No of cos I don’t think they will chase this amount, but i need to declare a cash balance, else that’ll be missing, and they might come “aha u have shares at IB, but why have u not declared the connected cash account? U obviously have something to hide, send us a complete list of everything.”

OK I see, so you just want to avoid further investigation from them, which could be possible. Of course, it’s perfectly possible that you have 0 CHF and only shares.

Btw, I for example did not report my Revolut holdings, like 2000 CHF in total. I really don’t think this should ever be an issue, or? With a wealth tax rate of 0.1%, I “cheated” the state for sth like 2 CHF.

Thes don’t even have the capacities to chase the big fish. I think for the wealth tax they wouldn’t bother for any of the readers of this forum.

Income is another cup of tea.

I just looked at the generated “FX income worksheet” from IB and its such a confusing mess. I was hoping for a better overview for transactions but you don’t even see a total amount. I guess I will just be using the WV to declare my holdings

For cash you only care about the year end value, don’t bother with FX income.

Can you make a deduction for the IB account cost (120 CHF per year) as “Verwaltungskosten für Wertschriften und sonstige Kapitalanlagen”?

Yes, you can do that.

I even do more, I calculate the cost of the TER of my index founds on a spreadsheet and I deduce it as “Verwaltungskosten”. The TER of an index found can be seen as “Verwaltungskosten” but not the TER of an actively managed found.

I have been told by a bank employee that as long as the management cost of your wealth is smaller than 0.3% of your wealth the tax administration will never ask for a proof.

Happy tax declaration.

0.3% smaller than your taxable income, capital or ETFs worth? Or you mean TER is smaller than 0.3%?

RTFM

“Als Pauschale (d. h. ohne Nachweis der tatsächlichen Kosten) können 3‰ des Steuerwerts dieser durch Dritte verwalteten Wertschriften, maximal jedoch CHF 6’000, abgezogen werden.”

0.3% of securities value can be claimed no questions asked

As said by hedgedog 0.3% of your wealth. I ammended my post to make it more clear.

I was not aware of the limit of CHF 6000.

0.3% of the value of your securities, not all wealth. Cash in bank and real estate for example doesn’t count

ISIN

Hi everyone, thanks for all the info.

Can anyone send the link again to the DA-1? I went on another forum page and the link does not work anymore.

Just to clarify (I think we discussed this when we met in December in Zürich): You simply add the DA-1 to the full tax declaration and you only get this money back indirectly through a deduction from the total tax amount (similar to 3a)? There is no direct payment for these specific 15% correct?

One last question: if you have a common account with your partner, does anyone know how to deal with DA-1 (we are not married)?

For Zürich: https://www.steueramt.zh.ch/internet/finanzdirektion/ksta/de/steuererklaerung/formulare-merkblaetter.html

Note that you should send the DA-1 separately, and at least for me I usually just get a refund in my bank account a few weeks later.

Ok many thanks. I actually used the link above and will try to manage using the software.

→ Does the DA-1 have to be sent to the same place as for the tax declaration? I assume with your answer that it is then possible to send the DA-1 without having filled the rest of tax declaration? Are those 2 separate processes then?

->Do dividends on Swiss ETFs need to be declared since WHT it has already been paid upfront or they appear somewhere on tax declaration?

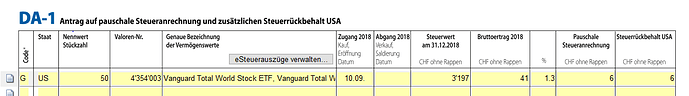

→ Just to make sure that I understand it correctly. Let’s assume I purchased 50 VT on 10/09/2018. This is what I get using ICTax. Is this correct?

→ I assume my partner will simply have to declare half of the shares on her side.

Just hope it is ok for the cases when the number of shares is not strictly a multiple of 2.

-> Does the DA-1 have to be sent to the same place as for the tax declaration? I assume with your answer that it is then possible to send the DA-1 without having filled the rest of tax declaration? Are those 2 separate processes then?

I think it’s possible, personally I use the software and send it once I’m done. IIRC it’s at a different place.

->Do dividends on Swiss ETFs need to be declared since WHT it has already been paid upfront or they appear somewhere on tax declaration?

They shouldn’t be declared on DA-1. If you don’t have tax filing obligation (e.g. tax at source < 120k per year), then I don’t know whether you need to declare them or if the original WHT is sufficient (that said it’s probably better to declare them since the WHT is likely higher than your marginal tax rate)

-> Just to make sure that I understand it correctly. Let’s assume I purchased 50 VT on 10/09/2018. This is what I get using ICTax. Is this correct?

That’s likely correct (didn’t check in details) if you use a swiss broker, otherwise there shouldn’t be the extra USA withholding.

-> I assume my partner will simply have to declare half of the shares on her side.

Just hope it is ok for the cases when the number of shares is not strictly a multiple of 2.

Sorry no idea how joint account work if you’re not filing jointly.

How did you get VT on Zurich’s Tax software? I had to write all by hand and I somehow made a mistake since I can’t write the “steuerruckbehalt USA”

Edit: I’m not sure it should be there tbh, but I don’t understand how the DA-1 should be read. There isn’t an amount clearly marked as something they should return me.

You declare the dividend amounts/dates and if you hold the security at a swiss broker. The sofware calculates the 15/30% then.

That’s likely correct (didn’t check in details) if you use a swiss broker, otherwise there shouldn’t be the extra USA withholding.

not sure i get this right. I filled the W8 BEN form on interactive brokers. Therefore i am claiming only 15% back.

I’m totally confused by the tax documents offered by IB. What form do you you send in with your tax declaration?

UI put the „Activity Statement”. It has the cash, positions, trades and dividends. I don’t think the tax office should need more. But I’ve never gotten any feedback, so not 100% sure yet.