When offering mortgages, all banks assume you want to have 10y fixed interest, why not going for libor or 2y istead? I feel like they are selling me an expensive insurance that I don’t really need… Any mustachian thought on this?

I can tell you that in Poland for many years there only existed the LIBOR loan (actually the PLN equivalent, WIBOR). But you have the mandatory monthly repayments already planned for the next e.g. 30 years.

In Switzerland, if you fixed the rate in the last 30 years, it would have always been a bad decision, because the LIBOR was falling almost all the time.

How is it gonna be in the future? It’s kind of a gamble between you and the bank. As @cray said, with a LIBOR mortgage you’re more flexible. You can switch the bank if you find a better offer, and you can fix your mortgage at any time.

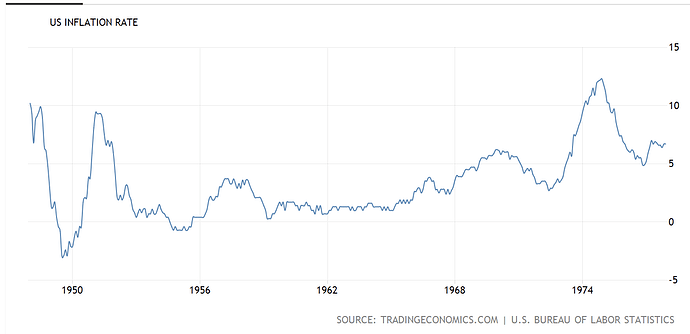

As an afterthought: currently the LIBOR is really low (negative) and it’s hard to imagine it would go even lower. However, it’s not hard to imagine it going up to it’s historical average of 5%. Well, the banks bet against it, by the fixed rates they offer, I guess they bet it’s not gonna go up. Just saying, if it suddenly spikes to 5%, you will be regretting that you didn’t fix it earlier ![]() .

.

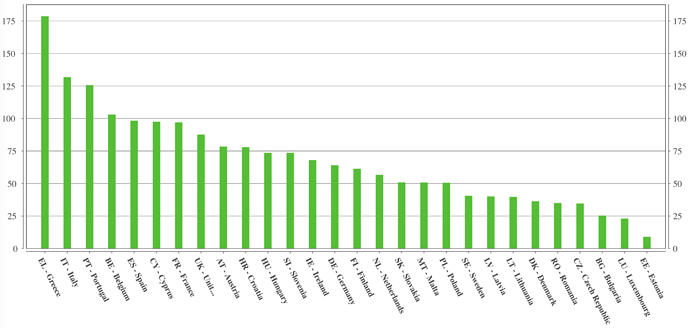

The European governments are relying on low interest rates in order to pay debts. ECB is printing money and buying the bonds of Italy etc., raising their price and lowering their debt. If this stops, then Italy, Portugal and Greece may go bankrupt.

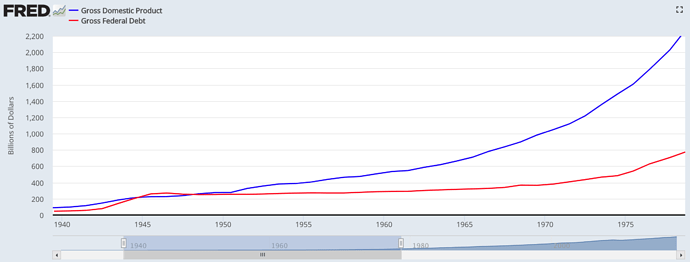

I didn’t do the actual math, but I would say the debt reduction was in half due to inflation and in half due to real GDP growth.

I have no idea what will happen, but if a government debt is 100% of its GDP and the cost of debt goes from 2% to 10%, they will struggle to cover this gap.

That’s an interesting observation. I looked a bit more into this. In 1945, the nominal federal debt was $250 billion, in 1977 it was $750 billion (3x). The nominal GDP went from $226 to $2278 billion (10x). However, the Real GDP went from $2000 billion (2009 chained dollars) to $6000 billion (3x).

For many years, the debt didn’t grow even in nominal terms, and after 30 years, it had the same value in real terms. So I guess the recipe to reduce debt is to triple your GDP. Can EU triple its real GDP until 2050? ![]()

From the very beginning, I was set as having my mortgage as a mix of Libor and Fixed. Part for reduced cost, part for “safety”, obviously. I have 1/3 Libor and 2/3 Fixed 9y.

Not all bankers are out there to get you. My advisor at UBS actually said he, personally, would go for at least 50% Libor and well … I should have taken his advice.

