Very good point

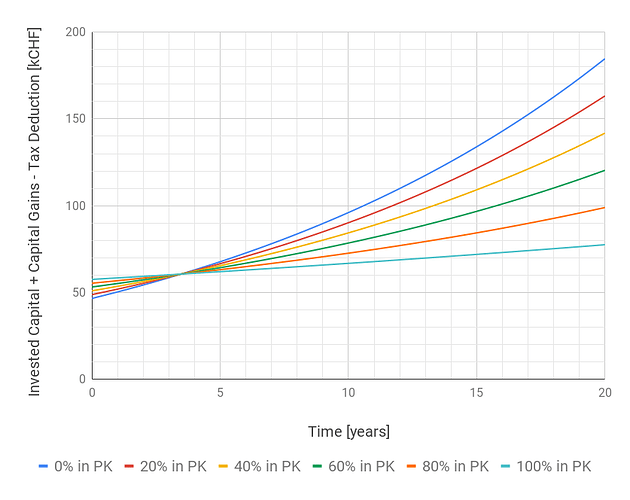

I ran the numbers with to a random case study and the result is quite robust with regards to input parameters. I played around with various parameters but the crossover-point did not move significantly.

Executive summary: I arrive at the same conclusion as this thread. Good short term investment (but watch out for the 3 years withdrawal limitation!) but a very bad long term investment with many unknowns.

Many thanks for all the contributions above! Rereading this thread I realise that I basically just repeated the thought process already laid out in this thread

Best, Mr. Lean Life

I agree with your analysis. However, there is one more thing we can take into account: asset allocation.

If you already have a very large investment, it may be interesting to add more to your second pillar as if it was bonds. The second pillar is very similar to a bond in that it’s quite safe. It may be interesting in having some safe money from a long-term view. Personally, my portfolio has probably too much bonds already since my investment account is too small. But if this changes, I may invest a bit into my second pillar.

I know that @MrRIP did several voluntary purchase. Maybe he’ll have an interesting opinion on that.

My 2nd pillar plans while young (23 currently):

- Contribute the minimum my employer requires me to

- See it as a “low-risk” investment in my overall portfolio, thus go higher allocation on equities with liquid capital (currently 100% other than cash flow in bank accounts)

- Either pledge it if buying a house in 5-15 years (so I don’t need to forfeit as much high returning liquid capital), withdraw it if leaving Switzerland to more a favourable investment/overseas pension plan, or use it to fund a company I may wish to start

- When I am closer to retirement (55-65) back-purchase as much as possible to pay no income tax for my final working years

I don’t think there is much reason to do back-purchases when so young, plenty of time for that closer to retirement when it is more to your advantage.

Would it make sense to buy 2nd pillar with money from 3a when you are in your 60’s ?

I do the same ![]() As my 2nd pillar is a rather large percentage of my overall portfolio at the moment I can keep ignoring the 2nd pillar for a while.

As my 2nd pillar is a rather large percentage of my overall portfolio at the moment I can keep ignoring the 2nd pillar for a while.

![]() Mhmmmm. I would actually doubt that this always would make sense. I have not vetted that thoroughly but I think the process would be:

Mhmmmm. I would actually doubt that this always would make sense. I have not vetted that thoroughly but I think the process would be:

- Take out 3rd pillar money

- Pay “Kapitalauszahlungssteuer” on that amount

- Contribute to 2nd pillar

- Reduce your taxable income and save with the marginal tax rate

- Wait > 3 years

- Take out 2nd pillar money

- Pay “Kapitalauszahlungssteuer” on that amount (again!)

This would mean that you pay the “Kapitalauszahlungssteuer” twice on the same amount! That being said and thinking about it a bit longer I think it could actually work if you live in the Canton of Schwyz or the Canton of Appenzell Innerrhoden. So you would probably have to run the numbers yourself depending on your fortune and your municipality of residence at the point of the events listed above. However, the key equation stays the same:

2 * "Kapitalauszahlungssteuer" < Savings from Marginal Tax Rate

If this holds true I would not see a reason to not do it (except the tax authorities having something to say about that).

Hello Everyone,

Wanted to just revive this topic, as negative interest rates environment seem to be lasting. Question: if you have high marginal tax, what is the downside of purchasing 2nd pillar vs holding long term cash? (or bond?).

Imagine at 35% marginal tax: for 10K buyback, you actually spend 6.5K. (3.5 K is a net reduction in your tax) So It gives you already a ~50% return on investment in the first year. Yes, then you are locked in for 20-25 years with ~1% return per year, But still at 20 years it gets to ~3.5% return, way better holding long term cash or bonds at current prices, and almost no risk.

Am I missing something? Why not allocate cash portion of your AA to 2nd pillar?

Hi Sammiz,

That’s one way to do it. If you invest conservatively or/and have a high net worth, considering it like part of the bonds side of your protfolio would allow yourself to invest more in stocks while keeping your assets allocation and your investments in the 2nd pillar should beat both domestic bonds rates and savings accounts returns at the current rates.

