My mistake. I was thinking of income tax, not wealth tax. Question is if income tax remains more important compared to wealth tax even with income taxes only based on capital earnings. As usual it depends on the canton…

Did you find an accurate calculator or table to simulate the AHV pension you can benefit by retiring at 58 y.o. ?

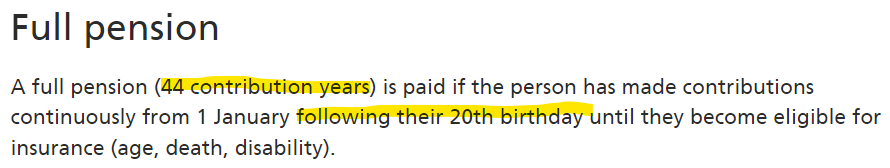

Will you have your 44 years contributed ?

Is this one not good?

Thank you both. I understand better how AHV works.

It assume, you started to contribute from 20 y.o. until you’ve reached 65 y.o.

I thought that because I joined Switzerland at 27 y.o., I had to contribute until 72 y.o. to get full pension.

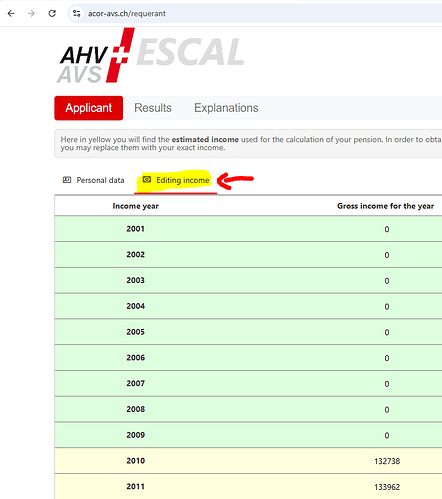

It is also the first time, I noticed you could customize your annual income on the tab Editing income of the calculator !

Yes, you have this fixed window of time to contribute. But I think the recent legislative changes (or proposals) now allow you to continue to contribute after the age of 65 if you are still working, so maybe there’s a chance to top up your pension if you are running low, but maybe not so much interest to those pursuing FIRE.

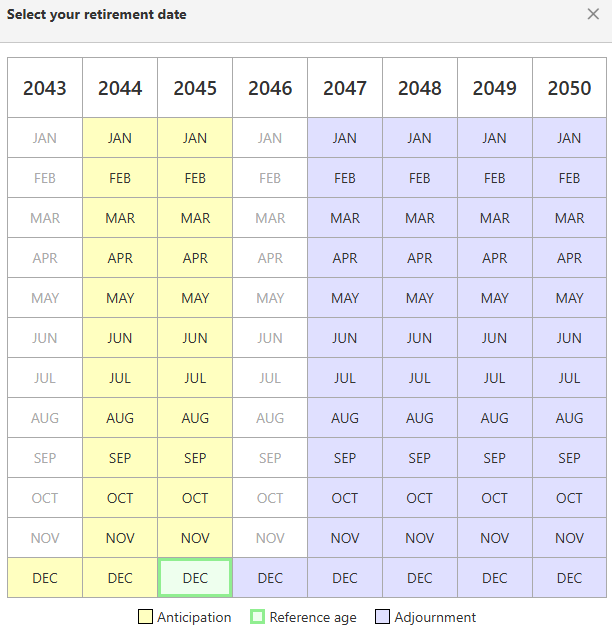

Yes you can decide to anticipate it 2 years earlier or defer it for 4 years.

It gives you a bit of flexibility to arbitrate your retirement age if you depleted some part of your asset or if your Net Worth inflated after a rally

People don’t get full AHV pensions, as they either don’t have the 44 years or their average salary for the entire career is below the threshold of CHF 85,320 per year (2020 figure).

I checked here and entered all salaries from many years back and for my 35 years of contributions, I might get CHF 2283 per month at the age of 65, starting in the month following my birthday. Given that I spent some years abroad, I will not ever obtain the maximum of CHF 2450.-

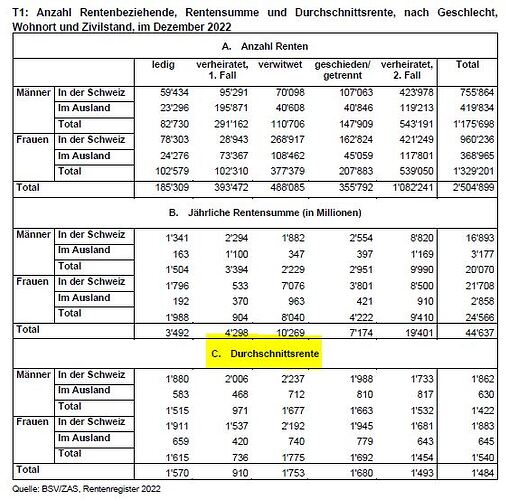

The following information is usually not communicated by AHV and can be found from Bundesamt für Sozialversicherungen. Divorced males like me get on average 1988.-

for details, see here

It also highly depends on how many years one is away from receiving state pension when running this calculation. The maximum in 10 years time might be around CHF 2700 if the values from previous decades are used for extrapolation. So even with 44 years of contribution it will be more difficult to receive the maximum state pension, as the required average salary increases.

Where is this tab, on which site?

I’ve added the calculator and the screen shot on where to edit your earnings.