Don’t know if this is the right thread but:

HEY! What’s happening to the USD Currency? Can anyone of you explain the current situation? I’m ready to learn

Don’t know if this is the right thread but:

HEY! What’s happening to the USD Currency? Can anyone of you explain the current situation? I’m ready to learn

Difference in interest rate (SNB rates are usually 2-3% higher than FED) is resulting in a devaluation of the USD. Will probably be at 0.50 CHF in 20 years.

What? So you basically said that:

It’s an estimate, but this is expected due to interest rate and inflation rate differences.

There will be short term fluctuations like today, but the longterm effects are clear.

Keep in mind, that you should, in principle earn higher interest on those 5673 USD, than on the 5000 CHF.

(Though notably, if you look it up at IBKR, at the moment you actually wouldn’t, really)

So, investing in an ETF (e.g. VT) in USD should be reconsidered right ?

I think it will be closer to 0.7 CHF than 0.5 CHF in 20 years, but that doens’t change anything

What does it have to do with USD:CHF exchange rate?

Cause you change CHF in USD today (0.88) and do the opposite 20 years later with a higher changing rate (0.5… 1.5) ?

Well, VT’s NAV might increase 10% in their trading and reporting currency - yet Kirby might be unable to “see” a similar gain in his account(ing) using CHF as base currency.

It certainly needs to be considered when looking at returns.

PS: obviously the difference in price between two identical funds traded in USD and CHF will be …just the USD/CHF exchange rate. All the time. In the end, what matters is how companies profit’s will be impacted by changes of the exchange rate - not the currency that an ETF is traded in.

That’s why I display everything in my base currency ![]()

And if the same stocks were denominated in CHF, you’d end up with exactly the same result. You’re buying the stock, not the currency (once you bought it, it has almost nothing to do with USD, besides regular fx exposure).

If the stock was quoted in bitcoin or gold or anything else, you’d still get exactly the same return after those 20 years in CHF.

In the end, you‘re buying shares of companies/businesses.

Not even the stock‘s trading currency matters much. Good examples might be companies with dual stock listings, such as Unilever and Shell (London in GBP and Amsterdam in EUR).

Nestle is listed in CHF and is a Swiss stock. 98% of its revenues are made abroad in 100+ different currencies. So is it really a CHF stock?

We live in a highly globalized world. One should just ignore FX changes.

It’s quite hard for me to ignore the USD, when it lost nearly 9% in 2020 alone. As someone who’s probably going to retire in CH, needing CHF to pay the bills, it certainly is an issue that we have one of the strongest currencies. Sure it doesn’t matter in what currency a share/ETF is listed, but it’s definitely an issue that the global earnings, e.g. of Nestle, are worth less and less every year in CHF.

No, because we have no inflation here

Exactly, people always say ‘ya returns are not the same in CHF than in USD’, actually pretty close by if accounting for inflation.

5% return p.a. is the expected market return, inflation adjusted. So in Switzerland probably around 5.5% (actually even lower if just looking at the inflation values of the past years), and 7% for US with an inflation of about 2%. Of course this is all expected, no real predective science.

So basically you can still work with a 4% SWR in Switzerland, would still work pretty well. (Actually when looking at FireSim or how it is called again, I kind of remember that the times it failed, it was not about lacking gross returns, but sky-high inflation periods at the beginning of FIRE).

I just spent half an hour looking at inflation rates, interest rates and the development of USD vs CHF for the last three decades. My biased opinion was that the theoretical explanations don’t match reality, and that the USD is depreciating way too quickly. But, looking at the actual data it does seem to hold up quite ok. Both prior to the 2007/2008 crisis when the US had substantially higher interest rates (and USD depreciated accordingly) but also has not substantially further depreciated since 2010 as the delta in interest rate vs inflation for both USD and CHF became comparable. I learned something today, thanks

Of course the 9% USD depreciation in 2020 is not explained by these dynamics but rather the economic and political crisis and should as such remain an outlier in the (very) long-term.

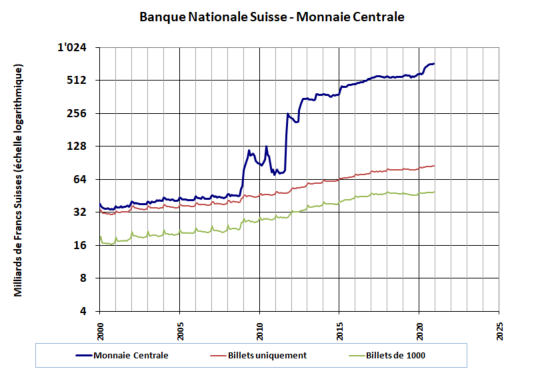

Since 2008 exchange rates depend on another major factor (more important than inflation rates and interest rates): the central banks’ balance sheets. This is especially meaningful for the CHF since the SNB is actively buying foreign currencies, including the USD.