I don’t mind paying for the following things:

Vacations: For me vacations are experiences and adventures. I am not so much into spending money at a high end hotel just because it’s a high end hotel. However, I will gladly drop 500 chf a night for staying at unique locations which give me unique experiences. For example, an eco lodge ran by indigenous people deep in amazonian rain forest or Serengeti. Basically, my vacations tend to be in wilderness with the mindfulness that my money is also helping save the location. But this does not always need to cost a lot.

Restaurants: Unique locations, service, tasting menus. We prefer to go to one good restaurant every three months than 3 average restaurants in a month.

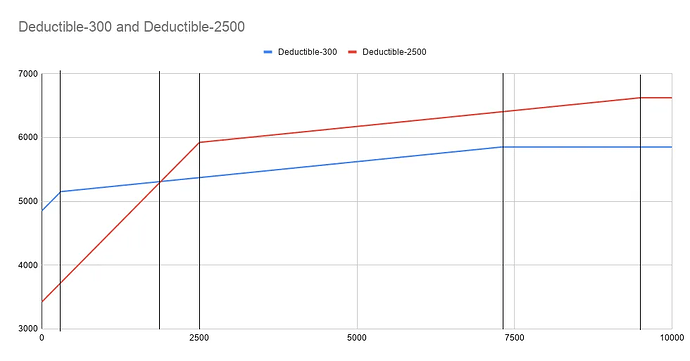

Complimentary health insurance: We have done our research and thought about what are the most important things for us. So, no options for alternative medicines (as we don’t believe in it), but options for global coverage and private accommodations.

Apartment: To be honest, we are lucky and have a great apartment for a very cheap price. But we would spend more otherwise.

Moving: Already stressful enough, so if we move, we hire the cleaners and the movers.

Family and friends: making sure they have a good time when they visit

Gardening: okay this not the most expensive thing in the world but each summer, we turn our balcony into a small farm forest and this takes some investments. If we ever get a proper house, then this will cost even more. But it is totally worth it for us.

Fitness/health: No point in being well off, if we are not going to be healthy. Also, health investments now will hopefully lower lifetime medical costs.

Things we have considered but not gone for yet:

Cleaning person: could be a big jump in our quality of life based on friends who do have one. But, we feel like we still have enough extra time. Maybe if we started a side gig, we will revisit this.

Flying first class: Ethical and financial reasons makes this not compelling. But boy, it would sure be nice to actually be able to sleep on an overnight flight. But then again, being able to fly at all would be a luxury right not.

Airport lounge: This might be a cheaper way to make flying more comfortable. Atleast in certain situations. I definitely regret not doing this at times.

Things we regret spending money on:

Cheap clothes: Stuff that falls apart within a year.

Too many clothes: This happened in the past. I definitely want to improve on this further.

New cheap furniture: we go second hand or buy higher quality new furniture.

Stuff in general: Gadgets, random souvenirs, etc. No more.

Expensive phones: Now I buy a low end, one generation old phone every 4 years. Always feels like an upgrade. I don’t even read about the new features on high end phones.

In general, for us it’s worth spending if it gives good value.