Yes, buying a future on USD/CHF is basically equivalent to borrowing CHF for the same period as the future (against CHF interest), converting it to USD, putting it treasuries with same maturity as the future (getting USD interest), and when the future expires leading to the obligation to buy USD with CHF, it is equivalent to using the CHF to reimburse the loan and keeping the USD that you got back from the principal reimbursement of the treasuries.

So the price of the future is the difference in interest rates over the period, which you can also see as the future contract being “free” or “neutral” if you subtract the difference of interest from the spot price. That’s where the 0.82 in Dec 25 comes from.

USD doesn‘t make fun at the moment.

Especially these days ![]()

Unfortunately doesn‘t seem that USD is getting stronger.

Probably not for quite a few months

USDCHF is currently above purchase parity and has been overvalued for a long time, its fair price is below 0.80. In the short term it could fluctuate and get stronger temporarily, but the trend is expected to further sink in the coming years, at least for as long as USD inflation is above CHF inflation.

What‘s going on today?

continued expectations of early fed cuts and low volume.

If I understand correctly from thid forum, hedging USD to mitigate the risk of USD decline is not really worth it. How do the more experienced users here handle this?

I think only going with Swiss stocks would be too risky. From my perspective, one just has to live with the USD decline.

I start to ask myself this question. I see VT (USD) increasing its value but the CHF worth at a lower speed obviously. This makes me think if investing only in USD is the right thing to do. I know that VT is based on 65% USD, but nevertheless its value is USD.

Assume that today you have 1M USD in VT (or any other USD-based ETF). US inflations is not getting better and it’s likely that it will continue. I started to read the book “Principles for Dealing with the Changing World Order: Why Nations Succeed or Fail” and the following picture made me think a bit about the long-term strategy. Is all the theory based on when US was one of (or the) most powerful nation in terms of economics?

It seems to me that your are mixing two effects:

-

The intrisic value of companies, which is affected by their ability to generate profits. This value can be expressed in a number of currency metrics, USD being one, CHF being another. Reading the value in USD or in CHF doesn’t change this intrisic value, therefor, VT gaining value when measured in USD and loosing value when measured in CHF is irrelevant to the Swiss investor. Only the CHF value matters, since that is how that money can be expected to be spent (by you or your heirs).

-

The prospects of varrying currencies when measured against each other. The USD is an inflationary currency while the CHF has been mostly flat as of late. A weaker currency helps exports but makes importing goods more expensive. On the other hand, inflation tends to be lower and salaries higher in countries with a strong currency.

That doesn’t mean the stock price of companies of a country may not have better or lesser prospects from each other (I consider the US to be overvalued because with their recent outperformance, people have dived into the S&P500 and the NASDAQ more than would probably be warranted by a proper valuation of the companies) but I would consider companies prospects independently from the behavior of the currency in which they are measured.

From December 2008 (near inception) to November 2023, 10 kCHF invested in VT would have turned into 36 kCHF in nominal terms and 34 kCHF in inflation adjusted (real) terms, for a real CAGR of 7.76%.

The lower apparent growth of the value of the fund measured in CHF has been compensated by lower inflation (5% total over the period in Switzerland vs 40% in the USA). The actual real CAGR are pretty close when measured both in USD and in CHF (7.19% in USD vs 7.76% in CHF).

This may not hold true in a world with bigger barriers to trade that may decouple domestic inflation from the international exchange rate of the domestic currency, so worries about the prospects of the US may, or may not, be warranted.

My whole year gains are basically gone due to this insane CHF apreciation compared to USD. Feels terrible.

Im thinking really hard about hedging right now. At least a bigger part of the portfolio.

You’re aware it doesn’t change the end result, right? Hedging costs the delta of the risk free rate between CHF and USD (3.75% currently), and over long period of time it’s going to be the same as not hedging.

(it sounds like you’re trying to time the FX market, which if you’re confident about your play you can make a lot more money than whatever you might gain with a successful hedge)

Yes, thousands of CHF gone by the day…

I now go for 25% of Swiss stocks ETF and 75% of All World stocks in USD.

There is some evidence partially hedging might be worth it. Im trying to find the paper again. You smooth the currency fluctuations and can take advantage due to rebalancing.

Since some time the benefit seems to be worth it as well. CHF USD made almost 20% ! in the last 4 years and the recent run-up was insane.

There has also been a recent paper by Scott Cederburg, that proposed a high home bias (35%) to be superior longterm and in this Rational Remidner Podcast episode https://www.youtube.com/watch?v=y3UK1kc0ako he also said hedging may be worth it, but didnt study it. Big part of a home bias being superior in his findings seems to be currency.

Im aware that it’s a bit sepcial in CH, due to SMI being all multinationals etc. That’s why Im thinking about a higher proportion of swiss stocks + a hedged portion. Something like 10-20% SPMCHA + 10-20% ACWIS maybe. Rest unhedged.

But equity day to day fluctuation typically trumps FX changes by a lot (that’s in the vanguard paper re hedging).

Edit: in any case just make you don’t have recency bias, it’s the worst enemy of the long term investor, you FOMO and decide to change your allocation, but that’s after the overperformance and you instead get the reversion to the mean ![]()

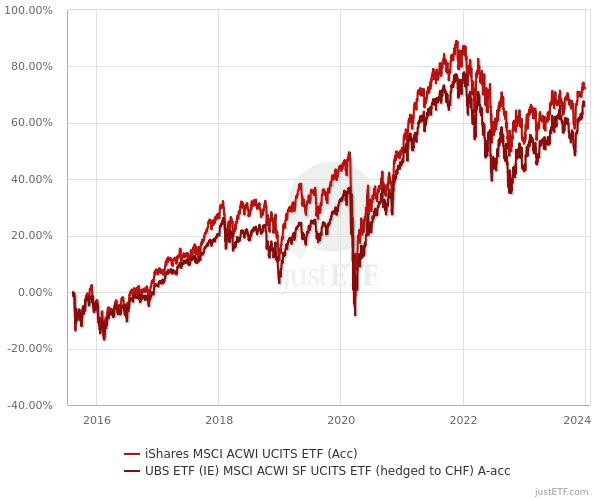

Here’s IE00B6R52259 vs IE00BYM11L64, both ACWI and similar TER, the UBS one is hedged to CHF.

Please help me read this chart: is the unhedged one in CHF as well, so did it perform about 5% better after four years when calculating in CHF?

According to justeft, the return chart for both is in CHF (I’d expect much bigger differences if wrong currencies were compared anyway).