Smaller companies, but the fund is 6 billions and 65k people insured.

Interesting.

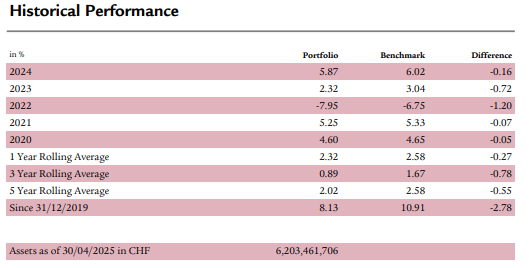

I see following chart where fund performance is mentioned. Not sure why interest credited is very low.

I understand and agree with the concern. However, I think there can be a way. I’m not saying allow people to YOLO their life savings on TrumpCoin. Rather be allowed to choose a pension provider amoung one of the providers who already are providing occupational pension schemes and meet various required criteria.

This Pension Fund has a HUGE number of disabled people - just as many as it has penioneers. Looks like it targets a few very special companies where loads of money was lost there. At the same time, it has a turnover of about 30% of employees within any given year. Meaning there is hardly no meaningful investment horizon. To make things worse - the number of employees has heavily increased. Any pension fund with increasing number of insured employees will face a challenge on their coverage ration and therefore reduced interest. I see many challenges, but these mainly result from the employers not nescecarily the pension pod.

I believe this is what 1e is meant for. But i also dont think people want control of their pension pot. I think people simply want more money but will not be able to tell you how exactly to do so while preserving capital every year

Yes. I would be in favour of more choice/flexibility for 1e.

How would people chose their pension fund? Based on Return I suppose - probably not in terms of return but stated conversion rate. Lets have a look at that pension fund that for years tries to attract new pensioneers (by means of attracting new smaller companies that transfer their money there). Tadaaa - let me present you Profond:

- Highest Interest Rates over the last 15 years or so (of those pension funds that are open to public aka small companies that want to join in)

- 8% Interest credited in 2024

- Conversion rate of 5.6%

… all sounds great, no?

bu thang on:

- technical interest rate of 2% (oubsiee)

- coverage ratio of 105.1% (what the fuck)

- 44% shares, 9% private equity, 22% real estate (wow!)

If people can chose their pension fund, they will go for funds like this, and by doing so they will drown the swiss pension system.

Is that bad? For equity heavy fund it sounds as expected after redistribution on the past years.

105% coverage ration means that your portfolio can drop by another 5%… and you liabilities exceed your assets. When you then realize that they discounted their liabilities by 2%… whereas at the moment, it would probably be appropriate to use something like 1.5% instead… the Pension Fund was likely already underwater right now.

How big is the risk that a 44% shares, 9% private equity portfolio loses another 5%? General rule of thumbs is that you need about 35-40% of shares as loss absorbing coverage capital (and Private Equity calls for at least the same). So they should be in the range of 118%+…

I’m talking about the 1e where you don’t have a conversion rate. The fund grows to whatever and you get a lump sum at the end.

Are there 1e without flexibility? You can have up to 10 strategies, should have something for everyone ![]()

That said 1e is not a good model, most people want some annuities and don’t like seeing their pot lose money. (Based on anecdotal evidence, where employees where against introducing a 1e after being explained what that was)

1e is in my view a morally questionable vehicle that is to be discontinued as soon as possible. It both undermines the solidarity and risk pooling of the second pillar (which is crucially important) and it serves as a major tax optimization loop hole.

They were “invented” about 10 years ago and whilst we were in the midst of the painful reduction in conversion rates and technical interest rates. These were the times when major subsidies took place among active invested and pensioneers. These times are over, at least for those people in an income group that qualifies for 1e. So there is simply no need to keep the 1e system up and running.

I hope that upcomming legislation will at least prevent any buy-ins into 1e plans, if not that it simply dis-continues them…

Discontinuing 1e is quite simple: They would only need to do two things. Start to, upon buy-in into the pension fund, enforce the rule that excess 3A money counts against the max buy-in potential… and then give people the option to either convert their 1e amounts back into normal second pillar amounts, or to convert it into a 3a account.

I think if more people knew and could, then more would want to also.

Whole heartedly disagree with it.

Pillar 1 is social across the board and rightly so.

Pillar 2 (up to the mandatory statuary BVG contribution up to the level prescribed by government ~ 86000 CHF annual gross salary) is and should remain as in the realm of solidarity and risk pooling. Any voluntary make-up / buy-in contributions can / should first go into this pool as it does currently.

Any contribution coming from the salary above and beyond the ~ CHF 86000 should not be forcibly put in the same pension fund or another supplemental pension fund that employer believes is good for everyone and individual has no say in it. Heck, even 1e is only on offer in the employer wishes so!

There is a lot of solidarity in pillar 1, statuary / mandatory BVG, health insurance premium reductions for the needy and progressive income taxation. I think it’s quite reasonable and not at all selfish to ask not to forcibly put contributions above statuary minimum in the same pool in the name of solidarity.

There are many problems in everything.

But I don’t quite understand why 1e is a problem.

Isn’t it simply breaking Pillar 2 into two pillars which kind of equates to Pillar 1 + Pillar 3

The fact is that someone need to take more risk in their asset allocation to allow for higher pension pot. Otherwise pension funds are forced to be conservative and then the total amount ends up being lower and this cycle continues

Either reforms in 2nd pillar need to happen where funds can increase the returns by taking higher risks or employee should be allowed to take higher risk like using 1e.

The objective function is not solidarity . The objective function is to make the total pension pot for individuals bigger and better. That’s the only thing that will make life better for everyone

I find the non-1e pension problematic as you have to be with the PF at retirement to get an annuity. If you lose your job, you lose your annuity and have to take a lump sum.

I would prefer that anyone contributing to a PF should be given the option to take an annuity with the PF. Maybe it wasn’t necessary in the past when you had a job for life, but now careers are fragmented and chance of losing job before retirement is high.

I didn’t realise this. But you are right, if someone lose their job and don’t find new one, they can not get 6.8% conversion rate for their BVG mandatory. Is this really the case or there is a provision that we don’t know about?

I am assuming market rates for annuity would be much lower .

Yup. Much lower, so not only do you end up subsidizing existing retirees, you will not benefit from it. Not much solidarity there.

It’s a penalty that everyone looking to FIRE will have to deal with. Unless they manage to get some job right before retirement age.

Wait a min

As usual CH govt thought about the common man ![]() but only when employer terminated the job.

but only when employer terminated the job.

Wrong. You still get your pension at 6.8 on the mandatory piece. Justvtransfer your dunds to stiftung auffangeinrichtung.