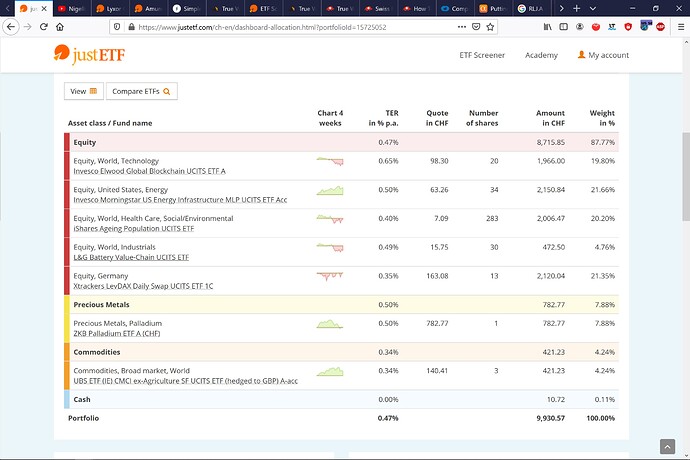

Hi, I found Just ETF and am playing around there a bit. It’s possible to create a fake ETF portfolio, so I went ahead to learn a bit more. How would you change this?

Thanks. As a basis for conversation, let’s say I want to have 10% return per year. I am not planning any withdrawals for the coming 5 years.

Nobody can promise that, at least not without massive loss potential.

Don’t forget that the past 10y have already had over average returns.

^This. 5 years is not long term. If you may have to withdraw more than 30% of the invested money in that period, you have to either:

- Dial down the risk with cash/bonds/eventually gold;

- Be able and in a position to decide that no, you won’t have that money at that time and whatever would have required it is delayed until the market recovers (could be 10-20 years).

If your potential needs are lower than 30%, then you have to be ready to accept that if you withdraw it, at that time, that could be your whole capital.

Regarding your choice of ETFs, not saying it is a bad idea but trying to understand the whys:

- Why the blockchain tilt?

- Why the energy infrastructure tilt?

- Why the ageing population tilt?

- Why the Germany tilt? (edit: why leveraged?)

- Why Palladium and not Gold?

- What do you expect from your commodities?

As a basis for conversation, I’d assume that you

- have conducted solid due diligence on your choice of ETFs

- through your analysis came to the conclusion that these investments will significantly outperform the overall equity market

- and therefore could reasonably explain Wolverine’s questions (to him/us/yourself/your husband’s girlfriend)

…and why is the commodity ETF hedged to GBP?

My husband’s girlfriend? I certainly don’t think I need to explain anything to her, but maybe his wife’s boyfriend…

I did the due diligence I could, as said - I’m learning. The commodity is hedged in GBP because it was the only option.

But as said, I’m happy for practical suggestions.

- Blockchain - because I work in cybersecurity and see the positive developments

- Energy - because we will always need it especially the coming 24 months when things are starting again

- Ageing population - because we are, and it’s a growing segment

- Germany and Palladium - I don’t remember

- Commodities - it’s always needed, so I thought it would be a stabilizing factor.

I am not planning to withdraw from this. On the contrary, I’m setting it up so that I’ll be using my current savings, transferring a sum every month (dollar for dollar?) That way I’ll be able to build a smaller emergency fund than my current while making my savings work for me.

But if you have other ideas, that will bring better yield or compound interest - I’m interested to know.

So why not a very simple portfolio: 100% VT (or equivalent)

VT? What is that? Value trading?

IE00BZ2GV965

For a 20%+ portfolio position in a leveraged (!) product, you better should!

But as said - this isn’t real money. So, it’s the perfect situation to learn. But what do you propose instead? Or that I simply should reallocate to fewer choices?

levDAX (at least that other levDAX ETF that has been around around longer) has returned a relatively 40% since 2007 - way less than the underlying “real” DAX.

This one’s really one to time the market (i.e. if you’re seeing a steady upward climb). levDAX seems (well, historically) like a good idea if you bought it at prices well below all-time highs of the DAX - that’s what we’re not having today.

The other positions are “if you believe in that, why not?” that I could understand to be held long-term.

But the levDAX fund has disproportionally large downward risk (and volatility risk).

