Then again, you don’t necessarily need to get that money in 1 day.

Maybe a few weeks or a month will also be convenient depending on situation/urgency

A low volume does not necessarily mean that it is impossible to trade large chunks, especially in the case of ETFs. There are usually market makers waiting to buy/sell under-/overpriced shares of an ETF. Maybe you would lose a bit of money (0.5 %?). But it would certainly possible.

I need to learn/understand a few things regarding the trade book and Spread,

Will watch some videos this evening

Until then, can you please tell me, roughly what is the liquidity for:

VUSA EUR @ Amsterdam

VUSA CHF @ SIX

Thank you,

Then look into trading algorithms. IB Pro has order types that support you with trickling a large junk of securities into a market while trying to preserve a good price (Order Types and Algos | Interactive Brokers LLC).

Buying on most liquid instrument on most liquid market is good thinking on your part. You might have to do the trickling manually and pay separately for each trade. Unless you go to the pros (i.e. established brokers) and pay them a fee to do it for you

IIRC in one of the Fundsmith ASMs Terry Smith says that they consider their positions to be liquid / no real lump sum risk if their position is up to 10% of the average daily volume. So I’d not really think about moving up to 700 shares per day, even if market makers don’t do too much.

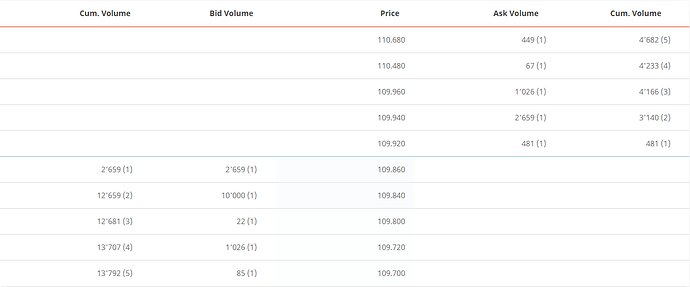

One thing I don’t get. If you would like to sell 50’000 shares, then we can see that the current orderbook does not show you how deep down with the price you’d have to go if you went with whatever the market is offering (cumulative offer of 13’792 shares).

So instead you could place a limit order, for example at CHF 109.86. Then you would await the market maker, who could step in, or not. In the meantime, let’s say the real NAV goes up by 1%, at which point your order gets filled. You just suffered a 1% loss, because you could have sold 1% higher. Or am I missing something?

It is not really different from any other exchange traded entity.

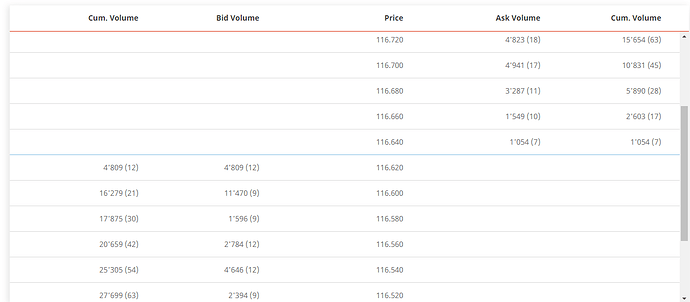

Nestlé also does not have infinite liquidity, but obviously a very small spread:

But you are obviously at the mercy of the market makers. If they suddenly step away or lower their prices because they think everyone is cashing out and going long boats then you may not get the price you expect.

If you do not want to run the risk of having an open bid then you can buy the shares that are being offered and await more shares being offered before placing another bid. But who is to say that the real NAV does not drop 1% while you play this game.

If you know you have a high risk of impacting the price with a large sell block (which, realistically, is a possibility with the scenario), you can try the Arrival Price Algo.

This order type will attempt to get the mid-point of bid-ask spread at the time of the order for the full sell order (however, its execution speed is very much not guaranteed).

If you were trading a US product, you could have tried to use a Fill or Kill order, in which case, in the theorical situation, either the market maker’s apetite is enough to buy your full order, or the order is immediately rejected.

These sophisticated order types exist in IB, but what about SQ?

Welp, that’s quite disappointing how limited their order types are, they don’t appear to have FOK orders (And Arrival Price algo are indeed a IB specific order).

I see Limit, Market, Stop, Stop Limit, Trailing Stop, Trailing Stop Limit, OCO at SQ.

Let me know on which lake that boat will be, I wouldn’t mind sharing the operating expenses ![]()

On ETF on liquid underlyings there is no problem to trade large volume. Don’t look at daily volume, it is meaningless. You’re not going to trade against someone else buying but with market maker.

Just put a large limit order at current bid and market makers will be happy to take the spread.

ETF volume is meaningless. You need to look at basket volume and it’s going to be big on your etf.

Only problem might be if you have etf on Iranian small cap and you’re trading it on a day when there’s bank holiday in Iran etc.

You find a lot of information about VUSA on the website of the swiss stock exchange.

Liquidity and spread is not always the key issue. One important issue is the currency used for the trading of the ETF. If you have to change currency trading it could end more expensive than the trading itself with some brokers.

FWIW, that stuff is usually way more complicated, at least in the US (but maybe the swiss market is simpler ![]() )

)

Sometimes, it’s possible to have non-lit orders (e.g. not visible in the book), or your broker might send your order elsewhere for price improvement (with usually some payment for order flow).

So you could be filled immediately with a mid-price limit order.

They are not exactly less liquid. The liquidity is there, provided by market makers. It is just not many actual trades happening. At the moment shown on the screenshot, you can buy ca. 1.5 million CHF worth of this ETF. And if you take some liquidity, market makers will almost instantly add more!

