In my accumuIation phase I used to practice value averaging* (with ETFs) before the stock picking sirens lured me in.**

Your question of a viable withdrawal stategy thus made my neurons (almost certainly prematurely) jump to this conclusion: reverse value averaging,*** i.e. selling varying dollar amounts based on an expected valuation path alongside a drawdown path with some flexibility on your consumption end.

The “classic” x% withdrawal path would be to withdraw a fixed % amount of dollars based on your projected needs every year, e.g. 2%, 3%, 4%, regardless of market valuation.

The reverse value withdrawal/cost averaging path would be to withdraw as much as your projected value withdrawal path allows, i.e. in years of market upswings, you withdraw more, in years of market downswings, you withdraw less.

You deal with the variation in withdrawal amounts by adjusting your lifestyle or by saving up a little more when the market upswings allowed you to withdraw more and vice versa.

The value averaging withdrawal path looks as follows:

It’s setting a (close to) zero target t years out, setting an expected value path of your portfolio for the years approaching t, estimating a yearly withdrawal rate, and — in its simplest form — withdrawing each year your expected withdrawal plus or minus the delta based on your expected valuation path (instead of a fixed dollar amount).****

* Value averaging is discussed in this forum e.g. here:

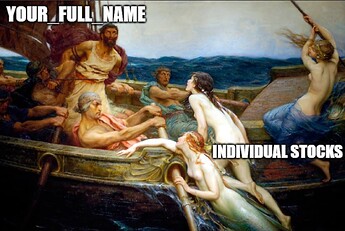

** Live shot here of the situation by one of my mates with a very early iPhone prototype available at the time:

Look at these beauties … how could I have

not deliberately cut myself loose from the mast?

*** Quick intro / refresher for those not familiar with value averaging:

-

if you were to DCA in its simlpest version, and you could set aside (e.g. nominal) $1’000 per year. In 30 years, you’d invest $36’000 (36 x $1000). If you expect a return of (e.g.) 5% p.a. then you expect to end up with about $70’000 in year 30.

Your schedule would be as follows:

- Start of year 1: invest $1000. End of year 1: expected value is $1’050.

- Start of year 2: invest $1000. End of year 2: expected value is $2’153.

- …

- Start of year 15: invest $1000. End of year 15: expected value is $22’657.

- …

- Start of year 30: invest $1000. End of year 30: expected value is about $70’000.

-

translate this to value averaging.

- Some math, for those inclined (skip over this if you’re not the math equation person and see the value plan below):

- you set a goal of $70k in 30 years

- you set up your value path with formulas

V_t = C * t * (1 + R)^t

where

R = (r+g)/2

V is your value at time t, C is your contribution initial (or average net) investment contribution,

r is your expected return over period t, g is your expected growth of your contribution after every time period t (essentially a proxy for you making more and wanting to adjust for inflation).

3. For example, following the DCA example above, you want to end up at $70k over 30 years, you’re willing to increase your contribution by 1% per year and you expect a 5% return every year, you get R = 3%. You put this into the first formula above and solve for C.

$70'000 = C * 30 * 1.03^{30}

C = $961

- Your value path is

V_t = 961 * t * 1.03^t

Sample points on your value path are as folllows:

- Start of year 1: invest $961. End of year 1: expected value is $990.

- End of year 2: expected value is: $2040.

- …

- End of year 15: expected value is: $22’465.

- …

- End of year 30: expected value is: $70’000.

-

Note that you will have invested $33’428 with value averaging (including growing your investment sum every year by 1%) versus having invested $36’000 with DCA and you still end up with the nominal $70’000 after year 30.

That’s the edge that value averaging claims over DCA.

**** Typically, in textbooks, the working out of an exact procedure is left as an exercise to the reader.

If there is any interest here, I’m happy to give it a shot at describing the value averaging drawdown plan in terms of formulae and sample numbers. Until then, be well and invest well!