Here is my contribution for people who want to filed their Tax declaration in the Canton of Vaud with VaudTax20 ![]() (I used a fake investment, though I will love to have that yet).

(I used a fake investment, though I will love to have that yet).

If you have VWRL:

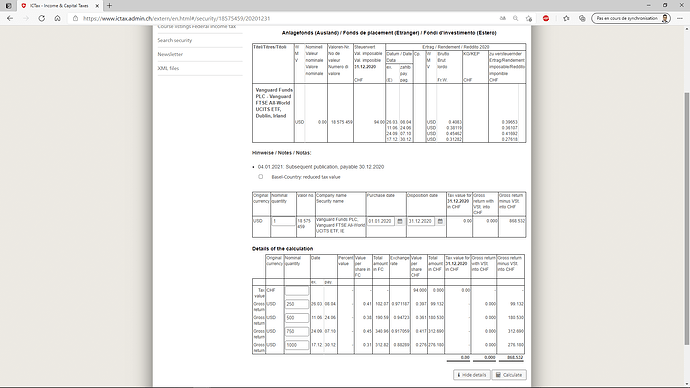

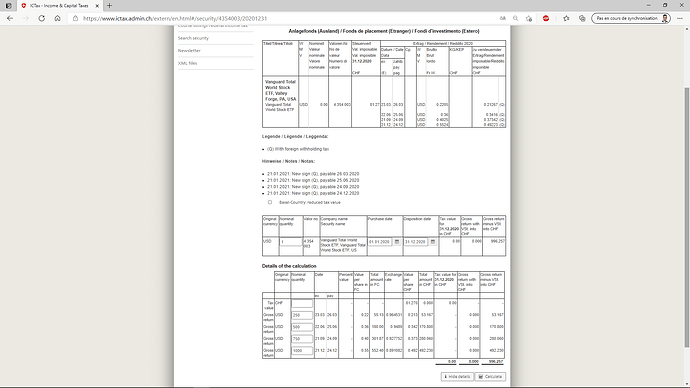

- First step: go to ICTax - Income & Capital Taxes (admin.ch) and filed how many position you have before each period of dividend like in the pictures. The website will calculate how much dividends you earned during 2020.

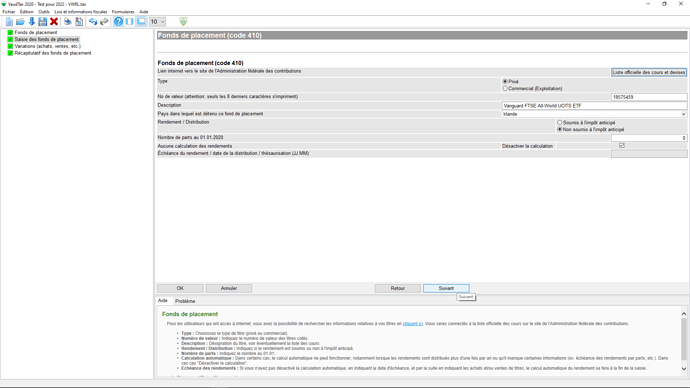

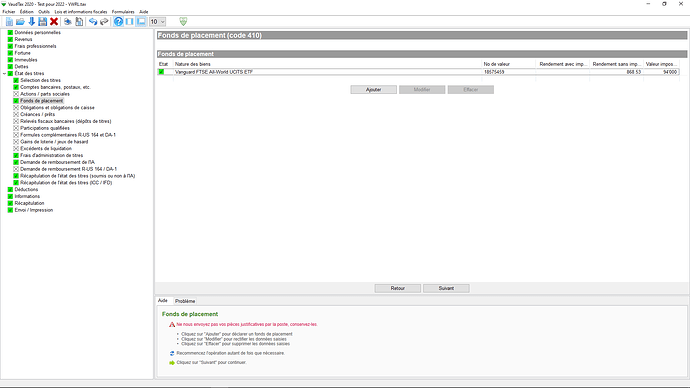

- Then in VaudTax20, go to Etat des titres > Selection > Fonds de placement and click on “Ajouter” then filed the information you need about VWRL

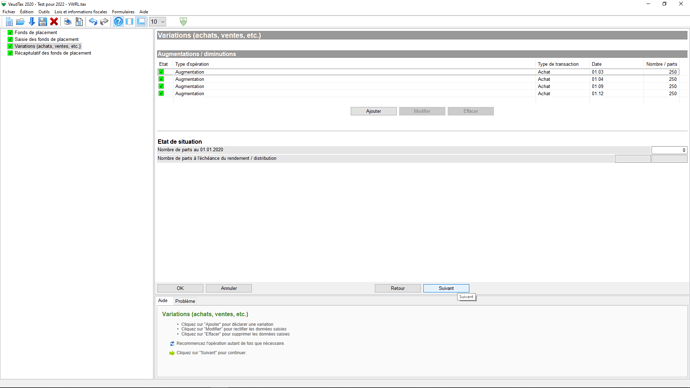

- Then filed how many trade you did with VWRL, here there is 4 trades each before the distribution of the dividend.

