Ok I agree to not buy “Bio” as it’s not necessarily healthier, but saying to buy cheaper is not a good suggestion.

Buy smart by buying healthy quality/price food. It’s not worth to retire few years earlier and at the expense of your health.

This is also my reasoning… by adding too many safety nets (belt & braces) I’ll end up retiring at normal retirement age… if I manage to reach it ! ![]()

I prefer to take some calculated risks but risk aversion (or lack thereof) is a very personal factor

Vanguard has published a research paper on SWR last year. It’s linked from this blog post: Fueling the FIRE movement: Updating the 4% rule for early retirees | Vanguard

It’s US-centric but compares US-only with global investment strategies. Their SWR conclusion is the following:

- 2.6% for US-only investments with 1.0% fee

- 2.8% for global investments with 1.0% fee

- 3.3% for global investments with 0.2% fee

- 4.0% for global investments with 0.2% fee and dynamic spending (adjust spending based on market performance)

Assumptions:

- 50% stocks / 50% bonds

- Global investment portfolio: 30% US stocks, 20% ex-US stocks, 35% US bonds, 15% ex-US bonds (no mention of hedging)

- 50 year retirement horizon

- Future returns based on Vanguard Capital Markets Model (VCMM) forecasts

- No taxes or social security

Update after 3 years: Basically the same plan but I‘m thinking about taking AHV early. Will depend on the market after I retire. If there is a major crash between 55-63, I‘m going to take it early. Assuming it‘s still possible to do so at 63 ![]()

What’s the plan if crash at 55? Is it that you have enough cash/bond to bridge until 63? Or you factor in less than 8 years for any crash at 55?

Haven‘t thought about that. Maybe I‘ll live in Thailand for 1-2 years then ![]()

3m, that includes pension and 3rd Pillar I guess? Do you have a projection when you want to be at what asset levels? Lets say 40, 45 and 50? I mainly wonder how much of your target figure depends on savings vs. Asset returns.

Hmm. I hadn’t thought of leaving the country as an emergency measure. Though with young kids, it would have to be in my 60s so AHV has kicked in or is about to so maybe not an option for me.

I’m surprised that after your recent promotions, the 3m figure hasn’t crept up yet…

After promotions, the 3m shouldn’t move up, the retirement age should move down! ![]()

My income ~doubled in the last 6 years, but expenses stayed roughly the same (exluding taxes). I used to spend 4.1k before taxes in 2019 and today it‘s around 4.4k before taxes. Mostly due to inflation I guess. 3 million with 4% is still 10k/month, which is way more than I need. But I like to imagine a retirement life where I will never worry about money.

@TeaGhost

I have. Will post it later, when I‘m back at home.

@assemblyrequired

That‘s exactly how I see it ![]()

Do you have kids yet? If not, prepare to have your budget blown up! ![]() Kids are like FI kryptonite!

Kids are like FI kryptonite!

You don’t necessarily need to have kids for that.

The right spouse can take care of this easily! ![]()

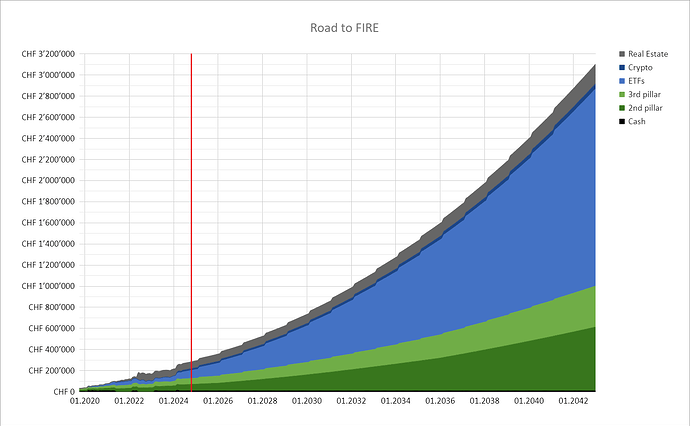

Couple of assumptions:

- My salary increases by 30k within the next 5 years and then +2k/year. Which will very likely turn out to be a very conservative estimate.

- There is no lifestyle inflation till I’m 40 (2031), thus everything what I earn more I’ll be able to save/invest more (after increasing taxes). Which was mostly the case in the last couple of years. After that age I’ll stop increasing my savings rate.

- Returns: ~1% RE, 3% BVG, 6% stocks, 6% crypto

- Accounted for increase of BVG contributions at 35, 45 and so on.

But as @PhilMongoose pointed out, I don’t have kids yet. This might change the equation, but the wife should earn some money.

I agree. But what is wealthy enough? In Switzerland, I guess you’ll never have a AHV cut below like 20M NW. But who knows.

Projection looks good. My only two cents were that I would propose to do this with “real” Swissies and not with Nominal ones. Meaning that I would put return assumptions to 0% RE, 1% BVG (a bit high), 4% Stocks and Crypto. From a salary adjustment point of view, I would further put things to 0 real growth from 45 onwards. But this shouldn’t materially change the picture, you are golden and I wouldn’t be surprised if you hit FI before 55. 3M is a high figure as realistically, no-one needs 120k of income as this was enough for a non-working partner and 1-2 kids as well. But always good to shoot a bit too high when young.

Changing those numbers like you suggested moves the 3M target from mid 2042 (51yo) to mid 2045 (54yo). I even assumed that my salary will top out at 40. But it‘s just an arbitrary number in the first place as half of it (1.5M) would be enough to sustain my current spendings including taxes as a retiree. Something I should reach by 2036 (45yo) taking your suggested numbers. But like you said, I like to shoot higher. Back in 2019 when I started investing (30k NW), I wasn’t expecting my salary to increase by that much. It could very well exceed my expectations again.

Think you take a great appraoch here. Always good to over-shoot in terms of savings aka aiming too high. You can then always later on re-consider and realize it was actually already good enough. Keep the dollars rolling ![]()