Thank you for the help so far, I think I’m pretty much done! Let me know if there’s a way that I can pay you a coffee ![]() .

.

I am also doing this for the first time. But are we not supposed to use/submit the DA-1 form? MP’s approach seems to be way simpler.

Or the DA-1 has to be submitted when you have stocks and not ETFs? My portfolio is dead simple, mainly US ETFs via IB, so very similar to MPs one.

But I guess the question whether, and when, I need to submit the DA-1 form is still unclear, could anyone help me out here ?

Thanks!

You should find the answers you are looking for in this thread:

The DA-1 is automatically generated for your US stocks and ETFs if you filled your positions correctly.

Stocks and funds are treated the same in this case.

You submit it if you are allowed (100 CHF minimum) and want (![]() ) to avoid double taxation by “getting back” the withholding tax paid to US.

) to avoid double taxation by “getting back” the withholding tax paid to US.

Good. So no need to fill out that DA1 PDF form manually? I see The Poor Swiss is doing it manually, but I am not sure why?

Got it but besides that, do I need to fill that PDF manually in case I have single stocks and not ETFs? I mean, what is the difference between doing it via the VaudTax platform in “Stocks and shares” (“Actions et parts sociales Code 410)" and doing it via the DA-1 PDF Form manually?

I might be mixing things up so I appreciate your patience ![]()

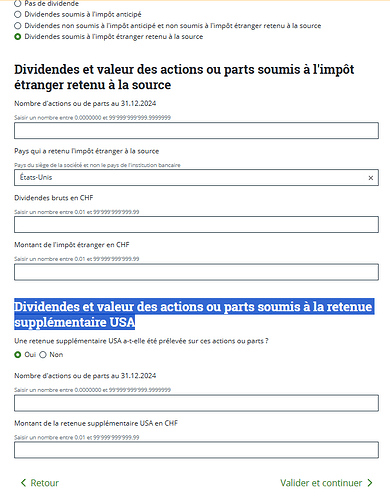

For US stocks from IBKR UK, I asume we need to select “Dividendes soumis à l’impot étranger retenu à la source” but I am not sure what to select at the bottom in " Dividendes et valeur des actions ou parts soumis à la retenue supplémentaire USA". This section should be yes/no? If yes, the Montant de la retenue supplémentaire USA en CHF is simply the amount of WHT in the IBKR report?

Thanks!

You should answer no, supplementary withholding is only for swiss brokers.

Ah yes, make sense ![]() thanks!

thanks!

An additional question! I was employed at a 100% rate in 2024 but I had a small side activity as freelancer where I got ~9000CHF. I can’t be considered as “independant” as I had only 1 client so I am not sure where to add this activity.

It makes sense for me to be considered as Activités salariées - Revenu (codes 100 à 120) → “Activité accessoire” but this option requires to add “Taux d’activité (en %)” and information that can be retrieved from the “certificat de salaire” that I don’t have for this activity. Should I declare it as “activitéé independante” or as “Autres revenus de toute nature (code 195)”?

…If I can avoid filling the " Bilan, comptes de pertes et profits" and the annoying "questionnaire pour les independants’ it would be awesome! haha

No, it is filled automatically. Filling it manually is just not a thing if you use VaudTax.

Not familiar with the software in Fribourg, but it may be a limitation specific to the canton.

No, fill out the information related to your stocks and ETFs in their respective sections. Once filled, you will see an additional section asking you for a couple additional information related to DA-1:

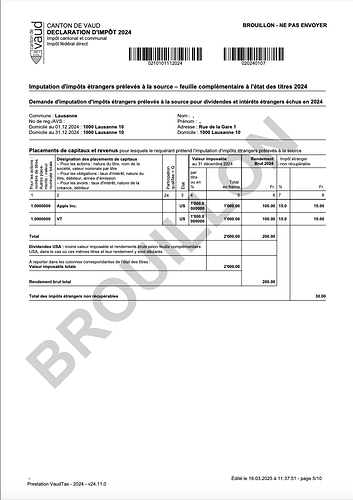

Now you can generate a draft of your tax declaration (panel on the right, “Imprimer un brouillon de la déclaration pour vos dossiers”) and you will see your DA-1 in pages 5-6 (if nothing else is filled out):

Note: dummy data for illustrative purposes.

Use “Autres revenus de toute nature (code 195)”.

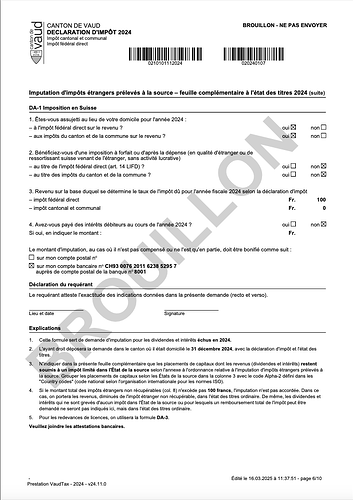

By the way what are w supposed to do with this DA-1? Nothing 'cause the tax office handles it, or should we send it somewhere?

It is sent electronically together with the rest of your tax declaration, the tax office then handles it.

However, the tax declaration and the DA-1 are processed separately. The DA-1 will be processed by a specialist once the tax declaration has been assessed and is final.

In many cantons the DA-1 are processed only by the cantonal tax office as the volume is not high enough to be done by the local tax offices (but afaik in Vaud local tax offices don’t exist anymore, everything has been centralised at the cantonal tax office anyway).

Ah great, thanks! That is what I did at the end. When you have additional revenues what happens with the AVS, they will ask me to pay for the additional income or only the respective income taxes?

I don’t think AVS and tax authorities are connected, it’s your responsibility to make sure you pay AVS if needed.

There is certainly some communication between tax authorities and AVS. At least for people that declare self-employed income, AVS will get the numbers at some point and will send the final AVS bill based on the numbers from the tax declaration.

However, I don’t know how far that communication goes. I.e., I have no idea whether such additional income will be reported to AVS.

Oh really? Wasn’t aware of this (I had the impression most of the systems weren’t connected).

Aah I expected the tax office to transfer the information to the AVS afterwards and then AVS will reclaim back a payment if needed. I can contact them just to be sure just in case…

In any case, I believe for freelancer that is how it works right ?

If you’re registered as self-employed, yes. I don’t know what exactly happens if you aren’t. In some cases they will actually claim pillar 1 contributions from your customer due to disguised self-employment (Scheinselbständigkeit) but I don’t know how exactly they decide to pursue something like this.

Hi everybody,

Last year, I started buying/selling options and since I have a B permit, I called the Vaud Tax Office in order to have the codes needed to file my taxes. I need to declare it before September 2025.

I started by declaring shares and now I’ve been struggling with options, there is no specific place for it.

I’ve been trying to talk with somebody from the Tax Office but nobody answers the phone. Besides that, I have already asked them some questions regarding options a few months ago and it seemed like they didn’t know what it was, maybe I was just unlucky.

Anyways, I closed most of my options positions before the end of the year but I still held 1 call and some shares. In 2024, I made a small profit of < CHF 5000.

How do you guys declare it ? Do I need to declare every single options transaction (Exercised, expired, assigned) ?

I have read a few posts about declaring options here but they are quite old and I can’t really find a clear answer.

Thanks y’all.

It has some cash value as per 31.12. Declare it as a part of your assets (wealth). That should do it.