But the levDAX fund has disproportionally large downward risk (and volatility risk).

VT ETF (total world stock market). That’s likely the baseline for any investment, if you want to deviate better have some justification.

If I had to remix it…

| ISIN | Name | % |

|---|---|---|

| IE00BGBN6P67 | Invesco Elwood Global Blockchain UCITS ETF | 20% |

| IE00BYZK4669 | iShares Ageing Population UCITS ETF | 20% |

| IE00BKLF1R75 | WisdomTree Battery Solutions UCITS ETF | 10% |

| DE0005933931 | iShares Core DAX UCITS ETF (DE) | 20% |

| IE00BF0BCP69 | L&G All Commodities | 10% |

| IE00BM67HN09 | Xtrackers MSCI World Consumer Staples UCITS ETF | 20% |

- Consolidating ~12% commodities into one fund position. Since you can’t remember the reason for picking Palladium, why not go with a broader Commodities ETF? Also, a 4% position will hardly make any difference, let alone stabilise the portfolio. Also, is there a good reason to leave out agriculture?

- Battery-value chain? Thanks, we’re having enough German car manufacturers in the DAX. And Tesla is ridiculously overpriced. I’d rather play a more battery-focused fund instead.

- Changing the DAX to a non-leveraged fund. The German domicile will hopefully be tax-efficient.

- Energy infrastructure? Just one country (the U.S.)? No thanks. Probably full of pipeline operators etc., so basically exposed to the oil price. Which I increased the coverage in the commodities ETF anyway. I’d rather…

- Going with the theme of “we’ll always need it” and the idea of “stabilising” the portfolio, I’d rather choose something else that’s somewhat steadily making money. Since we’ve already covered Healthcare (by way of the Ageing Population ETF), I’d rather diversify into a yet untapped sector: consumer staples.

I can make many shortcuts for you and advice you to buy this:

It is an optimum between maximum diversity/largest piece of the global stock market for a lowest price.

There is also an accumulating version, but it is not traded in Switzerland, only in European exchanges.

You could change global economy to stock market capitalisation ![]()

Hello all

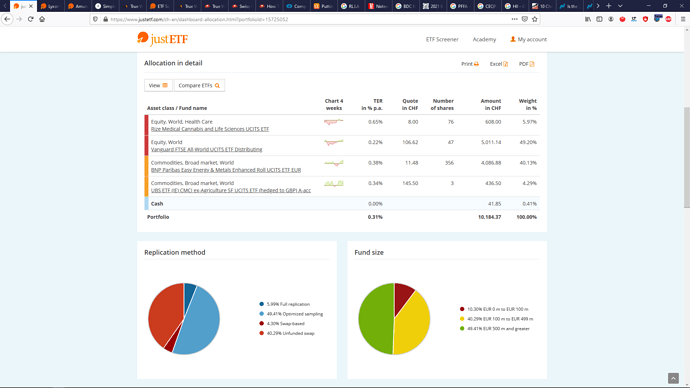

I’ve taken your advice and rebalanced the portfolio. Fewer choices, so maybe higher risk but better yield.

What does the consolidated expertise say about this:

Again, I’m learning - so am happy to take advice. I’m willing to take a reasonable risk, realizing that the gains might not be as high but neither will my losses.

What would you do instead?

That is a difficult question to answer, understandable, but difficult. How would you evaluate? Given that it’s a bit like asking ‘how long is a piece of string’…

I can self-manage. CHF seems simpler seeing that I’m in CH.

As @TeaCup commented, you are suggesting putting almost 50% of your portfolio into commodities (crude oil, petroleum products, and metals). This is silly.

Although this exposure is obtained using a fund who themselves use financial derivatives you still pay an implicit roll yield in holding these positions (think theoretical storage, insurance, financing cost). In the long term this will cause significant value decay to your positions.

The BNP Paribus fund also seems to skim some nice fees off the top for their “work”.

Don’t bother investing in commodities. Consensus is that futures do not pay a long term “risk premium” like equities (although funnily enough some academics believed that they did pre-2008 during the last commodity supercycle).

FYI I work at a prop commodity derivatives fund and in my personal account hold almost entirely 100% VT (Vanguard passive global equities).