There are different numbers and they are changing. Yesterday the overnight margin was like 2.1k USD I think, today it could be lower because the volatility went down.

I don’t understand. I use cash as a collateral and a cushion in case of the value decrease. Other cash is in other places. I can add more from my ongoing savings, in worst case it will be a margin loan.

Stocks: 150+ k in US ETFs at IB, 60+k in stocks index funds at finpension + some other funds. I am investing almost everything that is left at the end of the month. One MES is less than 10% on top of amount invested in stock funds.

My wife is accumulating cash, so I don’t know exactly how much is there. With our 2nd pillars we are below 50% in stocks.

Yes, and by extension on the whole portfolio.

Probably.

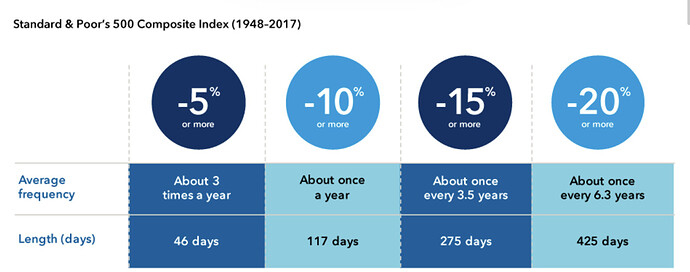

No. Leveraged ETFs use derivatives to keep a constant leverage rate. So if index goes up, they buy with gains more futures, for example, and if index goes down, they have to sell futures to decrease the leverage. At least that is my understanding, and I don’t know another way to keep leverage constant. So kind of counterproductive, and no surprise that in the long term you lose.

Future has a fixed lot size, like 5x SPX. If index goes up, you receive cash, if it goes down, you are losing cash, but the market value remains fixed. If market moves against you, you can add more cash to compensate losses, but you are not losing “overproportionally”.

Let’s say SPX is at 4000, it first moves up 500 points, then down 500 points.

With a 5x future you are almost at 0 difference, first getting 2500, then losing 2500 (there are implicit financing costs and accounting for dividends, but let’s ignore it for now).

With a 3x leveraged ETF and a starting value 20000 you first win 3*(500/4000)20000 = 7500. Now the value of your stake is 27500 and the leverage went down. The fund is buying more futures to be 3x leveraged again. Then you lose 3(500/4500)*27500= 9166. You have lost 1666.