I’ve learned a lot in this forum and on the MP blog and so I thought I’d share my bits here too!

About my life

I’m 21 years old and am born / live in Zürich. I am currently studying full-time at a university of applied sciences and thus have no income besides the obligatory “Zivildienst” ![]() . I still live with my parents which is quite profitable ;).

. I still live with my parents which is quite profitable ;).

In the past, I first did an apprenticeship with a known bank in IT for 4 years. Afterwards I was lucky to stay with them and got a role with quite some responsibilities! (Income was between 60-80k/y). Then last september I started studying part-time. End of January I quit my job and changed to full-time studying. (Luckily changed before the rise of corona ![]() )

)

Now to the finance part:

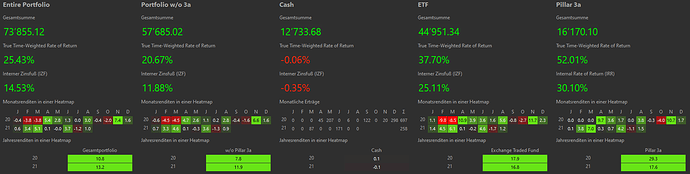

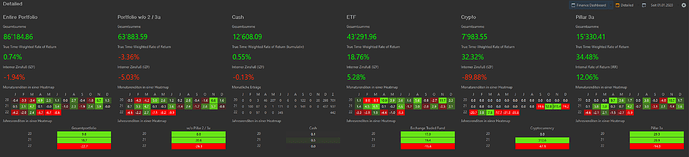

Cash / Emergency Fund

I have 20’000CHF in a savings account with an interest rate of 0.6%. The account is with Migros Bank (Sparkonto Free25). And obviously, normal cash account with ZKB of ~7’500CHF (zkb student package).

ETF / Stocks

I first had my investments with the bank I worked at, but then after I quit my job I transferred everything to Swissquote. I did hold quite a lot of ETFs and Stocks, but I recently (one week ago!) changed my strategy to a rather simple one and thus hold the following:

In the future, I’m only going invest in VWRL / SWDA. I won’t invest in IUIT & RBOT anymore but will hold to it.

The (dividend) stocks I bought during the pandemic time and will sell it as soon as a specific threshold is reached (dont worry, i did some analysis on the stocks!).

VIAC 3a

I started paying to a 3a cash account last year and this year in march, I moved everything to VIAC 3a. Also I’ve deposited 4’000CHF this year and am planning to deposit the remaining part soon. My strategy in VIAC 3a is the Global 100 (which is why I changed my ETF porfolio).

Current Profit is at ~16%. ![]()

P2P

This year, I invested about 3k on Mintos, but after this pandemic I’ve realised how risky this can be and therefore went out of it. ~200EUR are still with Mintos but I can’t get it for now.

Regarding FIRE

I deliberately haven’t calculated a FIRE number as I’m still 21 years old! There will be many changes in the future, which will certainly change some aspects necessary for the calculation. Heck, I don’t even know if I still want to retire early in the future. I might move to another country or stay in switzerland for ever… But I think it’s best to work towards it in slow steps so that I still enjoy my life.

My expenses are obviously low due to living at home (for free), eating at home, etc. I’ve calculated my yearly expenses and it’s currently at ~8k CHF per year without food / taxes (high probability that there is something i forgot to add tho!).

Next Steps

I’m planning on moving my assets to IB as I currently only see advantages. As I’m younger than 25, I’d only pay 3$/m or 36$/y on custody fees, which is less then the 64.64CHF/y on Swissquote. Transaction cost is obviously cheaper, but I’m not yet finished with my “investigation”.

Thank you

Lastly, I’d like to thank you all on the discussions here on this forum as it helped me a lot. I was able to add more deductions to my tax declaration and many more things! Thank you! ![]()

Looking forward to your comments ![]()