I will probably convert to 100% LIBOR when my fixed mortgage expires. At the same time I’m paying my amortization and build a safety pocket to repay a part of my mortgage should the rates become very expensive. My long term goal is to repay most or all of the mortgage as I want no uncertain financial obligations on retirement.

Potentially more than the sum of all remaining interest! Some contracts state that the compensation for early cancellation is to be computed as a difference between your mortgage rate and “Kapitalmarkt” rates for remaining duration. And as the latter are negative yielding currently that means you’d owe more money to cancel than to stick with it.

You can normally convert LIBOR into fix at any time, so no reason not chose 100% LIBOR if it’s cheaper than a fix. Which is not the case however, short term fix is cheaper than libor, so you’ve been had. Mixing contracts of different durations is VERY bad, you won’t be able to shop around when the shorter contract runs out and will be locked in to the same bank or forced to pay cash

There were no fixes cheaper than LIBOR back in 2015. And there’s a very good reason why I have 9y fix instead of 10y - my contracts run out at the same time. My LIBOR is renewed every 3y.

I should add, by the time you know you want to convert Libor to fixed, the bank will have already increased the rates for fixed mortgages.

And how do you explain this? also the variable rates are much higher then the fixed ones which makes no sense to me…

That’s an interesting question. First of all, I didn’t find examples of 1-3 Fest Hypo being lower than LIBOR. They are, at best, the same.

Secondly, the Variable Hypo you can quit anytime (with 3/6 notice period), but the LIBOR Hypo you apparently have a contract for e.g. 5 years and can’t quit earlier without a penalty fee. But still, the LIBOR is like 1% and the Variable 2.5%, the difference is huge. Wonder if anyone could explain me why would decide for it.

Here’s an example.

As far as I know there’s a caveat - none of the online mortgages will finance more than 65% of the property value. The same with BVG’s. The insurances on the other hand will advertise low rates, but will often only give them to you if they can suck you into other insurance products. Also, splitting the mortgage into 1st (65%) and 2nd (15%) at different rates is common.

And yes, LIBOR mortgages come with a fixed term, in my case it’s 3 years. You can switch to fix only on renewal date, but fixing the rate is possible in advance at an additional cost.

They make you pay an additional premium for the freedom to leave earlier…

Here the 2y is 0.1% cheaper:

https://moneypark.ch/en/mortgage/current-mortgage-rates/

They also give a 5y fixed mortgage for 0.6%. That’s just so incredibly cheap… It really sounds too good to be true.

Moneypark is the biggest independent mortgage broker in Switzerland. They most probably show best-case scenarios rates in the page but I suppose every other provider does…

Real estate market correction in Sweden 1992. At the peak the interest rates were at 500%…very rare event though

You can only finance up to 65% property value (instead of the usual 80%). Other then that, these are real rates.

That’s still great. Imagine you save up 200’000. You take a loan for 400’000 to buy a flat worth 600’000. You will pay 2’400 interest per year, or 200 per month! You save rent worth 600’000 * 3% = 18’000 per year, or 1’500 per month. That’s an annual return of 15’600 / 200’000 = 7.8%. Not bad!

Of course, there’s a trap. If the interest rate goes up to 3%, you will pay 12’000 interest per year. Your 200’000 only squeezes 3% per year. So you decide to sell. But the cheap loans are gone, so the demand has sunken, and nobody will buy your flat for more than 500’000.

This is why I currently amortize directly - I want to get down to 65% ASAP so I can shop for best rates.

For a 600k apartment, you need to calculate another 400 CHF/month for management/renovation fund etc. and another 300 CHF/month in tax (Eigenmietwert) so your effective rent savings are less than you estimated, more like 1000 CHF/month.

If a prospect of 3-5% interest rates pushes the risk too high for you, you can always fix the mortgage for longer, but that obviously exposes you to whole other kinds of risks.

For me, the effective return is 6.25% (excluding amortization).

Renovation - I agree, but what do you mean by management? Mind you, I calculated the rent of 1’500 as Kaltmiete, without Nebenkosten, as for both scenarios these costs are similar.

True, I forgot that. Eigenmietwert is a theoretical income that you get by being your own tenant, but you can deduct the interest. So effectively you would need to pay your marginal income tax rate on that 15’600, which indeed is about 300 per month.

But if we deduct these costs, we arrive at 8’000 savings with 200’000 locked as collateral. That’s a return of only 4%! How do you arrive at 6.25%? I thought my assumptions were pretty realistic.

It also has to be mentioned that if you invest that 200’000 otherwise, it might also trigger income tax. Unless the main return is capital gains.