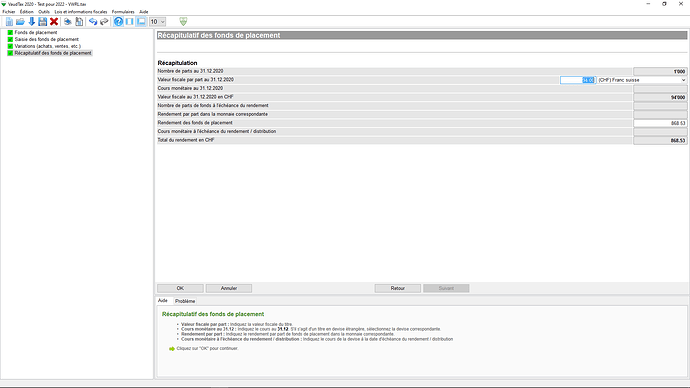

- Then filed the “Valeur fiscale” on the 31st December 2020 and the distribution you receive. You will find this information on ICTax - Income & Capital Taxes (admin.ch)

- At the end it will look like this:

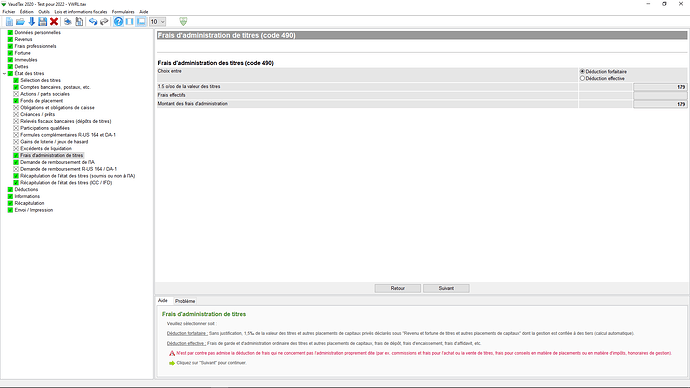

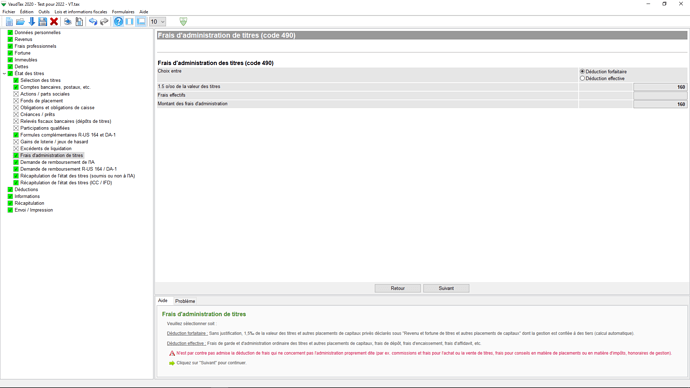

- Obviously, you can claim the fees about your investment, just take the “forfaitaire”

If you have VT:

- First step: go to ICTax - Income & Capital Taxes (admin.ch) and filed how many position you have before each period of dividend like in the pictures. The website will calculate how much dividends you earned during 2020.

