i dont even know why i have a margin account would it be better to go with a cash account …can i downgrade without any penalty and does it matter?

You can change I think. But I don’t know how.

It’s not a problem. You don’t really need to downgrade. Just don’t use margin. It’s always good to only invest what you have.

Margin is like taking a loan to invest. Sometimes it’s useful when you have an opportunity and want to maximise. But it’s not something for everyone

My main currency is GBP

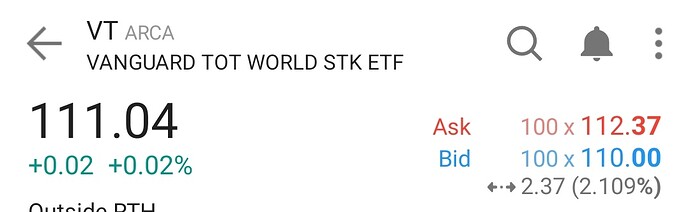

I hope they is the right ticker

I nearly messed it up by buying some and it not going through and then buying more and the previous had been pending still…which is why I don’t like this margin account

Yeah it’s right ticker

I live here and pay tax here yes …i am british and have a gbp account with hsbc.

Can you tell me the tax benefits please?

Do you mean you’re not a swiss resident?

I meant that US ETFs have tax efficiency. But that’s mainly for CH residents.

If you are based outside CH, then perhaps UCITS might be more beneficial.

Yes resident of Switzerland with a property.

Just looking to know benefits tax wise

The main benefit is that tax withheld by US on dividends can be claimed via DA1 form

I haven’t as well. Is it included intransparently in the exchange rate? The “Comm/Fee” column, which should show how high the fees were as far as I understand it, always show “0.00”. The code shows as “AFx” (Auto Forex) just as expected.

I also checked the conversion rates, really zoomed in the graph at the time, the conversion was done, and could not see a difference between this and what I paid. But I’ll check again next time.

Hi,

I need to change my strategy because of a new job. In order to save in fees, I need an ETF which can be traded on the SIX Swiss Exchange. So VT is no more interesting for my situation.

I found this one :

UBS MSCI World (USD) - IE00B7KQ7B66 / WRDUSY

Do you have a better idea ?

CHF and USD shares are available. I can maybe save some bank fees by buying the CHF one. I know there will anyway be some fees inside the ETF. Does that make sense ?

Thank you for your valuable help ![]()

Just adding two more to list from @oslasho

Both are accumulating

SPDR ACWI (traded on SIX) in CHF following MSCI ACWI index (large and mid caps), TER 0.12%

FWRA (traded on SIX) in CHF following FTSE all world index (large and mid caps) , TER 0.15%

VT is all world, so thought to let you know all world index.

MSCI world + EM = MSCI ACWI

Some poor sap thought they were being smart and put a market order in for BRK.A when the glitch in the NYSE made it cost 99.99% less. The order went through after NYSE unfroze transactions and that person found themselves with a BRK.A stock and >600k in debt. I think I remember reading there were a few trades which were not cancelled/reversed.

I don’t trust market orders AT ALL, whenever I’m buying I see what’s the current bid/ask and add a couple of cents to it, it’s been fine so far ![]()

For BRK.A I also wouldn’t place market orders. It’s such a huge stock price

In general market orders work well when spreads are so low. I use them only for VT. They get filled in one second.

But I do not see the advantage here, since limit orders are also executed within seconds if you don’t put the limit too low…

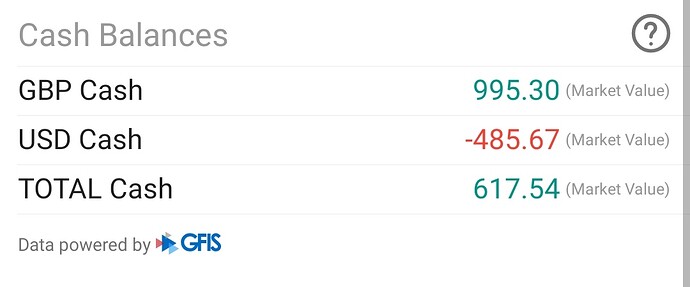

Do you know why my usd is in red when I buy a stock …I thought it would automatically take cash from gbp

No advantage

I just wanted to say that since order gets filled fast, I am not worried about getting burned with a mistrade or something

I think in Auto Fx route sometimes there is some background transactions happening

Give it a day, it should sort out itself