[Splitting topics to have more visibility]

And yet I reiterate: focusing on saving rate is what moves the needle the most, so it should be talked about more often. And if someone tells you that to achieve FIRE in a reasonable delay you should focus on being in a position to save more money, i see it as a welcome wakeup call, even if the tone is rough.

Let me illustrate my point (people allergetic to Maths can skip this section and go directly to the table below).

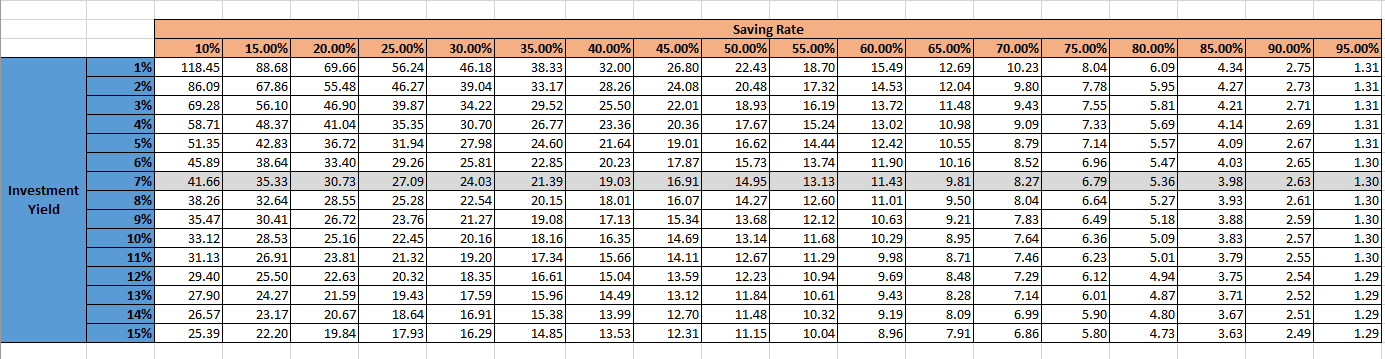

Assuming that you start from scratch and you will use the 4% rule (i.e your target capital is 25 times your annual expenses) then the time it takes to reach fire can be easily calculated.

Let:

- r be the annual yield of your investments

- and s your saving rate defined as savings/revenues

Then the time it takes to reach fire, N, in years, is worth:

N = LN(1+25 * r *(1- S)/S) / LN (1+r).

If you create a table of N as a function of r and S, it is very instructive:

I have highlighted the line where r=7%, which someone using index funds should expect over the long term.

Let’s try to describe the average guy on the forum (if such a thing is ever doable):

- it is likely that at some point it will be in a household, with partner and kids

- with such a configuration i haven’t seen many people having less than 40-45k CHF of annual expenses. (taxes excluded, you can add 10k of taxes)

if such a houshold is unable to save 100k within three years, it cannot save 33k within a year, so let’s say they save 25k per year, their saving rate is 25/(45+10+25)= 30%

The table say it then takes 24 years to reach FIRE at such a saving rate. Now if they focus on boosting saving rate to 60%, the time needed to reach FIRE is now 11 years: you save 13 f#*#g years!

As lowering expenses has a point of diminishing returns, there is only one alternative: increasing revenues.

I mean, i don’t know that is more eye-opening that gaining back 13 years of your life. If someone is a little bit rude saying that you should save more money, knowing this table, it should be a wakeup call for many.

Yes, it is hard to change job/career. But it is certainly worth it.

The fact that someone leaves in Switzerland does not automatically grants the right to retire early if the saving rate does not follow. it surely makes the game easier than in France (for instance). But still, at some point we have to eat the broccoli and do the hard thing. 13 years of life is worth it.