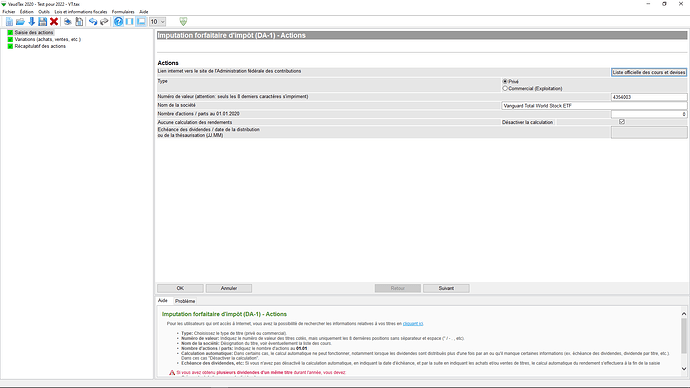

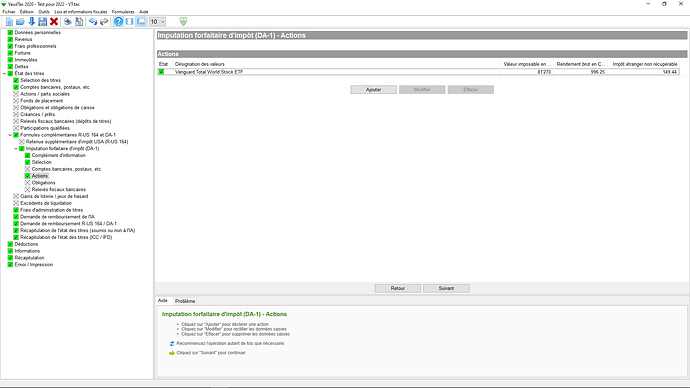

- Then in VaudTax20, go to Etat des titres > Selection > Formulaire complémentaire R-US 164 et DA-1 > Imputation forfaitaire d’impôt (DA-1) > Actions and click on “Ajouter” then filed the information you need about VT.

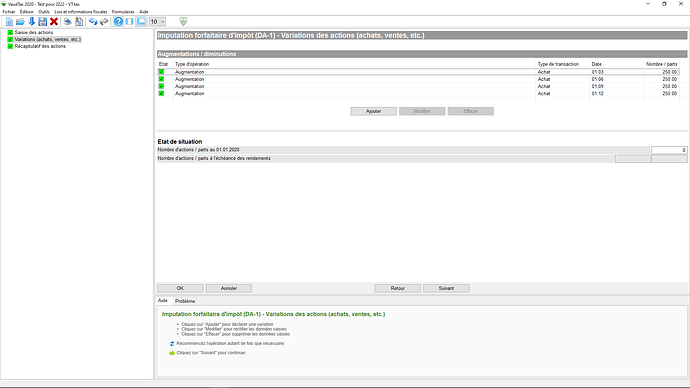

- Then filed how many trade you did with VT, here there is 4 trades each before the distribution of the dividend.

- Then filed the “Valeur fiscale” on the 31st December 2020 and the distribution you receive. You will find this information on ICTax - Income & Capital Taxes (admin.ch). Moreover, you have to select in which country there is the withowlding tax, here USA and you put 15% (as with IB you already filed the W8-BEN so you only need to claim 15%).

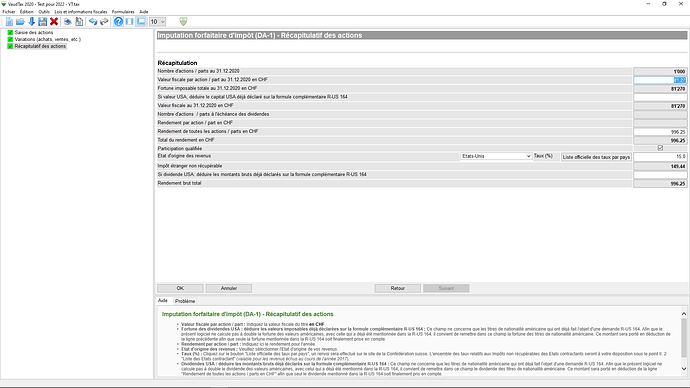

- At the end it will look like this:

- Obviously, you can claim the fees about your investment, just take the “forfaitaire”

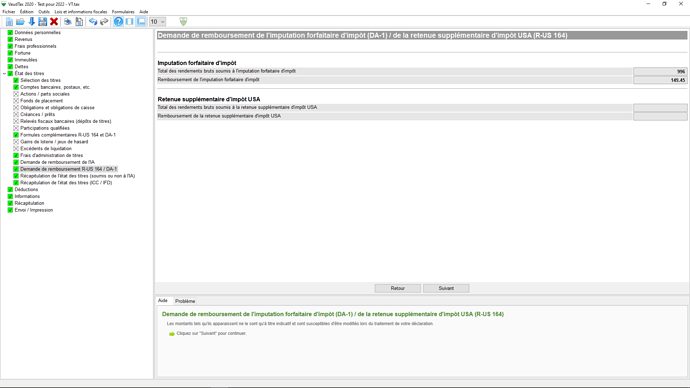

- And here is what will be deducted from your tax, aka the WHT part.

Hope it could help, and please correct me if I missed something as I didn’t need to filed this for 2020, but will do it for 2021 ![]()

PS: You can have more detail on the blog of @_MP ![]()