Hope that because of your age you won’t lose money with that double translation!

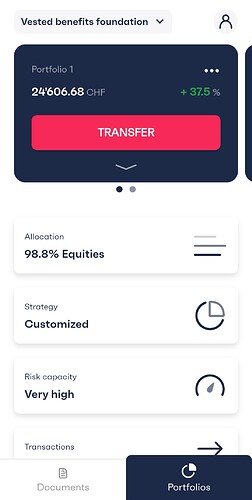

Perfectly in time. I went ahead with 50% to VIAC and ValuePension.

ValuePension is objectively better but splitting gives flexibility when withdrawing later in life.

I’ll do DCA over the next few months because the market is a bit frothy (and I’ll sleep better)

If you prefer one provider over the other, you can also open multiple accounts with both VIAC and FinPension.

It is not permitted to manage two accounts with the same vested benefits foundation.

And their interpretation requires the further interpretation that keeping a vested benefits account while in a new working relationship is fine in regards to the law. Food for thoughts.

I hadn’t given this any thought, I just shared as I remembered seeing it.

Are there valid cases where it is not obligatory to move all vested assets to your employer, for ex. If assets> max permitted amount in employer plan?

Thanks for it, I’m curious too. That’s the option I’ve thought of but there probably are others too.

Obligatory transfer is only about the mandatory part. 7% / 10% / 15% / 18% of your insured salary up until 61k (86k - 25k Koordinationsabzug). So let’s assume someone starts working with 25 and switches the employee 5 years later. He had an avg. salary of 125k and an insured salary of 100k (-25k Koordinationsabzug). As his pension fund was pretty good, the deductions were 5%/10% instead of the required minimum of 3.5%/3.5%.

5 years x 7% x 61k = 21.5k mandatory BVG.

5 years x 15% x 100k = 75k total.

At least 21.5k need to be transferred to your next pension fund, the rest is extra mandatory and you are free to transfer that to a vested benefits account.

Not while your working there, but when you leave them.

This extra mandatory part is also the amount that you can always withdraw once you leave Switzerland.

I see no legal basis for that.

The law also covers non-mandatory benefits and clearly says that termination benefits have to be transferred to the new pension fund (art. 3 FZG) to be used to “buy in” to the new pension plan. Only when that is maxed out, as @Barto said, are you free (or you have) to transfer it elsewhere (art. 13 FZG).

Not while you’re working there and covered by their pension fund plan…

…and neither when you leave and join a new employer fund with pension fund coverage.

And again, even if you did transfer it to a vested benefits foundation during a period of not being insured with a pension, you are obliged to close your accounts there and have them (including any non-mandatory part) transferred to your new pension fund upon becoming insured with them.

To back this up, see Mitteilungen über die berufliche Vorsorge from the Bundesamt für Sozialversicherungen (page 47):

“Ab 1. Januar 1995 gilt der Grundsatz, dass die Austrittsleistung (Freizügigkeitsleistung) von der bisherigen Kasse zur Vorsorgeeinrichtung des neuen Arbeitgebers übertragen werden muss. Die Übertragung der Austrittsleistung auf eine Freizügigkeitspolice oder auf ein Freizügigkeitskonto ist nur dann zulässig, wenn der Versicherte keiner neuen Vorsorgeeinrichtung beitritt. Das könnte dann der Fall sein, wenn der Versicherte in der Schweiz keinen neuen Arbeitgeber hat, eine selbständige Erwerbstätigkeit aufnimmt oder die Schweiz endgültig verlässt, ferner wenn der AHV-beitragspflichtige Lohn unter dem BVG-Mindestjahreslohn liegt und nicht versichert ist. Wird in der neuen Vorsorgeeinrichtung nicht die gesamte mitgebrachte Austrittsleistung zum Einkauf des Versicherten in die vollen reglementarischen Leistungen benötigt, kann die Differenz ebenfalls auf eine Freizügigkeitseinrichtung übertragen werden.”

