Excellent. Thanks. Looks like I can buy that on CT ![]()

I’m glad I could help. ![]()

Does it make sense fee-wise to convert CHF to USD at CT to be able to buy this ETF?

0.5% is not the end of the world I guess. I’m also not sure if I want “All China” since I have the largest companies in other ETFs already.

Another thing is, MSCI started to include A-Shares in the MSCI EM Index:

At the moment it will only be 5% of A-Shares.

FTSE has done that earlier apparently:

Good chance VT and VWRL already has some of the A-Shares, this is all pretty confusing.

I read that it’s ongoing process related to China’s trade liberalisation and it will continue next years, so I guess slowly global indexes will include more and more of these shares. I once checked VT and it seemed it didn’t have Chinese small caps, but I’m not sure about the amount of A shares.

0.5% one way and another 0.5% for conversion back to CHF. I find it pretty hefty.

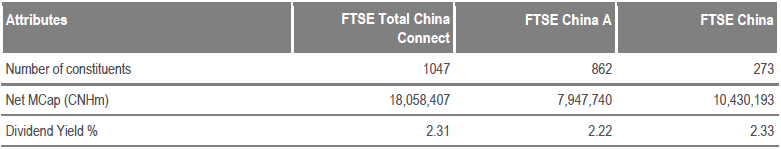

From the FTSE factsheet:

18tn CNY is 2.6tn USD. That’s not really that much, somehow…

OK now I understand what you mean. Well. I can tell you this: FTSE Global All Cap (base for VT) has a market cap of $53tn, compared to an actual stock market cap of $85tn. $32tn missing, probably most of which non-tradeable.

When talking about Poland, it has a 0.13% share in VT with a cap of $67bn. And on the website from the first post, Warsaw Stock Exchange has a cap of $171bn, which would mean a share of 0.20%. So yes, Warsaw is underweighted in VT.

That’s because not all A shares are accessible for international investors. On the HK exchange website there is actually a list:

I am strongly for buying China A shares to diversify and MSCI index covers more stocks thank the CSI 300 or FTSE A50 . However, I bought the Lyxor fund and I can confirm it’s a bad idea. This fund is small 31 AUM and offers really low liquidity/high spread.

The funds mentioned are traded on the American stock exchange.

I would advise:

- MSCI China A UCITS ETF IE00BQT3WG13

-CSI300 Swap UCITS ETF 1C LU0779800910

-Harvest CSI300 UCITS ETF 1D LU0875160326

Most of us use IB, so it’s not a problem.

Indeed, I have also came to the same conclusion, although I would exclude the swap based one as prefer my ETFs physically backed.

The Xtrackers Harvest CSI300 (Ticker: RQFI) is what I have on my watch list now.

Kind of regret today for not having bought last week ![]()

Sure, however the iShares MSCI China A ETF traded on Nasdaq has a TER of 0.65% and iShares MSCI China A UCITS ETF traded in EU (SIX…) is only 0.40%.

So in conclusion, the two best options without swap would be:

-MSCI China A UCITS ETF on SIX (IE00BQT3WG13) TER:0.40% + spread: ~0.55% = 0.95%

-Harvest CSI300 UCITS ETF 1D on SIX (LU0779800910) TER:0.65% + spread: ~0.45%= 1.1%

The MSCI index seems a little more diversify, but Ishares uses optimize sampling for it’s ETF so at the end I am not sure one index is better

EDIT: as mentionned by Glina, the TER of ishare ETF is temporary reduced. "From 11 July 2018 to 31 December 2018 (inclusive) the TER will be discounted to 0.40% from 0.65%. With effect from 1 January 2019 the discount will be removed and the TER will return to 0.65%. "

Only temporarily.

https://www.ishares.com/ch/intermediaries/en/products/273192/ishares-msci-china-a-ucits-etf

From 11 July 2018 to 31 December 2018 (inclusive) the TER will be discounted to 0.40% from 0.65%. With effect from 1 January 2019 the discount will be removed and the TER will return to 0.65%.

And for IB users, which would you recommend - KraneShares Bosera MSCI China A Share ETF?

Xtrackers ASHR (CSI 300 index) + ASHS (CSI 500 index) would be my choice.

So what are your guys leaning towards? Buying chinese ETF’s with comparably high TER’s or waiting for the companies to be integrated into something like VT / VXUS?

I’m more feeling like buying now and selling when they will get integrated. Otherwise, we might lose a bull after current bear ends.

So what’s wrong with the Vanguard Total China from Hong Kong, that you provided (9169 HK)? It seems the most complete of all. And you can buy it in USD. Is it available over IB? Wonder what are the transaction fees on the HKEX.

One minus is that you overweight China large caps if you’re already invested in EM or global index.

As @1000000CHF said, you already have most of it, along with 5% of A-shares if you track EM with FTSE or MSCI.

I checked on CT and it is 0.25% commission, minimum 196 HKD (~25 CHF) to purchase. Not sure about liquidity as the market was closed when I checked.

Another problem could be that it’s also not listed on ICTAX, whereas the Xtrackers Harvest CSI300 is.

For IB it’s 0.080% (broker fee) + 0.005% trade value + HKD 0.50 per trade (exchange fees).