What happens if you force the amount and continue ? Or you cannot enter an amount higher than the cash balance ?

If I enter an amount higher than my current cash balance, I get an error that says, 'Maximum amount (X) exceeded.

I think you can only buy (securities) on margin (on IBKR), not withdraw cash on margin.

I don’t buy on margin, so I don’t really know for sure.

Not true, i can withdraw several 100k more than my cash balance. Mr Money Mustache wrote a blogpost about buying a house lile that…

And your broker is IBKR? And you actually did withdraw several 100k more than your cash balance?

Genuinely interested, just have no experience with this at IBKR (or elsewhere).

Is your residence outside of Europe? I just found a Reddit post that says margin cash withdrawal within Europe is not possible (https://www.reddit.com/r/interactivebrokers/comments/1c0q61r/is_withdrawing_cash_from_ib_on_margin_in_europe/#:~:text=Since%20about%202%20years%20its,you%20can’t%20withdraw%20cash.)

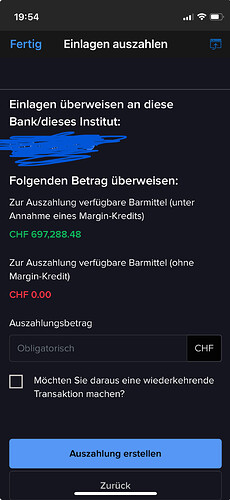

So my cash balance is slightly negative and this is what I see if I want to start a withdrawal:

I am with IBKR UK, living in CH.

So if you want credit, let me know! Only 10% interest per second, and your firstborn as collateral.

Let’s test this this through Independently-Verified-by-Goofy™:

I’ll DM you the account/bank you should withdraw to.

If you and the forum don’t ever hear back from me, you will know that cash withdrawals on margin can indeed be done.

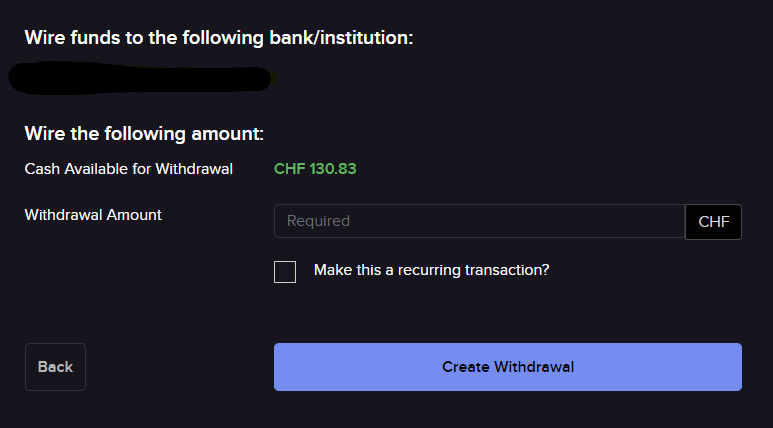

Interesting. My options look like this:

However, I switched from a cash account to a margin account on Saturday. Maybe it needs a couple of days to take effect, even though my account type already says 'margin

Same set-up here and I’ve withdrawn quite a lot of cash this way.

Possible. I confirm I have withdrawn > 200kCHF (in one shot) on margin a couple of years back. I don’t know if they have changed anything in the meanwhile, though

I know it‘s not possible in Germany with IB IE.

It is possible in CH with IB UK however.

Are you still able to withdraw cash?

I have had a negative cash balance on a margin account for years and like you withdrew cash many times in this past without any problem. But I cannot any longer.

IB customer service (Chicago) told me that due to a recent change IBUK customers can no longer withdraw cash if aggregate cash balance is -ve. You can still trade but not withdraw.

If the Customer Service contact is correct it seems dysfunctional. There would be a workaround to sell assets, withdraw the cash you need, then buy the same assets again.

I have asked for a manager call back but it did not arrive yet and I would welcome feedback if anyone else is seeing the same. A colleague does not seem to have the same restriction and I have another problem(*) that I am holding out can be fixed and might solve it before I have so start looking for another broker

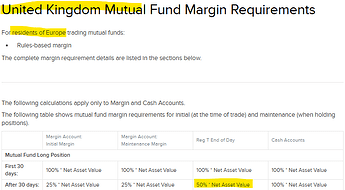

(*) IB Customer Service told me in September 2023 that IB changed Reg T margin requirement for ALL non US mutual funds from 50% to 100%. Since my main holding is Fundsmith, I have been below my Reg T margin since September 23rd which prevents me from withdrawing cash and is also damned scary. It was not communicated to me. IB website is still showing the Reg T margin requirement is 50%. IB are hiding behind “regulatory change”, per gooogle there may have been some tightening of regulations on risky products with leverage, but in my own opinion it also seems a mistake to apply 100% margin requirement to all equity funds

Do you have portfolio margin?

Do you have portfolio margin

No I have a Reg T margin

Changing to Portfolio Margin might change things. It will also reduce your margin requirements, as index funds etc. have very low requirements then.

Changing to Portfolio Margin might change things

I’ll ask them if I get a call back - I chased them again today. So far they told me the restriction on withdrawals is two fold, 1) the Reg T Margin requirement (mutual funds no longer accepted as collateral) and 2) the new rule that withdrawals are not allowed if you have -ve cash

As we know it is frustratingly difficult to find someone to talk to, the ping pong to and fro has been going on for 10 days

I have been below my Reg T margin since September 23rd which prevents me from withdrawing cash and is also damned scary.

Margin can be pulled at any time and often when you most need it.

I had to learn the hard way before I stopped using margin.

After another escalation I got a call back from a manager in London. Here is what I have been advised:

-

The new rule blocking withdrawals from IBKR UK if you have negative cash only applies if you are UK resident. I’m resident in CH so this is not the cause of my issue

-

Changing to a Portfolio Margin account as opposed to rules based margin should solve my problem. I have submitted the application for the change and I should know in a few days.

In my case my initial and maintenance margins are almost the same under both approaches which is why I never made the change until now. But I was advised the RegT Margin limitation on withdrawals will not apply after the change so I’ve gone ahead

-

I shared my feedback that this change to consider ALL mutual funds(*) as 0 collateral value did not make sense and seemed a big mistake from IB. He advised it had been escalated to the highest level in risk dept based on my issue and was not likely to change in the short term.

I advised this would lead IB to lose business. He acknowledged but so far I am the only person is he aware of to have escalated it but the change is only ~6 weeks old.

-

I pointed out that IBKR website (screen shot below) is still advising the margin requirement for mutual funds is 50% which is wrong because they are now applying 100%. He agreed and it needs to be changed.

He said that when there is change in margin requirement it should be communicated, I do not believe it was and I am quite sure I would have opened messages about change in margin requirement

(*) US mutual funds are still considered as collateral but only US citizens resident in the US are allowed to buy them in IB

Margin can be pulled at any time and often when you most need it.

I had to learn the hard way before I stopped using margin

Indeed this episode has given me the heebie jeebies about using margin at Interactive Brokers and is pushing me towards paying the premium for a swiss private bank