Isn’t that what I’m talking about?

It’s isn’t.

Volle reglementarische Leistungen = obligatorisch + überobligatorisch.

…unless, of course, a pension fund only provides the absolute “BVG” minimum mandated by law in their plan. Yet most pension fund plans go (often “way”) above that, also covering some non-mandatory benefits and/or insuring higher wages as well. And so will most users of this forum with their insured salaries and/or pension fund plans.

“Volle reglementarische Leistungen” means the maximum defined by a pension fund’s insurance plan - not only the “BVG-Obligatorium” minimum defined by law.

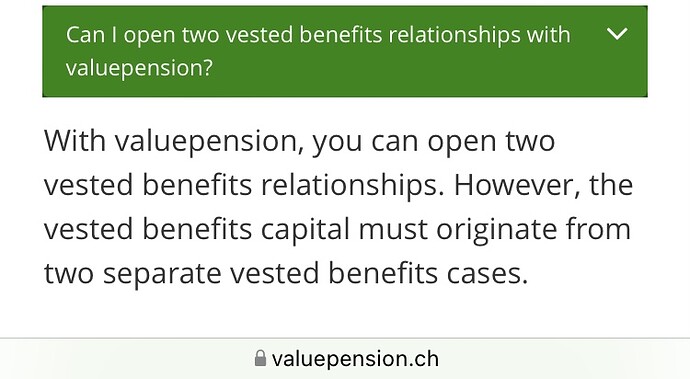

Ok but it needs to be come from two separate vested benefits in the first place. So It would not work if you split after you leave your job.

I started working when I was 25 and I am now almost 40. My salary has been always above 61K (currently 140K) . So, the maximum regulatory benefits for me would 9 (years until 34)* 7%*61K+6(years after 34)*10%*61K=75K. In my current pension fund of my employer, there is almost 240K. Does it mean that I can invest the 240-75=165K in vested benefits accounts when I change the employer at the end of the year?

That’s more or less what he meant and suggested - but not what the law allows (he’s wrong about that).

You’re not allowed to deliberately split between your new pension fund and a vested benefits account.

The statement “Obligatory transfer is only about the mandatory part. 7% / 10% / 15% / 18% of your insured salary” is very much about conforming with law and regulations. What he was saying is that you could legally transfer only (the mandatory) part of your pension fund benefits to the new pension fund. That is, to my knowledge and the sources provided, not true.

Is is technically possible to violate the law? Sure, just as you can evade taxes. You may even get away with it.

Again, no. Non-mandatory pension benefits are (usually) part of the maximum benefits according to the pension fund’s regulations.

Now, pension funds ususally do set a certain limit for maximum benefits (progressing with age), which will be a “cap” on maximum you can transfer from your old pension fund and/or pay in voluntarily. And, yes, someone can surpass this maximum with his portable benefits from his old employer’s pension fund. Maybe even you. You may have to transfer to vested benefits account then.

But the maximum amount of benefits according your pension fund’s regulation is not to be confused with the BVG maximum.

Furthermore, your new pension fund’s regulations don’t have to limit yearly savings contributions to the minimums set by the BVG law. They can be higher than 7%/10%/15%/18 or cover a higher salary.

PS: See this example from Profond (for a person born in 1965, but gets the points across):

- Sparskala exceeds legal minimum percentages

- …and applies to salary of 120’000/year (again exceeding legal minimum)

The maximum amount benefits for the 40-year old in 2005 would have been 201’646 CHF according to pension fund regulations. Sure, it may only be an example - but the amount is much higher than the maximum amount according to BVG (the same 1965-born person would be age 56 in 2021, and in 2005 have had a maximum of BVG benefits of 77909 CHF).

TL;DR: You are required to transfer pension benefits to your new pension fund up to the maximum provided by its regulations and insurance plan. The fund’s maximum amount will usually (far) exceed the maximum of “obligatory@ benefits according to BVG law.