Just in time. Got a message from Assura saying that normally they would not take over costs of certain treatment ordered by my general doctor, but they will do it just this time. Qualimed model. Not that it makes any difference, I am below 2.5k anyway, but the signal is clear. Good bye (or rather FU) Assura, I have paid you tons of money while never getting anything back. Now when I am not so young anymore and chances of me needing some medical treatments are rising, it’s time to look for some insurance which actually promises to do something if I need it. I am changing to KPT Win.win that has better conditions.

The luxury of the Swiss system: Insurers can’t turn you down. So you can use the cheapest budget insurance when you’re healthy and then hop over to the great-customer-service inusurance company when you actually need customer service.

I used Assura a long time. The only thing I ever needed customer service for was billing problems, and I was not impressed. I never got those sorted out because they never answered the phone or replied to emails. A lot of room for improvement there.

I’m having a hard time understanding though, how Assura could have the option of not paying for treatments, unless the treatments are only covered by supplementary and not mandatory insurance.

In the case of supplementary, the requirement to obtain a “Kostengutsprache” before receiving certain treatments is pretty standard.

I think that got a lot better since they have introduced the app where claims could be submitted through the phone. Worked really fine for me.

There is a catalogue of treatments which is published by the federal government and which is covered by the basic insurance

Insurers have to abide to this catalogue.

So my case is a bit special as I’m a doctor myself… I want to benefit of the lowest premiums but want to make my own desicions when it comes to my health. I settled on Philos Prima Flex. Not the cheapest option where I live, but I get to consult a doctor or specialist if I like while maybe having to call in first and telling them where I’ll go.

I’ve had a similar option the year before where I called and told them that I want to see a specialist and why. No questions asked.

I’ve asked around and this seems to be the only insurer (Groupe Mutuel) where you’re free to do what you like after checking with the hotline.

Does anybody have a different experience or knows of an insurer like that? One that’s cheaper than Philos.

In my understanding any telemed, including KPT win.win combo option (you can either call up the free phone line or consult a non-free GP, before being referred to a specialist).

Not sure whether you can also choose the specific specialist yourself, or they send you to their recommended one.

Can’t you send yourself to …you?

The issue in my case was that I set up a direct debit, but Assura mistakenly linked this to just my policy. So my premiums were debited directly, but I get the bills for the kids in the app and would have to make sure to check on those and pay them each individually. A big headache all in all. I’m sure if I could have gotten someone on the phone or if they’d have read the messages I wrote, this could have been solved in a minute. But I’ve had to deal with it the past 2 years. For the money I saved (since they were the cheapest) it was still worth the hassle, but I’m glad that there are cheaper insurers now.

In Qualimed model for some treatments one is obliged to consult with the call center even if the general doctor directs you to a specialist. If you don’t do this, they are allowed to pay nothing. I was sure that my situation was not included, but they somehow decided that it was. Well, not relevant.

![]() I don’t think so, no… My patients are smaller, drool and cry a lot and poo their diapers frequently.

I don’t think so, no… My patients are smaller, drool and cry a lot and poo their diapers frequently.

From your answer, I still evaluate at 10% the chances you’re a geriatric doctor ![]()

OK, but assuming you follow the managed care procedures, the mandatory health insurance coverage guaranteed by law is…guaranteed.

With supplemental insurance it’s different. There are cases when the insurance company can decide whether or not to cover something. For these coverages, you have to apply and send in quotes first, after which you get a guarantee of coverage from the insurance company. This is often the case with orthodontic treatments, for example.

A small update. In the message that I received there is a comment that it is possible to be transferred to the base model retroactively. So there is some paid way out if you made a mistake.

Hi All

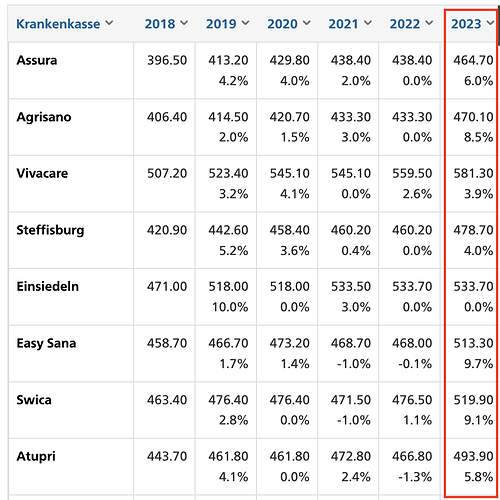

I just would like to remind you that you have a bit more than 1 month left to check & switch your base health insurance. The premiums can rise substantially based on your actual model:

If you want a very easy step-by-step guide, I wrote one on my personal blog: Cost reduction: Health insurance (Swiss) - Giles.Money

Let’s share what you saved by switching your insurance / plan!

In my case I moved from SLKK to Assura and selected the Plusmed plan, where you can use the MedGate app which makes it very easy for me. Result: 133.- less premium + 88.- for the yearly payment.

I didn’t change my basic insurance as the monthly savings was not worth for me as I’m quite happy with the one I have now. I did quit one additional insurance that I didn’t even use at all and am thus saving about 250.- per year in 2023 compared to 2022 even with premiums going up.

There’s already a thread here

https://forum.mustachianpost.com/t/your-future-health-insurance-2023-edition

I already had my wife and I on Assura with the Care network model. So but much savings to expect.

I am just getting the increase from 311 to 349 by month in Geneva.

I have no complementary insurance.

I won’t switch insurance this year as we have on going treatments.

I will wait next year to see the feedback on the community with KPT Win.win

In what way does that matter?

The savings won’t be huge with the switch.

Any chance a bill could be missed ?

Legally the every base insurance has to cover exactly the same costs, so there are no bills who should be missed. What might happen is that the old insurance already confirmed covering the costs and the new one will have to approve that again what might lead to some admin efforts from your side.

So if the difference is very small and the costs come from the same treatment, I wouldn’t switch either to avoid the pain of resupplying some documents etc.

Update: the new invoice increased to CHF 296 per month starting January 2023 (Grund- und Zusatzversicherung).