I think I did this:

This is not Wir specific, but since the topic is discussed here: How does the contract of Mastercard and Wir look like? Is there even an option for Mastercard’s corporate customers (such as Wir) to chose between different exchange rates? In other words, why would Mastercard even offer a true interbank rate to their corporate customers, since they seem to have their own way of handling currency conversions. If they offered such an interbank system, Mastercard would face an fx risk plus additional complications (they have no direct control over the interbank rate system). As a true US capitalist company I can hardy imagine Mastercard doing such good things for humanity.

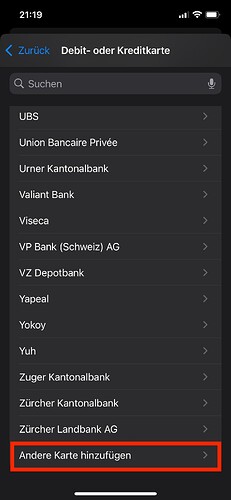

I did it with the SIX app (there’s a button to add to Applepay), not settings.

Edit: I can still see interbank rate. Will then inform SECO though. ![]()

Mastercard doesn’t do interbanking rate afaik.

Revolut/Wise do it (but FX conversion is part of their core business, so it makes sense they have the technology). Radicant does it and I wonder how it’s implemented (especially to avoid carrying FX risk on your balance sheet over the weekend)

(tbf any card that offers the raw MC/Visa rate is already pretty good and this used to be miles ahead from anything you could get in Europe before Revolut et al. came to the market, I used to use the schwab debit card a while ago for this)

(and obviously I agree that you’re misleading your customer if you say you have the interbank rate when you use the Visa/MC rate… it’s definitely not the same thing, my point earlier is that it’s a different thing, because it is fixed for a day which justifies some kind of premium, e.g. the rate quoted won’t change by 20% in seconds like when SNB removed the peg in 2015 ![]() )

)

Meaning that (at least for major currencies) the Bank shall keep the deposit in FX and convert to CHF at the next Bank day. Thats at least what I wouldd expect (and how YUH does it).

Yuh does it this way because you have FX balance in the app, right? (sorry I don’t use Yuh) Most credit cards are not multi currency and the end-user currency charge is shown/converted when the transaction happens (at least that’s what users are used to have)

Mastercard doesn’t do interbanking rate afaik.

Revolut/Wise do it (but FX conversion is part of their core business, so it makes sense they have the technology). Radicant does it and I wonder how it’s implemented (especially to avoid carrying FX risk on your balance sheet over the weekend)

This is confusing to me. Mastercard is a company that issues credit and debit cards. Revolut/Wise are banks (not in the traditional sense, but still banks). Banks have contracts with credit card issuing companies such as Visa, Mastercard (at least this is my understanding). So if a payment is made on a Mastercard issues by Revolut/Wise, I assume it goes through the Mastercard payment processing system and used the Mastercard fx system. Or is this not the case?

I assume they just tell MC to always charge in the original currency so they can handle it on their side.

@anon91694432 Not until now. I will call them next week if there is no response. This usually takes a while, and sometimes questions like this need to be escalated to a supervisor, otherwise nothing happens…just from my past experience with them.

In general, I’m willing to accept bad customer service if they offer the interbank rate. But if it turns out that this was misleading information and they only offer the Mastercard rate, then I’ll definitely end my relationship with them ![]()

And yes, if they really only offer the Mastercard rate and don’t change their description on their website in time, then I will consider filling out the form for unlawful practice.

I assume they just tell MC to always charge in the original currency so they can handle it on their side.

That would make sense. And open up more interesting questions. Why would a big bank such a UBS not have the same agreement with Mastercard? This would give UBS the freedom to handle FX rates on their own terms. How can Radicant, a drwarf in the banking landscape, efficiently handle such FX in their own system?

Why would a big bank such a UBS not have the same agreement with Mastercard?

What make you think that UBS is not handling FX themselves?

UBS indeed does not charge a favorable exchange rate, but that is because they choose to make money by adding their markup.

My best guess is as @nabalzbhf said: credit card issuers can choose to be charged in the original currency or let MC/Visa handling the conversion. In any cases, they can then add a markup if they want.

Sounds like your case: Exchange rate for a credit card transaction - Bankingombudsman

Apart from that: I can hardly understand, why a bank should offer the interbank rate (except for employees), unless the banks is generating more money with you on other things.

Giving you the interbank rate is the same principle as granting you a mortgage for the effective Saron or Swap rate ![]()

What are your monthly FX volumes? Does the difference between interbank and MC rate really matter?

What make you think that UBS is not handling FX themselves?

This quote from the UBS website:

Jede Kartentransaktion in einer anderen als der festgelegten Währung wird zum Devisenkurs vom Vortag des Buchungsdatums umgerechnet, der von der Gegenpartei auf der Marktseite (UBS Investment Bank, Visa oder Mastercard) ermittelt wird.

Don’t they say it is either converted by themselves (UBS Investment Bank) or left to MC/Visa? Maybe they handle major currency pairs, but leave minor/exotic ones to MC/Visa.

Don’t they say it is either converted by themselves (UBS Investment Bank) or left to MC/Visa?

You’re right. I somehow glanced over the UBS part …

Sounds like your case: Exchange rate for a credit card transaction - Bankingombudsman

Apart from that: I can hardly understand, why a bank should offer the interbank rate (except for employees), unless the banks is generating more money with you on other things.

Giving you the interbank rate is the same principle as granting you a mortgage for the effective Saron or Swap rate

What are your monthly FX volumes? Does the difference between interbank and MC rate really matter?

- I don’t think you understand what this is about. It’s not about whether I buy for CHF 1 or CHF 100,000 in foreign currencies per year. It’s about the fact that the bank is apparently deliberately using false information in its advertising to attract customers. If this is the case, it is a violation of the Federal Act on Unfair Competition (UCA).

- Reporting to SECO is therefore justified. The banking ombudsman is the wrong address and, in most cases, useless (as your cited case also shows) and a joke. Its main purpose is to prevent customers from going to court, since banks fear nothing more than a legally binding court ruling that would subsequently affect the entire industry and all customers, as it would serve as a benchmark. The banks would therefore rather make ridiculous settlements.

- How the bank finances its advertised offer is certainly not the problem of the attracted customers. I couldn’t care less about that.

- But to your question: Well yes it does matter. Because Interbank rate is the USP they offer. MC rate are offered by other banks as well. And their IT system is not as crappy as WIR’s.

What exactly are you expecting or hoping for here?

Have you reached out to the bank to ask about the situation, or have they responded to your concerns?

Do you just want to waste your time, or what?

If you could read, you would know that @TRSP already reached out. So I should reach out for the exact same matter?

How nice that you are worried about my time, while wasting your own. ![]()

So you think reporting to SECO is a waste of time? Or what the hell are you referring to?