For CAD yes, but you will pay a (small and fair) fee when sending it out and/or exchanging it to another currency. Also for EUR if you don’t already have a EUR account somewhere.

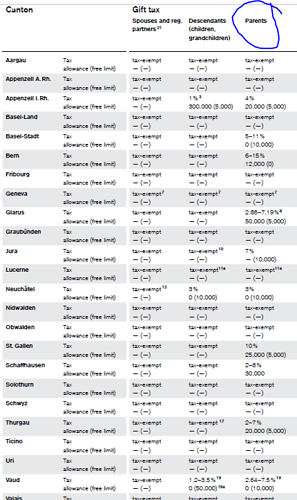

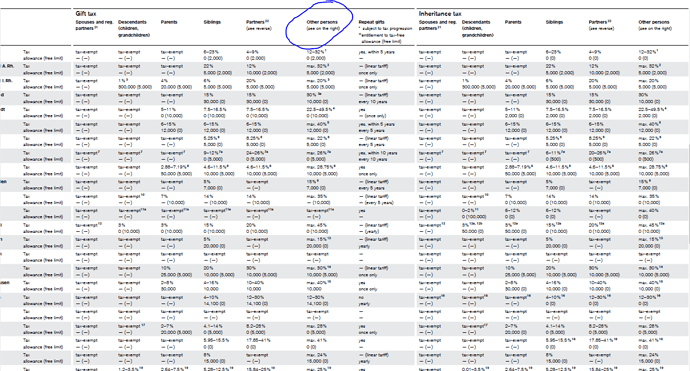

I have found this 2-page PDF from Credit Suisse, would it be possible to check if I have read it correctly please? (there is only 1 table without much explanations). It seems to me that receiving 40k Euro from my parents would be tax exempt for most of the cantons, for example Zurich seems to tax only starting from 200k and most cantons don’t even have an upper limit? Here is the PDF and the print-screen of what I have quoted as numbers(if it’s the correct column to read from)

OK as I speak French but not German, maybe I should check French banks then? I will check if they open bank account for a non-EU citizen, Swiss resident like me.

I can’t find it now, but there was a discussion about this table. The table headings are TO whom money are given. So if you get money from your parents, look at the column before last.

I didn’t want to disturb you further but I have already spent one hour research and can’t find an straightforward answer. are you referring to the highlighted column with the title “Other Persons”?

BTW the word “parent” only appeared once in the gift tax part of the table. which was the column I selected on my earlier post

I have then found the official doc of SO canton but it’s paragraphs in German and even with Deepl I can’t search with an English keyword “parent” quickly

https://so.ch/verwaltung/finanzdepartement/steueramt/sondersteuern-quellensteuer/erbschafts-schenkungs-und-handaenderungssteuer/?

I assume he meant the ‘Descendants’ column, which should be correct.

As you mention EUR and CAD, is the tax residence of your parents outside Switzerland? If so, you also need to check the tax law in that country (and potentially check for a double taxation agreement with Switzerland). If they live in Switzerland, the canton of your parents is relevant, not your residence.

That seems odd. I also had a UBS EUR account a few years ago and received and sent SEPA transfers with minimal fees. Withdrawing EUR in cash from your account at the ATM has a 1% fee, same for depositing EUR cash at the ATM. Currency conversion is also typically expensive at UBS. And there may be a fixed monthly account fee nowadays.

A fixed CHF 0.30 fee per SEPA transfer may apply depending on your banking package. And non-SEPA transfers may be more expensive. However, I’d be very surprised if there was a 1% fee on transfers, especially SEPA.

Thanks a lot Jay, but even for this column, for most of the cantons(all but Appenzell, Neuchatel and Vaud) tax rates are 0 and don’t have an upper limit, but Dr. Pi said

maybe Dr. PI was talking about the scenario that parents living in CH? My parent live in non-EU country, could you confirm that the gift tax for me to pay would be 0? (I don’t live in those 3 cantons) Thanks a lot!

BTW please feel free to share a Yuh referral code, I have found these codes online but would love to return you a favor

This sounds right to me. In most cantons there is no gift tax for money parents give to their children.

You won’t have to pay anything in Switzerland. However, you have to check the tax law of that non-EU country to determine whether you or your parents have to pay any gift taxes in that country. Without saying which country it is, nobody can answer that.

The most reliable way is to ask your cantonal tax administration concerning your taxes and tax authority of the country your parents are living.

You can also name that country, if it is one many forum members are coming from, you might get a closer answer right here.

Why?

N26 then?

(20 characters)

One month ago or so I was thinking about opening an account with them. Was suggested to put myself in a waiting list. Still waiting.

Thanks Neville. For my purpose, do you think it’s better to open account with Yuh or N26? and what will happen to us non-EU passport holder and Swiss resident if N26 goes bankrupt?

Do you mean they have put you on a waiting list? For my purpose, do you think it’s better to open account with Yuh or N26? Thanks

I honestly don’t know, I’m not a customer of either.

What kind of bank license does N26 have? I think they have a German license with full state coverage?

N26 is a EUR-only account. Since and if you do not want to convert the funds (whether that makes sense or not, since the CHF has been a mostly appreciating currency, and you with your Swiss residence will be able to hold it in cash cheaper than most other people on the planet), it would be out of the question.

IIRC, client intake has been limited by regulators due to deficiencies in internal procedures and compliance.

Covered by German deposit insurance. It’s a German bank.

Thanks for your interesting input, when you say “appreciate”, are you talking about against other currencies or inflation wise?

you mean they have to put customers wanting to open account on the waiting list because they don’t have enough staff to check the KYC things etc?

I have seen on thepoorSwiss website the owner says he wouldn’t put more than 1000 Euros on N26 and I wish to know is 40k too much for it? I don’t know to which extent this insurance will cover.

I have checked his blog, he says it’s because N26 has shown some strange behavior in the past where accounts have been locked down.

Now here’s the thing: You can’t get excellent and super reliable service for nothing. If you pay no monetary fees, you’ll pay other fees instead. Bad service is just one such fee.

Choose what matters most for you, and be prepared to pay for it.

Against other currencies - but that should also decrease inflation, since (I assume) Switzerland is a net importer of consumer staples.