so a generally higher risk portfolio, I assume since there are no CG taxes on these, and there is technically a capital gain tax on 3. pillar withdrawals it would be reasonable to keep the lower risk, lower return parts of my portfolio in the 3. pillar if I decide to open one, right? Unless I am missing something. I will probably have the ‘home bias’ in the 3. pillar, so mostly the SMI, or other Swiss ETFs, maybe some bonds. Would this make sense? Or Should I keep the same ratio inside and outside of the 3. pillar?

3, Can I separate accounts within finpension any time? Or it’s better to have 5 accounts from the start? Would this even matter if I were to leave the country before retirement age and withdraw the money then?

4, How does finpension handle this from the technical aspects, if I open 5 accounts? Is it like having more accounts at IBKR, and I can switch with the same login? Or completely separate? Would I need to create 5 different bank transactions to send to each account or I can allocate it within finpension once I send it all out?