First of all, I know the Mustachian answer to that question is “as soon as possible!”, but hear me out.

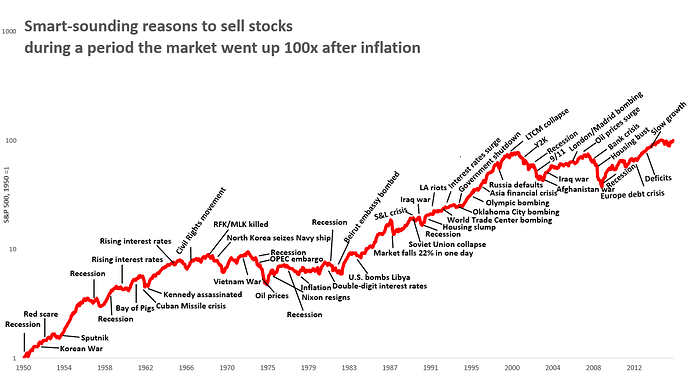

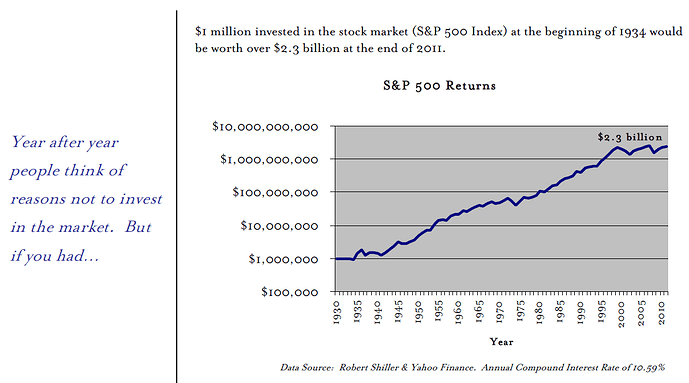

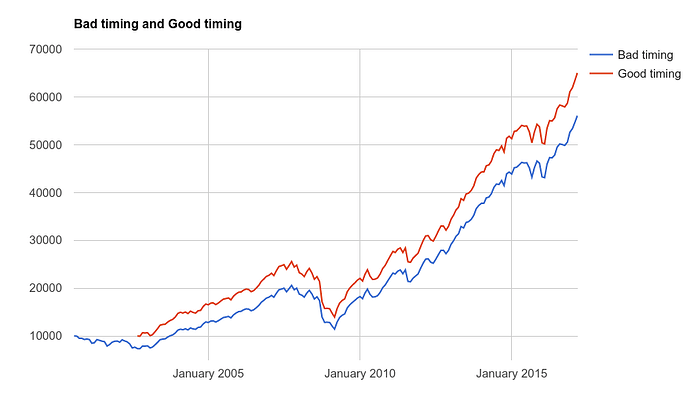

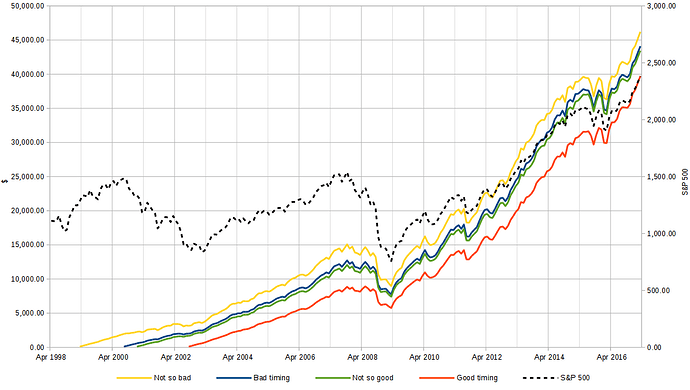

I have a bunch of cash sitting around waiting to be converted into ETFs, but I’m a bit nervous at doing it all in one go because of the current market situation. Both ETFs (IWDA and EIMI) are basically at their 1-year high, so I wouldn’t want to put in a bunch of money just to watch it drop in a couple of months. So far I’ve been buying “small” amounts every 3 months, but each time the price is higher so I probably should just have gone all in at the beginning.

I know, market timing is bad, over the long run it won’t matter if the market drops in two months, etc. But still, the psychological fear is there… How do you guys deal with this? What should I do, just make the trades and not look at the account for then next 6 months?

) if you want to have an overview of the actual value, maybe you can include other asset classets (if you have any) to balance it a bit (any property, bonds, cash etc.) so that it doesn’t look so radical when there is a big drop

) if you want to have an overview of the actual value, maybe you can include other asset classets (if you have any) to balance it a bit (any property, bonds, cash etc.) so that it doesn’t look so radical when there is a big drop

)

)