I’ve attached Dec 31 account summaries from TD Ameritrade and Interactive brokers along with us 1042 summary of dividends and withholding tax for the purposes of DA-1 and never had any questions so far. I do a little summary in excel with FX conversion and attach it

We talking about BS right?

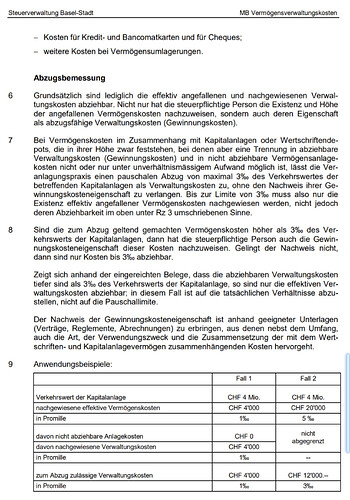

I understand it like this - only proven costs can be deducted, to a max. of 3 Promille.

This is a strict & rare rule, other cantons are more generous, allowing Pauschal 2 or 3 Promille.

“Grundsätzlich sind lediglich die effektiv angefallenen und nachgewiesenen Verwal-

tungskosten abziehbar. Nicht nur hat die steuerpflichtige Person die Existenz und Höhe

der angefallenen Vermögenskosten nachzuweisen, sondern auch deren Eigenschaft

als abzugsfähige Verwaltungskosten”

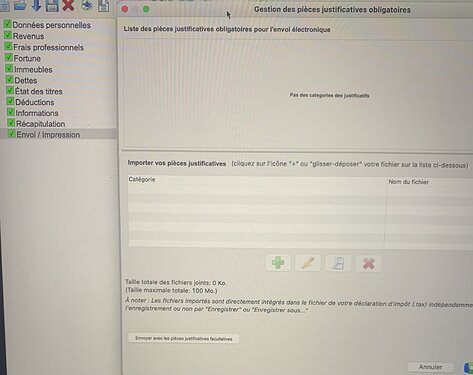

I send already my tax declaration via VaudTax Declaration 2020, but i forgot to attach my 3a deductions and my VWRL report from Degiro(i didn’t send any documents) .Is it a problem? can i send it now?or is better to wait if they will ask for that documents? thank you

I would contact the tax office and discuss with them directly. the missing VWRL report might be no problem, but the 3a deduction will likely not be accepted without the documentation. I have seen a case, where the tax official has denied the 3a deduction without prior inquiry. If you then fail to object within 30 days, the assessment becomes binding…

When i have sent my tax Declaration ,i wasn’t enable to attach the documents as you can see in this pic.Do you know why? Does it happened to someone?

I can’t remember but sometimes I send it on a different title and they will see it anyway.

On the e-Demarche website for the Geneva tax reclamation, you can only attached pdf files. Could it be a problem with your file format ?

I was not enable to attach nothing (no pdf, no image,etc), and if you read 0 documents are mandatory.

I tried calling them several times but they never answer, so i sent already a email, waiting for the answer.

Hi guys,

This is this time of the year again so I will revive this topic.

I started to fill my taxes declaration with the Geneva software (GeTax).

I have few questions as it is the first time I have to do the full tax declaration with the new 2021 rules.

In the Shares and Bank account section, I have detailled only the shares/ETF I have on IBKR especially to reclaim the withholding tax (DA-1).

I have entered the other bank accounts and brokers in the Other Revenue and Wealth section as 1 line for the dividends converted in chf and the same for the amount in the various bank accounts.

Do you think it is a too lazy approach and I should detail all lines instead ? I got easily 30 lines with various buy/sell activity during the year.

Hi everyone.

Starting to do my tax return quite late (the true portuguese spirit!).

I live in Geneva and wondering if the GeTax software is now our best option to fill it in?

I’m still on B permit - revenue less than 120k in 2021 and in fair honesty I just have the max 3rd pillar contributions to fill in --» and because of this, if I’m correct, I need to fill in that TOU.

I’m feeling that my tax return is quite straight forward but trying not to mess it up…

Appreciate any hints from people living in GE.

Cheers

Hi,

With in your case, it will be super easy to fill the GeTax. I did it for the first time this year and request it the TOU because I need to do it. More than 120k and more than 3k in other revenue.

