Sounds good

For time being no other financial jugglery needed then ![]()

Yep, as it‘s not marginal tax rate they use for the calculation (which in my eyes is completely unfair and should maybe even be challenged in court… as youe received dividends are taxed at marginal rate, to me there is an unfair difference here), it‘s your average tax rate. So if your average tax rate is below 15%, you‘ll not get the full refund.

So even if you don‘t deduct wealth or loans or anything, you‘ll never get the full da-1 in ZH, as long as your average tax rate is below 15%.

I made a spreadsheet for da-1 calculations and it suddenly was super obvious to me ![]()

There is no tax rate difference between e.g. employment income and dividend income. You can’t say employment income is taxed first and then dividend income is taxed at the marginal rate, or vice versa. The marginal tax rate is relevant for comparisons and deductions, but I think it makes sense that the average tax rate is used for DA-1, unfortunately.

It should work like a tax deduction then. There you also get effectively the marginal rate back.

I think it actually does work somewhat similar to a deduction of taxable income but without affecting the tax rate (“satzbestimmendes Einkommen” stays the same). Which is consistent with how e.g. income from foreign real estate is taxed.

Except that the refund is capped at the absolute US WHT amount, as it’s only an elimination of double taxation (in contrast to foreign real estate where the other country typically has an exclusive right to tax it).

I think marginal tax rate is a fictional number which is just for understanding the value of last increment of income or value of the deduction.

Average tax is what Tax office gets and that’s what matters. Its the rate which is applied to final taxable income

In fact in tax returns it’s clearly mentioned.

Got it, it’s really abstracted to this.

This I still don’t get. Please bear with me another round ![]()

For L1 tax leakage, wouldn’t it even be the other way around? The ones with L1 WHT go to taxable, as they would have minimally lower dividends, all else being equal?

Unless pension funds or 3a can reclaim those? For example CH-US tax treaty exempts them from WHT, but I understood that corresponds to L2 level (which you could typically reclaim yourself, as well), but not extended to L1.

Can 3a funds limit avoid or reclaim L1 WHT on an EM or APAC fund that a regular ETF in taxable couldn’t? Would be interested to read more about that.

Or am I missing some other fundamental point?

I know it’s counterintuitive. So let’s try Canadian (tax credit) vs European (no tax credit) stocks:

| Stocks | Account | Fund Domicile | L1 | L2 | L3 | After Tax |

|---|---|---|---|---|---|---|

| Canadian | IBKR | CA | 0% | 15% | r-15% | (1-r) |

| European | IBKR | IE | 15% | 0% | r | (1-15%)*(1-r) |

| Canadian | 3a | IE | 15% | 0% | 0% | (1-15%) |

| European | 3a | IE | 15% | 0% | 0% | (1-15%) |

Simplifying assumptions:

- Tax rate r > 15%

- European stocks have 15% WHT

- Both regions have the same base return

- Using IE ETFs for 3a. You can use CH funds, which have the same result but you temporarily pay and then fully get back 35% Swiss WHT.

Let’s say you split assets equally between 3a and IBKR. You also want equal amounts of Canadian and European. Where do you put European and where do you put Canadian if you want to minimize taxes?

But this assumes CA in 3a is IE-domiciled and has a L1 of 15%.

I’d assume the fund (CH ISIN) can reclaim it just as I do, basically acting like L2 on my behalf. then, CA in 3a would become 1 instead of 1-r.

This goes back to the question from the very beginning of the thread. @San_Francisco quoted UBS which confirms this for US, but is not clear on other major markets.

The next question is, whether the 3a or pension fund could get back some or all of the 15% from the European fund, as well.

So does the fund act like an individual that could reclaim WHT in DE, FR, etc.? Or are those UBS, Swisscanto etc. fund rather comparable like the IE-based ETF that can’t?

Give me one 3a CA fund that has no L1. (Or L2, if it is CA domiciled)

That is the problem with calling it “reclaim”. You reclaim taxes from the foreign government down to treaty rate. There is no reclaim after you got down to treaty rate. The Swiss government gives you a tax credit for foreign treaty rate taxes paid. You don’t pay any Swiss taxes? You don’t get any credit.

Can you tell me, which Swiss taxes do you pay in 3a?

