9 months is way too short to transfer your fund into equity. Move it to something very conservative with no or only super safe (aka government) CHF bond like return in order to avoid any drawdown.

Some practical background:

I have a … ahem, “friend” who quit his job and then moved his pillar 2 into two different Freizügigkeitsstiftungen, VIAC* and Finpension. That friend then (after a short break) took on a new job and moved the funds from VIAC to his new employer’s pillar 2. He forgot about his Finpension account.

Worked out just fine.

Additional comments:

Nobody asked him any questions.

The tax authorities don’t know about these funds and I am not sure they cared if they knew.

The people running the Freizügigkeitsstiftungen aren’t interested in whether you have a new employer or not. If anything, they are probably interested in you staying with them (moar fees!).

The new employer most of the time does not care. There’s no incentive to care.**

The pension fund at my new employer was happy (as I heard through the grapevine) to only receive one of the Freizügigkeitsfunds as pillar 2 money since at the time it was still challenging to actually invest it guaranteeing a (small but still) positive government mandated return with no drawdown ever and eventually, should the pensioner choose that option, to pay an again government set return on the mandatory portion of “your” accumulated capital (negative interest rates, does anyone remember? ![]() ).

).

To be clear, the government is interested in you moving all your pillar 2 money to a safe place (like a pension fund) to avoid you making stupid mistakes (and them paying for your mistake by having to subsudize you) when you allocate your “forgotten” money at the Freizügigkeitsstiftung 100% into the “fully risk tolerant” profile with two years to go until your retirement. Or - even worse! - nine months to go until your retirement … ![]()

However, there’s nobody at the government knowing about or enforcing things.

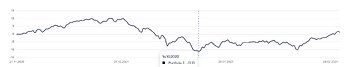

This friend’s forgotten Freizügigkeitsfunds at Finpension are only just now - a little over three years later - back with a tiny positive return.*** I’m pretty sure they’ll do just fine over the next decade or so that I, er, … I mean, that he plans to have that money invested, but anything below even just five years would be gambling, IMO.

YMMV, of course.

* See also my recent post on a different thread why you might want to avoid VIAC: Introduction + Anything Missing for RE? - Share your story - Mustachian Post Community

** In my corner case, my employer cares a little bit (moar fees!), as we’re an asset manager and some of the company’s pension fund gets invested in our own products. A little weird, I know, but the folks running our pension fund are mostly independent of us.

I say “mostly” because of course our company can choose a different company to run our pension fund, should they, you know, stupidly decide to not also use our products to run our pension fund. Which would be less fees for them. And in turn for us.

(Did I already mention that people in the asset management business are motivated by fees?)

***