I recently got this article in my news feed: https://www.forbes.com/sites/michaelfoster/2020/07/14/this-5-fund-portfolio-pays-a-monthly-89-dividend/ kind of sounds too good to be true. 8,9% returns payed out monthly. What‘s the caveat here? High TER? Volatile returns?

I haven‘t found any topic here about Close End Funds.

I trade CEF’s – but not buy and hold, so the strategies with cefs aren’t for beginners.

Screeners: https://www.cefconnect.com/ | https://www.cefchannel.com/

You can find some more infos on seekingalpha or buying a book on amazon.

I started with the ebook “James Altucher - Closed End Fund Strategy Guide”.

TBH Forbes seems to be becoming some shit-tier clickbait website… That article you read there is nothing but an ad for those funds!

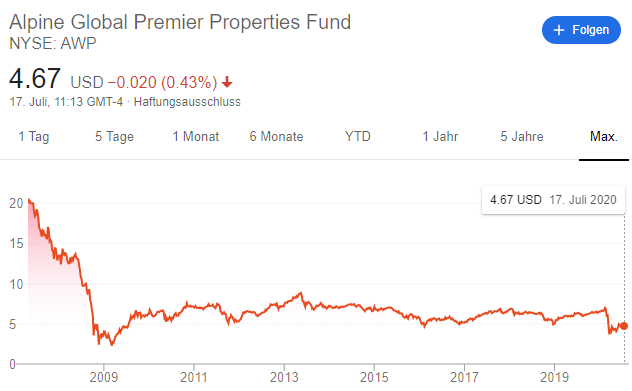

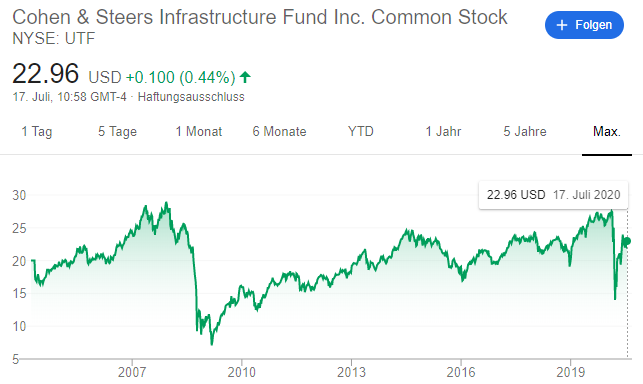

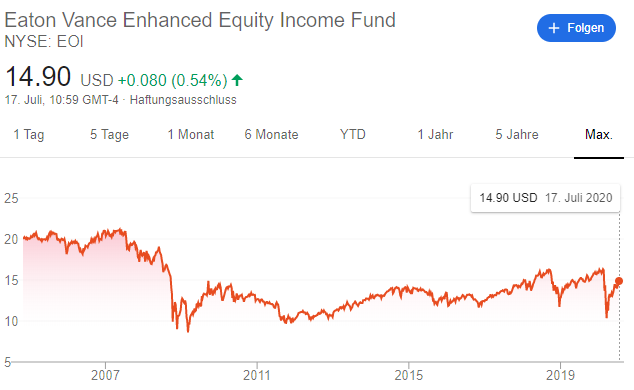

Look at the performace of those “magic” 10% dividend funds:

Great isn’t it? /s

It’s the classic “dividends are everything” bullshit again. What’s the point of a 10% dividend, if you lose more than 10% of portfolio value compared to the benchmark?

Isn‘t it expected for such products to mostly trade sideways due to the payed out dividends?