I’d adjust it to my long term scenario (i.e. : taking out the capital or the annuity when reaching retirement) and it’s subject to legal hazard (the law may change though I don’t see a scenario where taking it out as capital would stop being an option as remotely likely).

You loose on it if you compare it to investing into stocks. It can still be useful if you’d have money sitting around in a savings account or in safe bonds earning less than 2-3% and you can still sleep at night considering this money as part of the “safe” part of your portfolio.

You still need to be prepared for an emergency, so you’d still need some other safe and liquid assets readily available on top of your 2nd pillar and you should consider that you won’t be able to put in later the money that you are putting in now so you may want to consider postponing your additional contributions if you think your marginal tax rate is likely to grow in the future.

Disclaimer : I’m not a financial advisor. Long term retirement planning (how much you want to have for retirement, of which how much you’d want to use from the 2nd pillar into an annuity and what you’d do with your 2nd pillar in the mean time, including if there’s a freelancing part of your career where you’d take it out along the way and/or real estate purposes) is probably worth discussing with a financial advisor at one point (doesn’t mean you have to buy anything).

For the middle earning class and depeding on the canton you live in, buying some 2nd pillar (+3a) can lower your taxable income enough so that your rent expenses are also deductible wich can then, in turn, lower again your final taxable income.

Worth playing around with the calculation program

I had never thought of that. It actually seems like a big oversight to me (that is, if/that you can get enough taxable income reductions to qualify for some kind of subsidies). Is there a maximal amount that can be contributed pro year to 2nd pillar purchases (other than the maximal amount you can actually purchase on your whole 2nd pillar) and does that really allow you to gather tax advantages like deductible rent expenses (not available in my canton that I am aware of) or health insurance subsidies?

That would make waiting it out, allowing the amount you can purchase back to grow (because it didn’t bring interests) and buying it all on one or two years an actually interesting option (financially speaking, I’m quite a bit appalled by the social aspects of it if it works but that’s another topic entirely).

In nominal terms, it’s a good plan.

Is it necessarily?

I had a thought: Couldn’t you use it as a “backdoor entry” (so to speak) into a tax-free vested benefits investment like VIAC or valuepension - especially when planning to leave Switzerland?

Sure, as long as you’re employed in Switzerland (and being insured with a pension fund), you’re technically not allowed to keep the vested benefits.

If you become self-employed or leave the country, you can keep these accounts - and as far as I know, they won’t be taxed by many countries, due to being part of the pension fund/social security system.

I just read the thread and as I understood on the long term investing in something else would beat the 1% return even when one skipps the tax benefits.

But what about this case (not me)

- 37 y, B permit, single no kids

- In CH for 5 years therefore not a lot of 2nd pillar savings (aka swiss bias/bond)

- Salary 96K

- Current 2nd pillar savings: 22K

- Potential Purchase: 75K

What would you do?

Edit: Is the purchase also affecting the “Altersrente”, which is 21k/y now?

The amount itself does not matter much. If you are not going to touch this money for the next 30 years or so, it’s much better invested in the stock market in a broker account.

But of course, there are other things to take into account:

- If not in the second pillar, Is he actually going to invest the money or keep it as cash?

- Does he plan to use the second pillar pension to retire or not?

I wouldn’t do it.

Invest max in 3a & the rest at the broker of one’s choice.

Of course some people have problems not spending money that is not “blocked” on a nice car (Tesla of course😉) or something. This may be a reason to pay into the Pensionskasse.

TBH I see it also as a way of diversifying away from myself

Personally, I‘d consider it later in life.

Not 30 years before reaching retirement age.

I read this UBS article. Now I am wondering whether the following is allowed or makes sense if you want to buy a home with the proceeds from a stock sale:

- Sell the stock

- If you have already found a home you like, buy it with the minimal equity percentage allowed

- Do a 2nd pillar buyback with the rest of the proceeds to minimize taxation on the income generated from the sale

- 3 years later when you can use your voluntary purchase without losing the tax benefits refinance your mortgage/increase your equity with the 2nd pillar

Sounds a bit involved but if it works (and you are lucky enough to be selling a couple hundred thousand CHF worth of stock) the savings could be substantial.

Some problems with the idea:

- You might not be allowed to voluntarily purchase a significant sum (my fund tells me I can purchase a lot if I go for early retirement but then I have to retire early or I lose money)

- The stock price 3 years later might be higher than any savings you realize

- Your stock broker might withhold a lot of taxes after you sell and you might have to rely on the refund after your declaration

- Using your 2nd pillar to refinance or increase equity on an existing mortgage might not be allowed (I know renovations are allowed by pure finance engineering?)

What do you think?

There are no taxes on capital gains for private investors in Switzerland.

The idea of shifting part of your tax burden from a high-income to a lower-income tax year through 2nd pillar buy-ins is sound, if planned correctly.

But as @Dr.PI mentioned, personal sales of securities are (in general) not taxable in Switzerland.

If you aren’t living in Switzerland, the question is whether voluntary contributions to a foreign (Swiss) retirement scheme will decrease your local taxes.