Or third choice - buy swap-based crap. Like this thing for example. Says 0.26% - -0.15% = 0.41% tracking difference last year in your favor as compared to net return index with 30% withholding baked in.

sounds like a terrible deal, 30% withholding baked in? or am I missing something?

No, 30% withholding is the standard assumption for ETFs benchmark indexes.

Even if the fund is actually located, say, in IE with only 15%, it just makes it easier for fund managers to beat their benchmark and move product…

ok, the benchmarks might assume 30%, but the question is how good is VT (and VWRL) vs the Lyxor one in the end

Use a calculator. Takes a bit of effort, but all the numbers you need are right there and in ictax.

Hi @male, could you please let me know the meaning of L1WT ?

Thanks.

see https://www.bogleheads.org/wiki/Nonresident_alien_with_no_US_tax_treaty_%26_Irish_ETFs

level 1 withholding tax.

it’s what the ETF has to directly pay in taxes and as such cannot be deducted from your tax (that’s my understanding)

level 2 withholding tax is what the broker withholds from you and what you can typically deduct from taxes and/or reclaim from tax authorities

Thanks a lot! I am starting with this world. I plan to start with DEGIRO and my idea so far that the expenses related to for example buying VWRL was just the TER. Is there any other expense I should be aware of? When does happen? how shall I calculate it?

Personally, I don’t see the value in having multiple accounts with different brokers. Especially since brokers like IB offer benefits for having over 100k in your account. Your money is kept separate from the company’s balance sheet, which means that your stock holdings are not in jeopardy even if IB went bankrupt or seized to exist tomorrow.

The only exception to this would be if some brokers offer better services in some regard. For example, one could offer ETF purchases without a transaction fee while another could have significantly lower costs for investing into individual stocks or some distinct market place.

PRIIP is in effect in Finland and you do not have to sell your US ETF’s. It just means that you can’t buy more.

Well, you know… 100k is not an amount that would warrant an early retirement. We’re talking about 500k or 1m. But even 200k might be worth splitting between 2 brokers.

If they do everything right, then your assets are safe. But during the bankruptcy proceedings they could be locked in for months (years maybe?). I’m not an expert here, just repeating what someone else said ![]()

And what if they do something wrong? Software glitch: poof, your position is gone, we don’t know why, corrupt database or something. Fraud: someone breaks into your account and makes transactions that put you at a loss.

ceased ![]()

During bankruptcy proceedings they could indeed be locked in for a while, but I consider that to be such a low possibility that it doesn’t warrant extra precautions from me. However, if you want to cover all your bases and sleep better knowing that all your holding are not in the same place, by all means go for it.

I’m by no means an expert on how brokers store data, but I know that they are kept in multiple locations/companies and with back-up. At least in Finland, your broker is not the only entity that knows your holdings. I’d imagine it’s the same in Switzerland and the rest of Europe aswell.

Fraud or hacking is also one possibility, but I believe there are safety measures in place for that aswell. I haven’t looked into the specifics, but I would find it pretty amazing if your broker would leave you hanging and carrying all the risk for that.

So if you worry about these possibilities, then by all means spread your eggs into multiple baskets.

Whoopsie daisy ![]()

Well, you know, better safe than sorry. Normally I wouldn’t bother with such precautions, but we’re talking about whole life’s savings, potentially. I’m not saying it’s a must to have multiple brokers, I’m just want to make sure it’s really safe before I decide to keep it all in one place.

Well, the broker itself could become a victim of some cyber attack. I really do hope that they keep backups and their live data in multiple locations. But what good is a backup when what counts is your current balance? Yes sir, you had 10’000 shares of VT yesterday, but you’ve sold them this morning and put them into Venezuelan Bolivar FX with 500:1 leverage.

It’s nice that some brokers offer fraud insurance, for example Schwab:

We want you to have the highest level of confidence when you do business with Schwab. So we offer you this simple guarantee: Schwab will cover 100% of any losses in any of your Schwab accounts due to unauthorized activity.

https://www.schwab.com/public/schwab/nn/legal_compliance/schwabsafe/security_guarantee.html

Sadly, I don’t think IB is offering such a guarantee.

That’s a fair point. To be honest, I might very well reconsider my position once I get to sums that size. Part of the reason I’m not too concerned about the aforementioned risks at the moment is because my portfolio is only a fraction of what I would have to be for retirement.

If that’s truly the case then I can definitely see the value in having multiple brokers and accounts. Especially if they wouldn’t even cover blatantly obvious cases such as the one you described.

Mmmmh, thats a nice example. I always asked me if Lyxor was doing some arbitrage of dividend by making swap between founds invested by private investors and founds invested by pension founds.

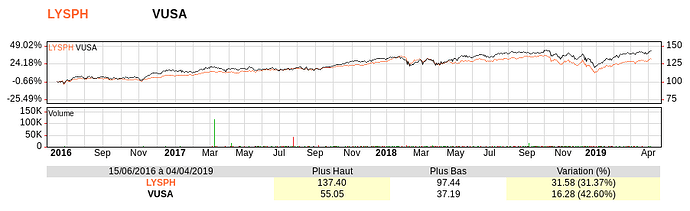

When I compare Lyxor with Vanguard, both based within the EU, both distributing the dividend and both at the SIX in CHF I arrive to the conclusion that LYSPH is a poor performer respective to VUSA.

Hedgedog was right qupting it “swap based crap”.

Hi there,

Have there been any changes relating to this topic since the last updates? I’ve only just found this and started reading about it…seems strange that there seems to be so little concrete info about something that has a huge impact on EU/CH based investors…many of whom are using “simple” portfolios containing V/VTI/VOO or similar.

Is it still the case that even when using IB, come January 2020, we will need to seek alternatives to VT for example (VWRL?)?

Just from my example…with DEGIRO I can confirm that the US based Vanguard funds no longer show up in the system, although I still have my open positions there.

Thanks in advance.

Dear community,

Hello to everybody.

I live in CH and got inspired by your experience and wanted to invest in US market. After check big US broker companies (Schwab, IB, TD Ameritrade etc.) it appear that it is not possible anymore to buy US ETF’s for non US citizens. I’m interested in VTI.

Are there any other good alternatives where I can open an account and build my low fee portfolio?

Thanks in advance for suggestions and tips.

Best regards,

Peter.

You are wrong, we can still buy US ETFs via IB.

For new account - no.

Can you show us proof? I did not find anything about it for swiss investors. IB does have a FAQ for EU investorst though. I’d believe they would write it for swiss as well if it was indeed true.

https://www.interactivebrokers.co.uk/en/search/search.php?q=us%2Betf