You should fill it and simulate the outcome as it may not be interesting in your case.

In my case, even with 3rd pillar and 2nd pillar buyback, I will need to contribute an extra 3000 due to fortune tax and other revenue.

This. If you have the choice to stay tax at source, you may end up paying more tax by doing a declaration even if you have contributed to 3rd pillar.

Thanks for both responses.

I’ve done a simulation for 2022 and it seems that it is profitable still…

reviving old thread but the topic fits here.

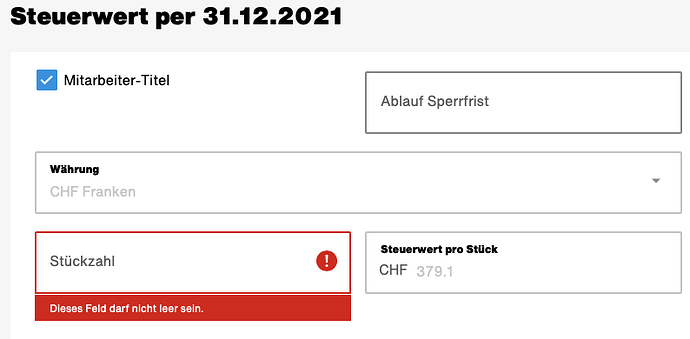

I bought some shares from my employer through 2021 (on monthly basis) at 20% discount but they are blocked for 4 years from the date of purchase.

For each month I have an entry for the number of shares I purchased and number of shares given to me by the company (which is 25% on top of my purchase)

How do I fill in this in “Wertschriften” in ZHprivateTax ?

a) number of shares I paid for?

OR

b) number of shares I paid for + number of shares added by company?

The Vermögenssteuerausweis sent by the employer / agency that hold these shares lists (b) as the number of shares. But it also mentions higher value in Bruttowert (gross value) and lower value in Steuerwert (tax value)

ZHprivateTax also has something called Mitarbeitier-Titel check box which comes with a ‘blocked until date’ - I first thought it may be applicable to me (discounted + blocked shares), but could it be for more for the RSUs (not applicable to my case). I am throughly confused.

thanks for any hint!

Thanks for the suggestion. I’ll add this info in the note and add a beilagen to Lohnausweis

I tried using the Mitarbeiter-Titel and Ablauf Sperrfrist (unblocking date) and put the full number of shares.

ZHprivateTax automatically reduces the total value by ~26% as the unblocking is 4 years away. (quite close to what is mentioned in my account statement). Now I have gone from being confused to being impressed by the system, assuming I am doing it right.

I’ll simply use the above, add documents and mention it in comments at the end of return.

I have very similar situation, although I already have some shares not blocked any more (I have them longer than blocked period).

I get an overview from the brokerage which handles the MA-Aktien, showing all purchases per month, and blocked and unblocked shares on 31.12.

I make 2 lines in the Wertschriftenverzeichnis:

one line with unblocked shares at full value (like normal stocks), with no new transactions (unless I sold some).

The second line shows the blocked shares on 31.12. In this field I also fill in the 12 purchases individually (per month = number of shares I paid for + number of shares added by company), so that the dividends are calculated correctly.

This second line is declared as “MA-Aktien gesperrt” and the value “Steuerwert” is reduced automatically by 20% or whatever (depends on blocking-duration & canton how much %).

Thanks! So what I tried last evening with blocked shares matches the second line you described.

Good evening. I moved to Switzerland in 2020 and brought with me a stock portfolio to UBS. I sold the whole portfolio the same year in order to fund the share capital for my company I opened in 2020 and I’m the 100 % owner of. I didn’t declare the stocks or their sale in my 2020 tax return but I wonder should I declare it in my 2021 tax return which I have to submit by the end of next week?

In my UBS e-banking I found a certificate meant for the 2020 tax return but it doesn’t mention this sale and my custody account shows zero balance on Dec 31st 2020 because I sold the whole portfolio. So I don’t know should I have done something then and if yes what should I do now?

There’s no reason to declare it in 2021 since you weren’t owning any shares then. You could have declared the sale back in 2020, but there wouldn’t be any tax (and you don’t really have to, if you don’t hold any at the end of the year).

Worst case you didn’t declare income from these shares in 2020. Not to worry!