Got a very naive question related to this subject, for which I never found a good answer. I have wondered for years but never dared ask ![]()

Exhibit A: VWRL (and the like) holds a basket of world stocks trading in their respective stock markets at various time of our CET days. I always look at it between 15:30-16:00 as the NYSE starts trading at 15:30 CET. If the S&P500 opens with a big move, that move is reflected in VWRL. We’ve seen big price movements happening in our afternoons. What puzzles me is that if the S&P500 closes with a 1% gain, for instance, VWRL doesn’t OPEN reflecting the relative gain it should, given about 60% of VWRL is the S&P500. Can this be explained with eg loses in the remaining 40% overnight (which is basically Japan, given the European and NA markets are closed after 23:00 CET)?

Exhibit B: S&P500-tracking UCITS ETFs trade in European times in the European markets. Given they all track a specific set of US stocks, are the price movements OF THE ETFs reflecting pre-market info being priced in the S&P500 stocks before the NYSE opens?

Not intending to do anything with this info, just curiosity and need to understand better.

Also, again naive question regarding time of trading: if I buy a US stock, say BRK.B which I am buying, the order goes from my account to the SIX (?) and then sent and executed in NYSE…or on the SIX? Or via a market maker (in London? Frankfurt? Milan? Paris? Zurich?) to secure the price I am willing to pay?

Edit: I do my buying around midday CET as it’s usually quieter in terms of volatility. Don’t pay much attention to spreads because what I’m buying is liquid enough that spreads are in the range of 1-2 rappen.

Well, an ETF is traded in different currencies and at different exchanges. This you know. Now let’s look closer to what is happening.

During the trading hours, the ETF provider (?) calculates the value of the basket of holdings in real time. This is known as indicative net assets value, iNAV. Because different tickers of the same fund are denominated in different currencies, the fund provider has to calculate iNAV in various currencies during various time intervals.

Market makers pick up iNAV data stream for respective tickers and place their orders to order books to ensure liquidity.

It used to be possible to add iNAV of VWRL, VEVE and (emerging markets counterpart) denominated in EUR to a chart in TradingView. In this way, you have actual “theoretical” values of these funds calculated “continuously”, not just individual data points for executed trades. The ticker was IVWRL and similar, but I can’t find it in TradingView anymore.

Now, UCITS ETFs, which we usually call “European ETFs”, are traded not only on European exchanges. I personally saw some listed in Israel, Mexico and Chili, and they are also supposed to be listed in many other countries, like African countries. For all these exchanges, the ETF provider must calculate continuous data stream of iNAV for the market makers.

All this long description is little relevant for long term investors that many here claim to be ![]() . You can say that it describes “exchange-traded” part of the ETF concept. It is there to provide liquidity and it is important, and it is good to understand how it works, but that’s it. iNAV calculations stop when the respective exchange is closing.

. You can say that it describes “exchange-traded” part of the ETF concept. It is there to provide liquidity and it is important, and it is good to understand how it works, but that’s it. iNAV calculations stop when the respective exchange is closing.

Furthermore, what you see as a “closing price” of a ticker is the price of the last executed trade, not even the last iNAV. Now you can imagine, if the last trade was executed hours before the close of the trading, there could be little relationship.

As a side note, this is a reason why I stopped following tickers on European exchanges. US American exchanges are not only the ones with the highest liquidity and the globally dominating markets, they are also, purely geographically, the last to close for a given calendar date. So, the close of US exchanges corresponds to the global end of trading for the date.

Once all trading is finished, it is “F” in “ETF”, which stands for a four-letter word “fund”, becomes relevant. This procedure is the same for ETFs and mutual funds. Based on the final prices of all holdings in the basket, the fund provider calculates NAV for the date. It is always calculated in fund’s base currency and it’s the most official value you get. You can usually find it on provider’s web site and some data aggregators, but not in tickers’ data.

So, movements after the close of European exchange will be reflected in the NAV of an ETF, but not in “closing price” of its tickers. NAV is what you should look at. I am always taking NAV to calculate the value of my porfolio.

Thanks, many thanks!

I’d thought along these lines about what’s happening but not with accurate terminology and wouldn’t be able to put it to words like you did.

After spending a couple of years looking at tickers on my phone 10 times per day (ok, more like 30) I’ve brought it down to a few times per day (ie 10+) and actual account value in CHF a few times per month. Next step, delete tickers from the phone.

And agree, this info has no practical value to long-term passive investing, but I always like to know how things work, especially when I’ve put my financial future on it ![]()

There are many predators willing to take their cut of the fee you pay for trading, in one way (broker’s commission) or another (execution fee that goes to the exchange, spread that goes to the market maker). For most traded stocks, we can’t say a priori whom you pay. You have to look at your specific details.

I just read recently how brokers and market makers profit overproportionally from retail trading in comparison to institutional one. The extreme case is Paying For Order Flow, which seems to getting banned in EU. So, if you are not careful, your order might end up with these predators, such as L&S exchange in Germany which is run by one market maker.

I am strongly convinced that the best time to execute trades is 16.00 CET ![]() . All European exchanges, London and New York are open. If you buy US stocks at IB, do it when US stocks market is open. For other brokers, I am not sure how they handle these orders, but surely to their advantage.

. All European exchanges, London and New York are open. If you buy US stocks at IB, do it when US stocks market is open. For other brokers, I am not sure how they handle these orders, but surely to their advantage.

Going back to your question about the difference in opening price between different days for European tickers of ETFs. US top stocks are essentially traded 24/5. After hours movements of top 5-10 US stocks alone would be enough to make a difference for the iNAV to be significantly different from the previous close, or NAV, or anything.