We have a special tax treaty with the US (and Japan), that makes our pension funds exempt from their WHT. The treaty rate is 0%. Pension funds can reclaim from the IRS any tax paid down to this treaty rate of 0%.

european stocks have pretty low L1 with IE domicile iIrc. It’s below 10%.

at least the euro countries, so an EMU etf for example. Switzerland is pretty trash with 35%.

See simplifying assumptions

As far as I know following markets don’t tax dividends for Swiss pension funds. These cover 70% of MsCI world.

- United States

- Japan

Some info at link here

For emerging markets , I don’t think there is any real difference between pension fund or a normal fund. Just treaty rates apply.

Couldn’t find more details for European Union. But I would be very surprised if EU countries tax pension funds from each other

OK so for the slow and stupid like me, do I understand that right:

- Let’s say I have shares of VT that paid out CHF 1’000 in dividends in 2023, of which Uncle Sam kept 15%, so I actually recieved CHF 850. In my tax returns however, the full 1’000 are declared and added to my income, which then amounts to, let’s say 100k net.

- My tax rate for this 100k net for 2023 for, let’s use ZH, is: 6.296%

- I take the basis of taxation of my municipality (without church taxes), example Zurich: 218%

- I multiply those: 6.296% × 218% = 13.72528%

- Then I take my federal tax rate (again, net income of 100k): 2.802%

- I add those together: 13.72528% + 2.802% = 16.52728%

I then fill out DA-1, which is basically me saying: hey I paid Swiss taxes on these 1’000.– dividends, but the US has already taxed that, give me back the part that was double-taxed.

- In the above case, US and CH both taxed 15%, and additionally, the Swiss taxed 1.52728% on top of that. I get back what both had taxed: 15% (which is the full 15% withholding tax)

- If the tax rate calculations from above would have resulted in, say, 10%, US and CH both would have taxed 10%, and additionally, the US taxed 5% on top of that. I get back what both would have taxed: 10%.

Is that correct? And in which equation above would I now have to include deductions for wealth management (e.g. 0.3% in ZH)?

“Reclaim” might be the wrong word and I couldn’t find the info in the funds I looked at. I did read about US and JP. But what about CA?

Haven’t checked others yet. I assume that’s in the OECD templates, so should be found in other treaties, as well.

As far as I know only US and JP benefit from special “pension fund” funds in 3a at the moment. There might be such tax treaties with other countries, but that doesn’t mean there is a fund that you can buy. I hold it likely that providers like Finpension and VIAC would offer them if they existed (in an efficient passive form).

There are actually three variables that play role

- the tax paid in US vs CH

- the relationship with mortgage. Not sure if that is indirectly included in the tax topic.

- Third party management fees.

You are right on the tax part.

The equation about 0.3% is another equation and we would need to refer to @jay ![]()

However I think it’s somehow linked to the fact that you cannot claim benefit twice. For example if you are reducing 0.3% from your taxable wealth (DA1 relevant assets) , then you can’t claim tax benefit due to DTAA for the same number.

Here is the treaty amendment with Canada

Article IV

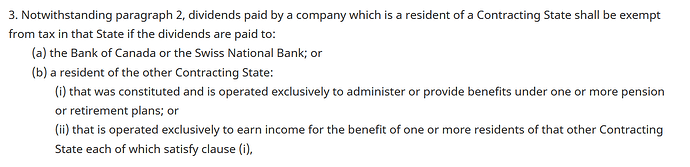

The following new paragraph 3 shall be added to Article 10 of the Convention:

“3. Notwithstanding paragraph 2, dividends paid by a company which is a resident of a Contracting State shall be exempt from tax in that State if the dividends are paid to:

- the Bank of Canada or the Swiss National Bank; or

- a resident of the other Contracting State:

- that was constituted and is operated exclusively to administer or provide benefits under one or more pension or retirement plans

To close the loop for now, I guess it comes down to whether the fund class offered in 3a or VB qualifies as “pension fund” under these standard DTAs.

If yes, it’s indeed not about reclaiming (as said, poor wording on my behalf), but there wouldn’t be a L1 in the first place.

Will try to find out more, maybe someone else already did?

I think you quoted / linked the draft. It’s been amended in 2010. Here’s the current treaty. This seems a standard wording from the OECD model, so I expect that to be found in many other treaties.

Question remains for another day to what extend it’s relevant for the question at hand ![]()